What is IT40 Strategy? - Course to Trade IT40 Index

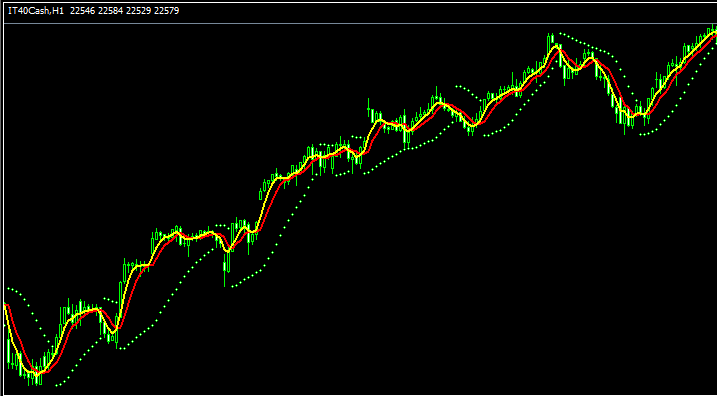

The IT40 Stock Index Trade Chart

The IT40 Indices chart is displayed and illustrated above. On the above example illustration this financial instrument is named IT40CASH. As a trader you want to find a broker that provides IT40 chart so that you as a trader can begin to trade it. Example displayed and illustrated above is of IT40 Stock Index on MT4 Forex Platform Software.

Strategy for Trading IT40 Stock Index

The IT40 Stock Index generally upward over long-term because stocks choosen represent best sectors in Italian economy therefore in general this stock index will keep heading up over time - because these chosen sectors are the ones that will be will be doing good/booming business within the economy.

As a trader wanting to trade this stock index, you want to be more biased toward upward market trend direction of this stock index.

As a trader you want to keep buying as the index moves upwards. When Italian economy is performing good (most of the times it's performing good) this upwards trend is much more likely to be the one that is ongoing. A good stock indices trading strategy would be to buy price dips.

During Economic Slow-Down & Recession

During the economic slowdown recession times, corporations begin and start reporting lower earnings, lower profits & slower growth projections. It is due to this reason that investors begin to sell stocks of companies which are reporting and recording lower profits & therefore Index tracking these particular specifed stocks also will begin moving downward.

Hence, during these times, market trends are more likely to be going and heading down and you as a trader should also adjust your strategy accordingly to suit the prevailing downwards trends of the index which you as a trader are trading.

Contracts and Specifications

Margin Requirement Per 1 Lot - € 250

Value per Pip - € 1

Note pips size of IT 40CASH is € 1 compared & analyzed to the pip size of the other stock indices such as Germany DAX and EUROSTOXX 50 whose size of one pip per lot is € 0.1 - However, the average pips movement for this index is much lower as when compared to other indexes such as DAX30 & EURO STOXX.

Note: Even though overall trend is generally moves upward, as a trader you've got to consider and factor on daily price volatility, on some of the days the Indices may move in a range or even retrace and retracement, the Indices market retracement move might also be a large one at times & therefore as a trader you need to time your trade entry accurately when using this strategy: indices strategy & at the same time use suitable & proper/suitable money management guidelines/principles just in case there's more unexpected volatility in the market. About Stock index money management rules courses: What is stock index money management guidelines/principles & Indices equity management plan/system.

Study More Topics and Lessons:

- List of Top Australia Forex Trade Brokers

- List of Strategies to Trade FRA 40 and List of FRA 40 Strategies

- How Can I Develop a EUR PLN Trade System?

- Standard Toolbar Menu and Customizing Standard Tool Bar in MT4 Platform

- Aroon Forex Robot/Bot Automated Expert Advisor

- Best Indicator for XAU/USD Indicators Analysis

- Inserting Line Studies Tools on the MT4 Trade Platform

- Gold Indicators Described and Explained Tutorial Guide

- Gold Leverage and Margin Tutorial Guide

- Balance of Power Broker Platform Software Indicator