Germany DAX 30 Index

The DAX 30 covers Germany's top blue chip stocks - 30 of the most liquid and actively traded shares on the Frankfurt Stock Exchange. Since Germany leads the Eurozone's economy, the DAX 30 is a big deal among investors across Europe.

Similar to currency charts, the Germany DAX 30 Stock Index has its own graphical representation, allowing traders to analyze and execute transactions. They can place buy or sell orders and trade this index using standardized lots or contracts.

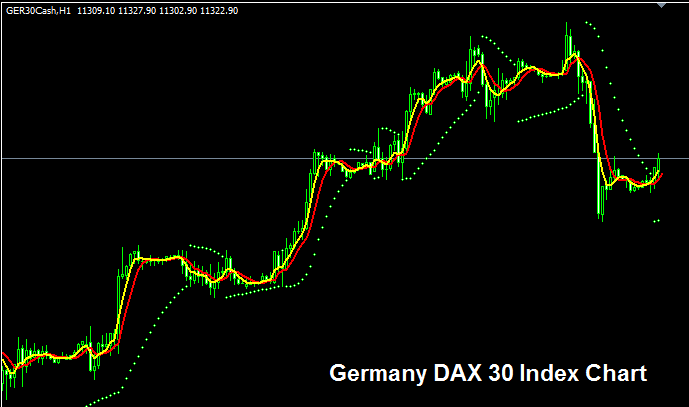

The Germany DAX 30 Chart

The chart for Germany's DAX30 is presented visually above. In this specific illustration, the financial instrument shown is labeled GER 30CASH. Your objective is to locate a brokerage that provides the Germany DAX30 chart so you can commence trading it. The illustration above depicts the Germany DAX30 Index as seen on the MT4 FX Trading Platform.

Other Details about Germany DAX30 Stock Index

Official Symbol - DAX:IND or GDAXI30

The 30 components stocks which constitute Germany DAX 30 Index are reviewed few times every year to figure out if to make changes to this components composition or not. Stocks which are not doing well may be replaced with other stocks/shares which are doing/performing well.

Strategy for Trading/Transacting Germany DAX30 Stock Index

The Germany DAX 30 Index tracks top blue-chip stocks on the Frankfurt exchange from Germany's strongest sectors. A smart way to trade it? Go long most times. Strong Frankfurt stocks tend to rise steadily, backed by Germany's top companies.

The Germany DAX30 Index is also checked again a few times each year to make sure that if one Index isn't doing well, it's switched out with a good blue chip Stock Indices. This makes sure that the Germany DAX30 Stock Index mostly keeps moving higher.

As a stock index trader, maintaining a buying bias is recommended while the index is moving higher. Given that the German economy frequently demonstrates strong performance, this uptrend is the most probable market condition currently in effect. A prudent strategy for stock index trading in this environment would involve buying during price dips.

During Economic Slow-Down and Recession

When the economy slows down or enters a recession, companies often start reporting slower earnings, reduced profits, and lowered expectations for future growth. Because of this, traders tend to sell shares of companies that are reporting lower profits, which causes indices that track these specific stocks to also start declining.

During periods where trends show downward momentum, it is critical for traders to adjust their strategies accordingly in order to align with the prevailing market direction of the index being traded.

Contracts and Specifications

Margin Requirement for 1 Contract - € 85

Value per Pip - € 0.1

Note: The overall trend heads up in general. As a trader, you must account for daily price swings. Some days, indices stay in a range or pull back. Pullbacks can be big at times. Time your entry with care when using this strategy. Also apply good money management rules for sudden volatility. On money management in indices lessons: What is index equity management and the indices equity system.

Get More Guides:

- What is the Pip Value for EUR USD?

- How Much is a Pips on a Standard FX Trade Account?

- FRA40 Indices Strategies List and Best Picks

- Where do I find the NETH 25 index symbol in FX?

- Four Types of Index Divergence Setups

- Gold Systems Example & Gold Plan Example

- AEX 25 Index: Forex Symbol and Quote Explained

- How to Set US 100 on MT4 US 100 Trade App

- NKY225 Stock Index Strategies for Optimal Results

- Strategy for Trading NETH25 Indices