How to trade engulfing candlestick patterns. Types of engulfing setups.

Trade Engulfing Patterns - Bearish Engulfing and Bullish Engulfing Candle Setups

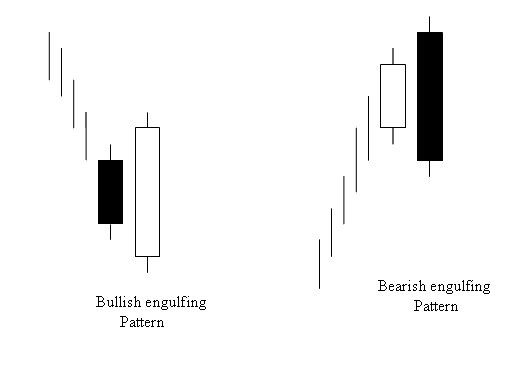

The Engulfing Candle Setup acts as a reversal pattern. It can signal bearish moves at downtrend ends or bullish ones at uptrend ends.

Bullish Engulfing Candle Pattern - Bearish Engulfing Candle Pattern

How to trade the bearish engulfing pattern - Trading the bullish engulfing candle

Colour of the first candle reflects the trend of day.

The second candle should completely engulf the first and should appear in the opposite trend color.

For Bullish Engulfing color of candle should be Blue

For Bearish Engulfing color of candlestick should be Red

How to Trade Engulfing Candlesticks Strategy - What constitutes an Engulfing Candle in the Market? - Varieties of Engulfing Candle Indicator Patterns - Strategies for Trading Bearish Engulfing Patterns vs Strategies for Trading Bullish Engulfing Candles

Morning Star, Evening Star, and Engulfing Candlestick Patterns

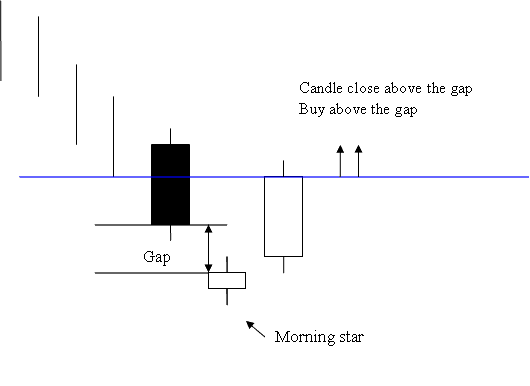

Morning Star Candle

Morning Star Candlestick Pattern

FX Analysis of the Morning Star Candlestick Pattern

Morning star candlestick is a 3 day bullish reversal candle setup.

First day is a long black stick.

Second day is a morning star that gaps away from the long black candle.

Third day is a long white candlestick which fills the gap.

Filling the gap with a white candle closing above signals strong bulls.

Forex traders should initiate a buy trade once the price has closed above the gap setup created by the morning star candlestick pattern, which serves as a confirmation of the buy signal generated by this candlestick configuration.

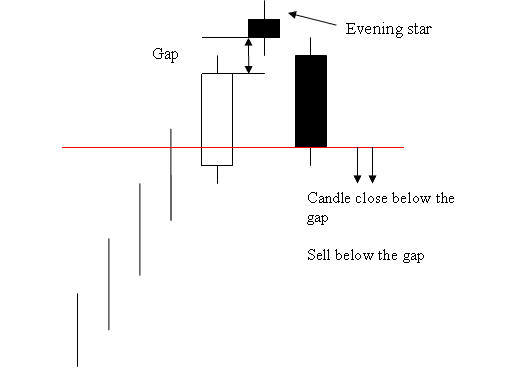

Evening Star Candle

Opposite of the morning star

Evening Star Candle Setup

FX Technical Analysis of Evening Star Candlestick Setup

Evening star is a 3 day bearish reversal candlestick setup.

First day is a long white candle.

The second day is evening star which gaps away from the long white candles.

Third day is a long black candlestick which fills the gap.

The subsequent filling of this gap, marked by the black candle closing below the gap area, represents a strong bearish indicator.

Investors and traders should consider executing a sell position once the market closes below the gap formed by an evening star pattern. This provides a confirmation signal generated from the candle formation.

Study More Lessons and Tutorials and Topics:

- Gold (XAU/USD) Order Placement with Trailing Stop Loss - Technical Analysis Indicator Levels

- How to Locate and Obtain Trading Expert Advisor (EA) Bots/Robots

- EUROSTOXX 50 Strategy for EURO STOXX50

- 100 Pips Value – Cent Lots Explained

- Overview of Gold Market Session Overlaps and the Three Primary Trading Sessions

- Technical Analysis of the Acceleration/Deceleration (AC) Indicator for XAU/USD

- Viewing Nasdaq Quotes and Symbols in MT4

- How does the Bears Power indicator work in trading?