Dow Jones 30 Trading Strategy Guide: Key Techniques for Success

The DowJones30 Stock Indices Trade Chart

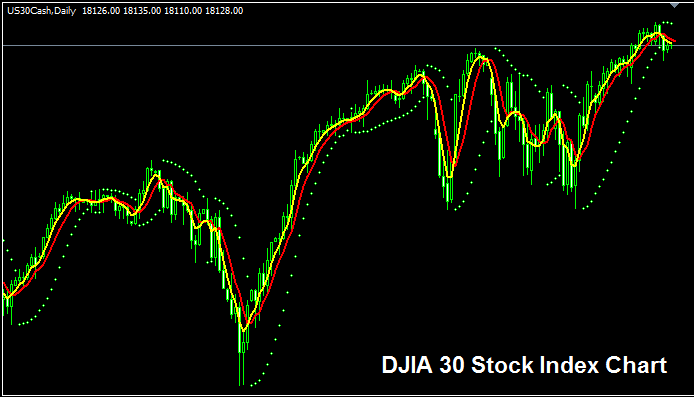

The DowJones30 Stock Index chart is displayed & shown above. On the above example illustration this financial instrument is named USA 30CASH. You want to search, look for & find a broker who offers DowJones30 Stock Index chart so that you can start & begin to tradeit. Example displayed and illustrated above is of DowJones30 Stock Index on MT4 Forex Platform Software.

Strategy for Trading DowJones30 Stock Indices

The Dow Jones 30 index calculation method makes it more volatile. This leads to bigger price swings. Over the long term, the index trends up because the US economy grows strong as the world's largest.

As a trader wanting to trade this stock index, be prepared for wider price swing and a little more volatility.

Study More Guides & Guides:

- Utilizing Bulls Power Indicator in MetaTrader 4

- MetaTrader S&P ASX Stock Indices S&P ASX200 MT5 FX Trade Software Platform

- Trading MetaTrader 5 Login to MT5 Account Login

- Steps to Calculate Pips for FTSE100 Indices

- How to Utilize the Triple Exponential Moving Average (TEMA) Indicator?

- Guide to Trading Forex with Pending Orders

- How to Add a Chart in the MT4 Trading Platform

- Looking for live copied XAUUSD trade signals? Here's how to get them.

- Gann HiLo Activator for Buy and Sell Signals

- Looking at the T3 Moving Average Indicator for XAU/USD