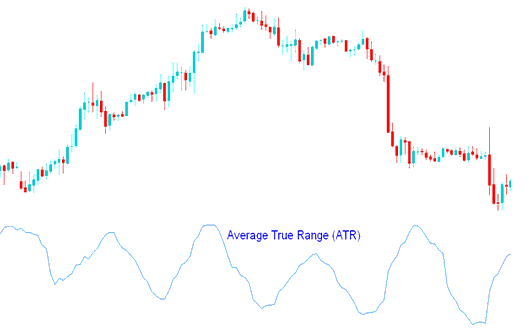

Average True Range ATR Technical Analysis & ATR Signals

Developed by J. Welles Wilder

This technical indicator estimates market ups and downs: it measures how much the price moves over a certain period. The ATR shows how much the price changes, but it does not say which direction the market trend is going.

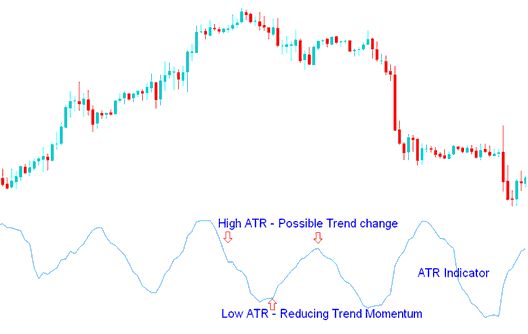

High ATR readings

High ATR indicator readings indicated market bottoms after a sell off.

Low ATR indicator values

Low ATR values signal long sideways moves. Prices stay range-bound at market tops or in consolidation. These readings fit drawn-out flat periods at peaks or during pauses.

Calculation

This technical indicator is calculated using the following:

- Difference between the current high & the current low

- Difference between previous closing price and the current high

- Difference between previous closing price & the current low

The final Average is determined by summing these values and calculating the mean.

Technical Analysis and How to Generate Signals

The ATR technical indicator can be examined using principles similar to those applied for other volatility indicators.

High values in this indicator signal a likely trend shift or reversal. The higher the value, the stronger the chance.

Trend strength measurement - The lower the value of the technical indicator, the weaker the trend movement.

Technical Analysis in XAUUSD Trading

More Guides:

- Hk50cash Index Trading

- How to Figure Out Forex Pip Values for Regular Forex Accounts

- Setting Up an Expert Advisor Utilizing the Forex Aroon Oscillator

- Williams Percent R XAU/USD Indicator Analysis in Gold

- How to Figure Out FX Pip Value for a Cent Forex Account: Explanation

- Forex TSI True Strength Index Expert Advisor Setup

- How Do I Add FTSE in MetaTrader 5 Android App?

- Opening Hours for SP 500 Index

- How to Calculate Stock Index Lot Size Calculator

- Moving Average Signals Observed Within Range-Bound Stock Indices Markets