Insights on Dow Jones Industrial Average (DJI 30) – Wall Street 30 Stock Index Analysis

The DJI 30 tracks 30 major US stocks. It uses shares from the largest American companies.

The DJI 30 is the top index people follow around the world. It once tracked industrial stocks only. Now it covers shares from other economy parts too. It picks stocks from America's biggest companies.

The DJI 30 swings more than other major indices. Over time, it trends up but pulls back often and pauses in ranges. Traders who like steady upward moves may pick other indices over the DJI 30.

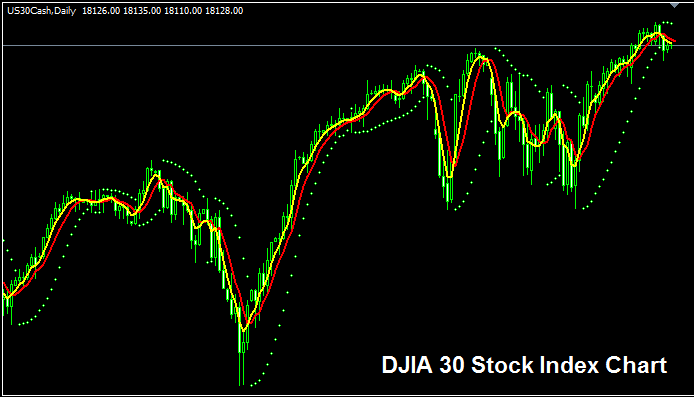

DJI30 Chart

The chart above displays the DJI 30 trading instrument. Here, it's called DJI30CASH. Seek a broker that offers DJI 30 stock index charts to start trading it. This example shows the DJI 30 index on the MT4 forex platform.

Other Info about DJI 30 Index

Indices Symbol - DJI

The 30 component stocks that constitute DJI 30 Stock Index are selected from top performing US corporations. The calculation of this stock index is however different compared to other Stock Index: the price constituent/component of these 30 stocks is sub-divided by a common divisor function so that to come up with this stock market index. This makes this stock index more volatile than other indices.

Strategy to Trading DJI 30 Stock Index

DJI 30 Index formula of calculating makes Dow 30 index more volatile & hence there are wider and more volatile swings in the price movement of this stock index. Although this stock index in general moves upward over long term because US economy also shows strong growth & is also the biggest economy in the world.

As a trader wanting to trade this stock index, be prepared for wider price swing and a little more volatility.

Get More Guides & Topics: