Moving Average Forex Strategies

- Price Period of MA

- SMA, EMA, LWMA & SMMA

- MA Trend Identification

- MA Whipsaws in Range Bound Market

- Moving Average Cross-over Strategy

- MA Support & Resistance

- How to Choose & Select a MA

- Short-Term and Long-Term Setups

- 20 Pips Price Range Trading Method

About the Moving Average Forex Strategy

Forex Moving average is one of the most widely used Forex Indicator because it is simple & easy to use.

This Trading Indicator is a market trend following trading indicator that's used by the traders for 3 things:

- Identify the beginning of a new trend

- Measure the sustainability of the new trend

- Identify the end of a trend & signal a reversal trading signal

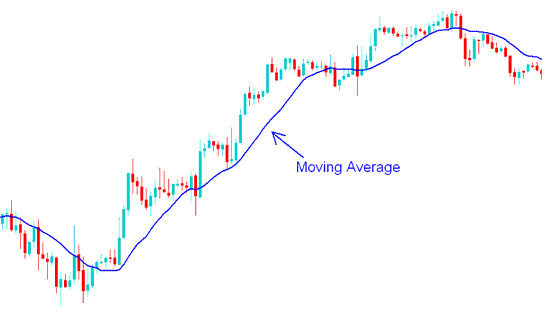

The Moving Average (MA) in Forex is a tool used to dampen the inherent choppiness of price movement: it functions as an overlay indicator, graphically superimposed directly onto the price chart.

On the chart below, the blue line is a 15-period Moving Average. It reduces price swings.

Forex Moving Average - MetaTrader 4 Forex Chart Indicators

Calculation of the Moving Average

The Moving Average (MA) is an average price calculated using the most recent price information available.

If the moving average calculates the price over a 10-period span, it is referred to as a 10-period forex moving average. Since many traders use daily periods, this is commonly called the 10-day Moving Average.

To find the 10-day moving average, average the prices from the last 10 days. The forex MA indicator updates after each new price bar. It recalculates with the latest 10 periods. That's why it's called a moving average - it shifts with new data.

More Topics:

- HSI 50 Trade Strategies Course Tutorials

- Detailed Explanation of Parabolic SAR Settings

- NETH25 Strategies Course Download

- StopLoss Trade Summary XAUUSD

- How to Include MT4 Linear Regression Acceleration Tool

- Studying the Chande QStick Indicator in XAUUSD

- How to Find and Get US 100 in MetaTrader 4 PC

- How to Trade Engulfing Candlestick Patterns Lesson Guide