Technical Analysis Using T3 Moving Average (MA): Signals and Insights

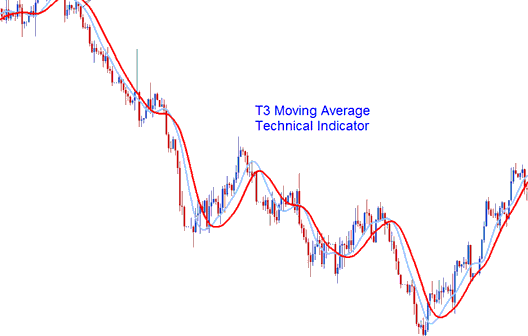

T3 applies a smoothing method for signals like moving averages. But its signals prove more precise. T3 tweaks the standard moving average formula. It creates a smoother line with less delay. This indicator tracks price moves and shifts with market direction.

Technical Analysis and Generating Signals

The T3 moving average MA is like the regular MA Moving Average, and you can trade with it the same way you trade with the regular Moving Average tool.

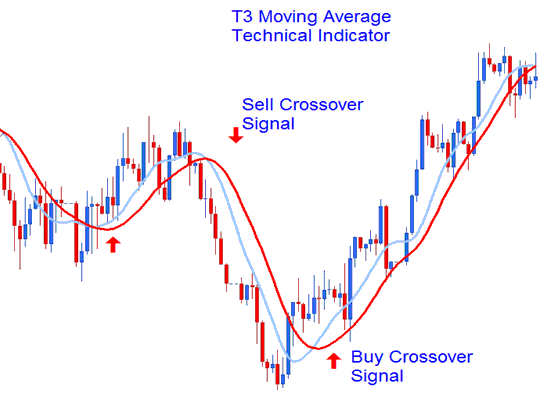

Moving Average Gold Cross-over Signal

This specific technique or method relies on employing two T3 Moving Averages, generating signals when they cross each other - an upward cross signals an uptrend, while a downward cross signals a downtrend.

Crossover Signal

Crossover Signal

Bullish trend: prices stay above the indicator. This setup means upward moves will keep going.

When prices stay below the T3 Average, the market's bearish. If the price is under this indicator, it usually means things will keep heading south.

Whipsaws - This is a refined indicator designed to minimize false signals. Its smoothing feature makes it less reactive to sudden price surges, ensuring that price spikes won't distort the data used for its creation and display.

Study More Lessons and Topics:

- MetaTrader NETH 25 Stock Values NETH 25 MT4 FX Software

- A List of Wall Street 30 Trading Systems

- Analysis of Average True Range

- Description of a Trading System Comprising Specific Indicators and Established Trading Rules

- Stochastic Crossover System for Index Trading

- Overview of DJI 30 Indices

- Method for Adding the US 500 Index on the MT4 Android Mobile Trading Application

- Guide for Trading IT40 Indices

- List of Strategies for SWI 20 and List of SWI 20 Strategies