HangSeng50 Index

The Hang Seng 50 index follows the market value of the top 50 firms on the Hong Kong Stock Exchange. These come from Hong Kong's key business areas.

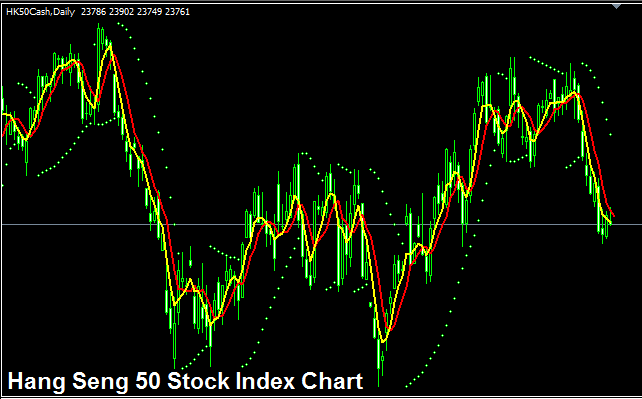

The HANGSENG 50 Trade Chart

Above are displayed and depicted the trade chart for the HANG SENG 50. This Stock Index is referred to as HK 50CASH in the aforementioned example. As you begin to trade the HANGSENG 50 chart, you should look for a broker who provides it. The MetaTrader 4 Forex & Platform's HANGSENG50 Index is shown in the example above.

Other Data about HANGSENG 50 Stock Index

Official Symbol - HSI:IND

The 50 component stocks which makes up HANGSENG 50 Index are chosen from the top companies in Hong Kong. The 50 shares make up majority of the turnover volume in Hong Kong Stock Exchange Market. The companies displayed on this index represent a total of 60%market capitalization of all securities shown in the Hong Kong Stock Exchange Market.

Strategy of HANGSENG 50 Index

The HANGSENG50 index follows the market value of Hong Kong's largest 50 companies. It rises over time but swings more than others. Compared to EURO STOXX or DAX30, it has bigger ups and downs in trends.

Long-term, this index goes up. Bias toward buys and add as it rises.

An effective strategy for trading this stock index involves buying during price dips: however, traders engaging with this index should remain prepared for noticeably wider price variations during active trading.

During Economic SlowDown & Recession

In times of economic slowdown and recession, companies start showing weaker revenues and earnings. Profits drop too, along with lower growth outlooks. Traders then sell off shares from firms with these weak results. Stock indices that follow such companies head lower as a result.

Therefore, during such periods, market direction is significantly more likely to trend downwards, requiring you, the trader, to likewise adapt your established strategy to correspond with the prevailing descending path of the index you are engaging with.

Contracts and Specifications

Margin Required for 1 Lot - HKD 450

Value per Pips - HKD 1

Note: Even if the general trend is up, traders must think about the market's daily ups and downs. On some days, the market might move up and down a lot, or even go back down. These pullbacks can be big sometimes. So, traders need to time their entries carefully using a specific strategy and also use good money management to protect against unexpected market changes. This is about how to manage your money when trading: What are the rules and ways to manage money in stock index trading?

More Guides & Topics: