FTSE100 Stock Index

FTSE - Financial Times Bourse, the FTSE100 index represents the Index of the top 1 hundred biggest companies in UK that are displayed and shown in London Stock Market Bourse. The calculation of this stock index is made up of a list of stocks which are determined quarterly. These stocks that are included in the FTSE100 Stock Index represent 80 percent of the total market value of the London Stock Exchange Market listed companies.

Since the FTSE100 Index tracks 100 companies, it's more volatile than something like Germany's DAX 30, which only covers 30 firms.

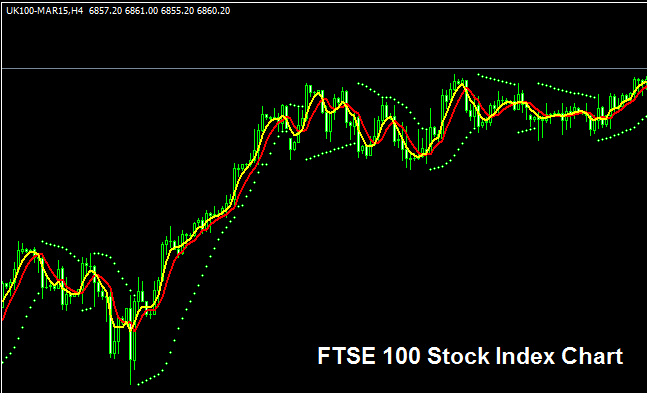

FTSE 100 Chart

FTSE100 chart is shown & shown above. On the above illustration the index is named UK 100CASH. You want to find an online broker that offers the FTSE 100 Stock Index chart so that you can begin to trade it. The example That is illustrated above is that of FTSE100 Stock Index on MT4 FX Trade Platform.

Other Data about FTSE100 Index

Official Indices Symbol - UKX:IND

The FTSE100 index includes 100 stocks from leading UK companies. People track it to gauge UK business health. Experts review its makeup every quarter. The index uses a basic market cap formula for its value.

Strategy to FTSE100 Index

FTSE100 Index represents the relative trend movement of the top 100 shares in UK. In general stock value of the top 1 hundred firms will keep moving upward, hence this stock index also will over time keep heading upward. Should a company not meet the required business expansion targets, the corporate will be removed from the index and replaced with another company that has better business growth prospects.

For a trader considering this Index, the prevailing general market sentiment at any given juncture is statistically more likely to be bullish than bearish. This is predicated on the assumption that as long as the 100 corporations under observation perform well in their businesses, their stock valuations will ascend, consequently driving this index along an upward market trajectory.

As a stock index trader you want to be biased and keep on buying as the index heads and moves upwards. When UK economy is doing good (most of the times it is doing well) this upward trend is much more likely to be the one that is ongoing. A good stock index trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down and Recession

When the economy slows down or goes into a recession, companies start to say that they are making less money and that they do not expect to grow as fast. Because of this, traders start selling shares of companies that are saying they are making less money, so Indices that follow these specific stocks will also start to go down.

At these times, market trends often head down. Traders must change their strategy to match the falling index trends they trade.

Contracts & Specs

Margin Requirement for 1 Lot - £ 70

Value per Pips - £ 0.1

Note: Even though general and overall trend is generally move upward, as a trader you've got to consider and factor on daily price volatility, on some of the days the Indices may move in a range or even retrace and pull back, the market retracement/correction move might also be a large one at times & therefore you as a trader you need to time your trade entry strictly using this trading strategy: strategy & at same the time use proper and appropriate money management techniques and guidelines just in case of unexpected market volatility. About equity money management strategies in indices tutorials: What's Stock Index equity money management guidelines and rules & Indices equity management strategies.

Study More Topics and Lessons:

- How do you set a pending trading order on MetaTrader 4?

- Analysis of Stock Index Trading

- Stochastics Oscillator Analysis Trading Strategies

- How to Configure GER30 in MetaTrader 5 Software?

- US 100 Indicator – Top MT4 Trading Tools

- What's Forex Triple Exponential Moving Average TEMA Indicator?

- Illustrative Trading Strategies for Dow Jones Indices