AEX25 INDEX - Amsterdam Bourse Index

The AEX Index tracks the performance of the top 25 stocks listed on the NYSE Euronext Amsterdam Stock Market in the Netherlands. Previously referred to as the Amsterdam Stock Exchange, this bourse serves as a key metric for market activity within the region.

They review the 25 companies in this stock index every quarter. The Index keeps track of the market cap of these top 25 firms.

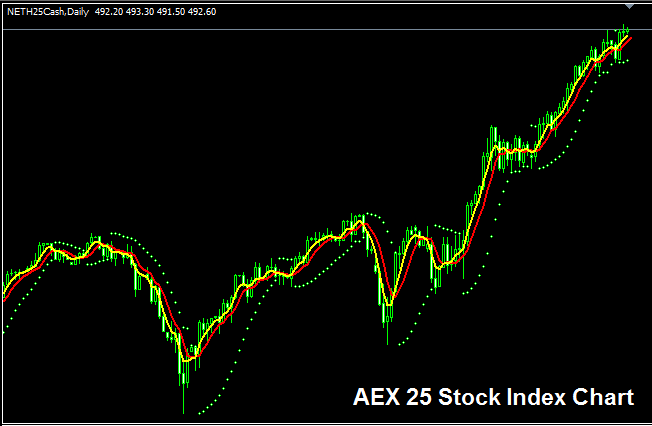

AEX 25 Chart

The AEX25 chart is displayed and shown above. On above example this Index is named NETH25CASH. You want to search, look for & find a broker who offers AEX25 Index chart so that you can begin to trade it. Example displayed and illustrated above is of AEX25 Indices on MT4 Forex Platform Software.

Other Details about AEX25 Index

Official Symbol - AEX:IND

The 25 components stocks which constitute AEX25 Index are chosen from the best performing corporations in Netherlands. The 25 stocks make up the majority of turnover volume in NYSE Euronext Amsterdam Stocks Market. The calculation is reviewed quarterly every year.

Strategy for Trading AEX25 Index

The AEX25 Index tracks the total market valuation of the top 25 Dutch corporations. Generally, this Stock Index exhibits a long-term upward trajectory mirroring the robust and stellar economic expansion observed in the Netherlands.

As a stock indices trader you want to be biased & keep on buying as the index heads & moves upward. When the Dutch economy is performing and doing good most of these top 25 shares/stocks will continue going upward & therefore this stock index also will go in an upwards trend. A good index strategy would be to buy the price dips.

During Economic Slow-Down & Recession

During the economic slowdown and recession periods, corporations start and begin to report slower earnings, slower profits and lowers growth projections. It's due to and because of this reason that traders begin to sell stocks of companies which are posting and recording lower profits and therefore Indices tracking these specified stocks/shares will also start and begin to move downwards.

In such periods, market trends often head down. As a trader, you must change your strategy to match the downward moves in the index you trade.

Contracts and Specifications

Margin Requirement for 1 Contract - € 5

Value per Pip - € 0.1

Even with a generally upward trend, traders must think about daily price changes. On some days, Indices might stay within a certain range or even go back a bit. These pullbacks in the Indices market could sometimes be significant. Therefore, as a trader, it's important to time your entries carefully when using this strategy. Also, you should use good money management rules if the market suddenly becomes unstable. About learning how to manage money in indices: What is managing index equity and how to manage Stock Index funds.

Study More Guides and Courses:

- DAX 30 Stock Index Best Methods for Practical Trade Compatibility

- How Can I Use Bears Power Indicator in Trade?

- Explanation of Minor Forex Pairs in Trading

- MetaTrader 4 XAU USD Platform

- CADJPY Market Opening Hours and Closing Hours

- GER 30 Strategy Guide

- Guide to Trading with UK100 Index Strategies

- Starting Out with Automated Forex Trading and Expert Advisors

- Example Methods for SX5E Trading

- What are DeMarks' Range Projections for Forex Buying & Selling?