Market Hours and The 3 Major XAUUSD Trading Sessions

Tokyo Close Charts

To grab more gold trade chances in peak hours, know when action peaks. That's when most XAUUSD deals happen.

Although there isn't a set time for when trading starts and ends each day, the week can be divided into three main XAUUSD trading periods, which are the Tokyo, London, and New York sessions.

Even though it might not seem super important at first, knowing when to trade is a very key thing you must know to trade successfully.

The optimal time is when the market is at its busiest, resulting in the highest transaction volume. When the market is more active, there is a higher chance of turning a profit, but when it is quiet and sluggish, it is a complete waste of time - don't even try trading at this moment: instead, switch off your computer.

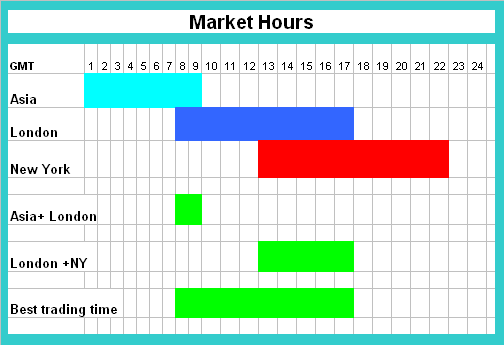

The market isn't always good for trading because how much it changes isn't steady. The following is a guide that shows when the XAUUSD Sessions happen. The time is GMT 0.

The three major sessions are:

- Asia Session Hours( Tokyo ): 00:00 - 9:00 GMT

- Europe Session Hours( London ): 7:00 to 17:00 GMT

- U.S. Market Session Hours( New York ): 13:00 - 22:00 GMT

Best Times

Sometimes there are hours when two sessions overlap:

London + Tokyo over-lap - 7:00 - 9:00 GMT

New York + London overlap - 13:00 - 17:00 GMT

During overlapping market hours, XAUUSD sees the most volume. This boosts win chances.

This means that the lion share of xauusd transactions is happening between the London session and US sessions. Naturally this is the best time to make profits.

Prices change a lot during the New York and London market hours because big companies, hedge funds, managed funds, and banks are open for trading then.

Multinational firms trade XAU/USD for global deals. Hedge funds and investment groups seek profits from it. Banks handle big swaps for clients. Tourists use it for trips, or people make cross-border buys and payments.

High transaction volumes during peak market hours create liquidity, causing significant price movements. During this period, short-term trends often form as charts move in specific directions.

As a trader, it's beneficial to participate during peak ordering times, as this is when liquidity is abundant and trading opportunities for profit are optimal. Increased liquidity tends to make price movements more predictable, in contrast to periods of low liquidity where price actions can be erratic and range-bound without a clear direction.

After trading for some time, you'll find that making money is easier when the market is going up or down, not when it stays within a certain range.

Asian Session Characteristics:

- Least volatile of the three sessions

- Account for 15% of daily transaction turnover

- Typical 20 -30 pip(point) moves

European Market Session Characteristics:

- Most volatile of the three markets sessions

- 35 % of daily transaction volume

- Typical 90 -150 pip moves

USA Session Characteristics:

- 2nd most volatile of the three markets sessions

- Accounts for 25% of daily trade turnover

- Focuses on US economic news

US & Europe Session Over-laps Characteristics:

- Combines the two most volatile sessions

- Accounts for 60% of the total daily trade transaction turnover

- Focuses on USAUS and European economic news

- Fast moving trading prices and xauusd instrument trends in a particular direction

- Typical 100 -150 pip moves for major xauusd

More Courses:

- Draw-down and Maximum Draw-down

- How Do You Set FTSE in MT5 FTSE App?

- Bollinger Band Width Indicator on MetaTrader 4 Guide

- Learn About Gold & XAU/USD Ways Guide Tutorial

- Trade Stock Index vs FX

- How to Find Stock Indices Signals Using Index Systems

- How Do You Analyze/Interpret MT4 Downwards XAUUSD Channel in MT4 XAUUSD Charts?

- Awesome MT4 Indicator

- Technical Analysis of Kurtosis Trading Indicator

- USDCHF Open Time and USDCHF Closing Time