S&P/ASX200 Index

The top firms on the Australian Bourse are tracked by the ASX200 Stock Index. The 200 largest Australian firms listed on the ASX 200 are the ones used to construct this stock index. The capitalization of the firms covered by this Index is used to compute it, and it is updated every three months.

Although this stock index calculation incorporates market capitalization, its tracking mechanism focuses not on the absolute capitalization value itself, but rather on the price fluctuations observed across the constituent stocks within the index.

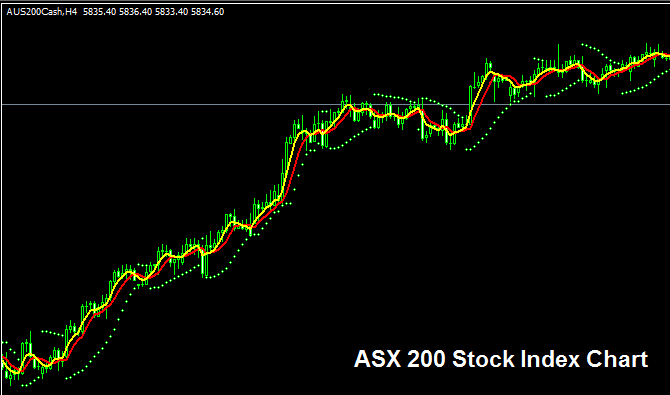

ASX200 Chart

ASX200 trading chart is illustrated and shown above. On the above example illustration this financial instrument is named AUS 200CASH. You want to look for & find a broker who offers ASX200 Index chart so that you can begin & start to trade it. The Indices example above is that of ASX200 Index on MT4 FX & Indices Software Platform.

Other Data about ASX200 Index

Official Stock Index Symbol - AS51

The ASX200 Index comprises 200 stock components sourced from leading Australian firms assessed by their market capitalization. This stock index is based on a defined standard, which adjusts the total market capitalization in relation to this standard. Additionally, it includes a divisor that ensures this index reflects changes only in stock prices that rise, rather than shifts in market capitalization. Consequently, this stock index illustrates the fluctuations in stock prices rather than the overall market capitalization. This occurs because the base signifies the initial value of all stock prices, and the index calculation monitors the total variations in stock prices.

Strategy to ASX200 Index

The ASX200 Index will usually go up because stock prices tend to rise over time. This Stock Index generally goes up over the long run because the Australian economy is also growing strongly, helped by its mining industry, which has large amounts of XAU/USD and other valuable resources.

If you're a trader who wants to trade this Stock Index, the Indices will go up faster when the Australian economic numbers show that the economy is growing more quickly.

As a stock index trader, it is advantageous to adopt a biased approach by purchasing as the index trends upward. When the Australian economy performs positively, this upward market trend is likely to prevail. A sound stock index trading strategy would involve continual purchases and buying during dips.

During Economic Slow-Down & Recession

During periods of economic contraction and recession, businesses typically report diminished profitability and revise their growth forecasts downward. Consequently, traders begin selling shares of companies reporting reduced earnings, causing the indices tracking these specific equities to consequently trend lower.

During bearish market phases, trends are more likely to move downward. As a trader, you should modify your strategy accordingly to reflect prevailing downtrends in the index you're trading.

Contracts and Specs

Margin Requirement per 1 Lot - AUD 70

Value per Pips - AUD 0.1

Note: Although the general tendency is typically upward, as a trader, it's essential to account for daily fluctuations in market prices. On some occasions, the Indices might fluctuate within a certain range or even experience a pullback. Sometimes, these retracement movements can be significant, so it's important to precisely time your trade entries using this trading strategy. Additionally, employing sound equity money management practices and principles is crucial in case of unexpected market volatility. Regarding the principles and methods of equity money management in learning about indices: What are the guidelines/rules for stock equity management and the system/plan for managing equity in indices?

Study More Guides & Guides:

- Understanding the DowJones30 Index in Trading

- How do you use MetaTrader 4 live charts for forex trading?

- Understanding Stock Indices Trends and Identifying Signals for Index Market Trend Reversal.

- Is Trade Index Better than Trade?

- Optimal Timing for Trading GBPSEK

- Short Term Gold with MAs MAs Moving Averages Indicator Illustrated and Shown

- Moving Average(MA) Strategy Analysis Trade Strategies

- Instructions for Drawing a Downward Trend Channel on MetaTrader 4 Charts

- Location within the MT4 Platform to Access the IBEX Index.

- Forex Trading Programs for Computers, Online Browsers, and Mobile Phone Devices