Balance of Power(BOP) Analysis and BOP Signals

Developed & Created by Igor Livshin

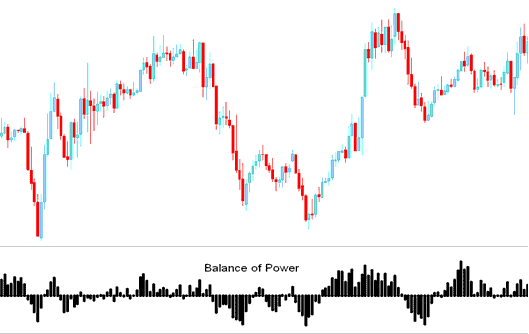

The BOP indicator functions by measuring the momentum balance between bullish and bearish market participants, assessing their capacity to drive prices to extreme points.

Forex Analysis and How to Generate Signals

When using this indicator, zero line cross-overs are used to generate trade signals.

Zero marks the center. Levels above or below spark trade signals.

Buy - The scale is marked from 0 to +100 for bullish movements

Sell - The scale is marked and tagged from Zero to -100 for bearish movements

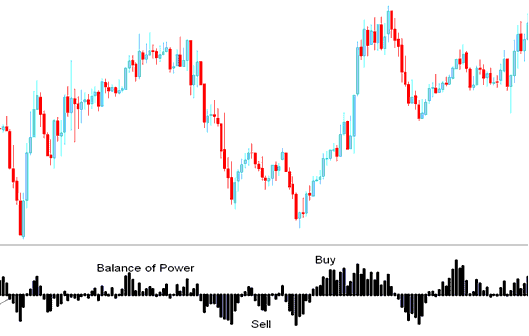

How to Generate Buy & Sell Signals

Buy Trade Signal

When Balance of Power(BOP) crosses above zero mark a buy signal is generated.

Also when the Balance of Power(BOP) is rising, the market is in an upward trend, some traders use this as a buy trade signal but it is best to wait out for the confirmation by indicator moving above zero mark. As this will be a buy signal in bearish region and this type of market trading signal is more likely to be a whipsaw fakeout.

Sell Signal

When Balance of Power crosses below zero mark a sell trade signal is given/generated.

Furthermore, a decline in the Balance of Power (BOP) suggests the market is heading downwards: while some traders treat this as a sell indicator, prudence dictates awaiting confirmation signals, specifically a move below the zero line, as a signal originating within the bullish region is suspect and has a higher likelihood of being a false spike (whipsaw).

Sell & Buy Signals

Divergence Trading

In the context of currency trading, discrepancies between the Balance of Power (BOP) indicator and the prevailing price can be effectively utilized to identify potential turning points for trend reversals or continuations. Different divergence configurations exist:

Classic Divergence Setup - Trend reversal signal

Hidden Divergence Trading Setup - Trend continuation

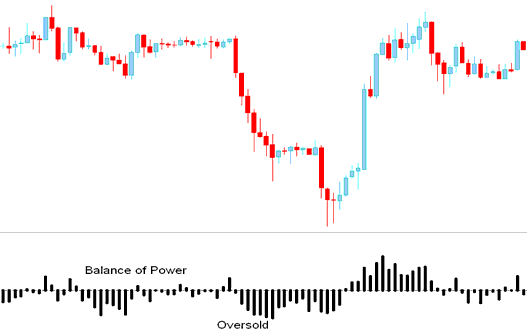

Forex Trading Overbought and Oversold Conditions

This Balance of Power (BOP) indicator can be utilized to pinpoint potential states of overbuying or overselling evident in price fluctuations.

- Overbought Oversold levels can be used to provide and give an early warning for potential trend reversals.

- These levels are derived & generated when technical indicator clusters its tops & bottoms thus setting up the overbought & oversold levels around those values.

Prices can linger in overbought or oversold zones and keep moving that way. Wait for the Balance of Power to cross zero before acting.

In the chart below, even though the Balance of Power (BOP) showed the price was oversold, the price kept dropping until the indicator finally moved above the zero line.

Analysis in FX Trading

Study More Lessons and Tutorials & Topics:

- How do you use Bulls Power in trading?

- Reversal Examples with Double Top and Double Bottoms XAUUSD Shapes

- Opening Time for S&P500 Index

- MACD Hidden Bullish & XAUUSD Hidden Bearish Trade Divergence Setups

- How to Calculate XAU/USD Margin Requirement for 1:50 XAUUSD Leverage

- A List of SPX500 Plans and Top SPX Plans for SPX Trading

- Leverage Ratio of 1:100

- Explanation of the Relative Vigor Index (RVI) Indicator