What are drawdown and maximum drawdown in the context of capital management for gold trading?

If you want to make money in business, you've got to learn how to handle risks. Gold trading's no different. To actually see profits, you need to get a grip on money management strategies. There's a bunch of them explained right here on this Gold trading site.

In Gold trading, the main risk is potential losses. Follow equity rules to shield your account. They help you earn profits in the long term.

Draw-down

Gold traders know that the biggest risk in trading Gold is draw-down, which is the amount you've lost from your account on a single Gold trade.

If you have $50,000 and you suffer a $500 loss on a trade, your drawdown is $500 divided by $50,000, equaling a 1 percent drawdown.

Maximum Draw-down

This is the total amount of money you've lost on your trading account before you start earning and making profitable trades. For illustration if you have $50,000 capital and make five consecutive losing positions with an overall total of $2,500 loss before making 10 winning trade positions with an overall total of $5,000 dollars profit. Then the draw down is $2,500 divided by $50,000 dollars, which is 5 % maximum draw down.

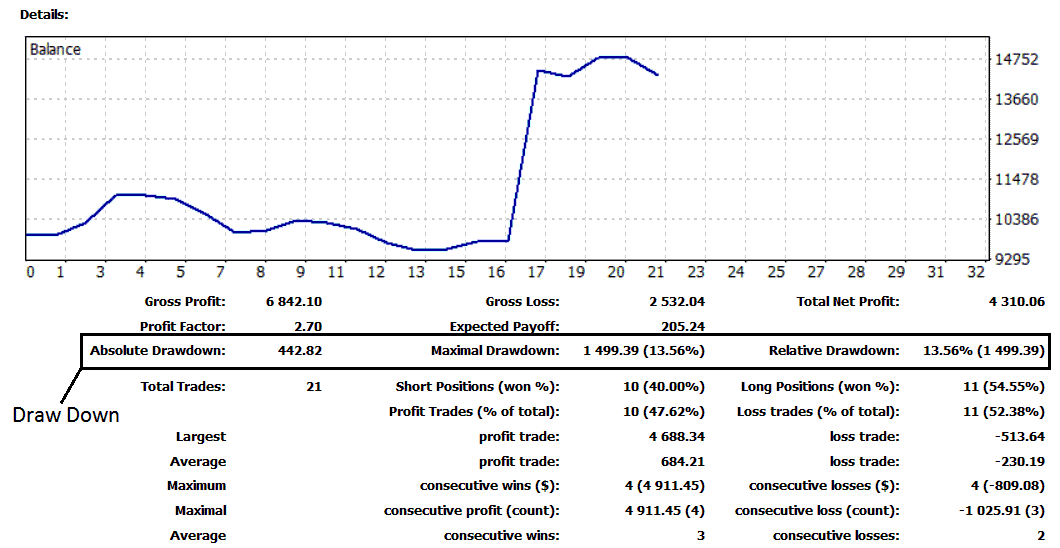

Draw Down on the illustration put on display above is $442.82 dollars (4.4 %)

Maximum Draw Down is $1,499.39 (13.56%)

To know how to generate and get above trade reports using MetaTrader 4 platform software: You can search on how to generate reports on MT4 Tutorials and Lessons.

Funds Management Techniques & Methods

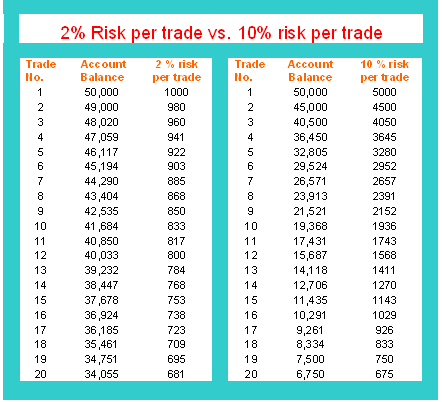

The chart below highlights the gap between risking a tiny slice of your capital and a bigger chunk. Smart trading rules tell investors and traders to never bet more than 2% of their full account balance on any single trade.

Percentage Risk Method

2% and 10% Risk Rule - Gold Money Management Guidelines

In trading, risking two percent of your account beats risking ten percent on a single deal by a wide margin.

In the event you experienced a losing streak while trading Gold and suffered 20 consecutive trade losses, your initial capital of $50,000 would have dwindled to only $6,750, assuming a 10% risk applied to every position. This scenario means you would have depleted more than 87.5% of your trading account's equity.

But, if you only risked 2 % when you made the trades, you would still have $34,055, which means you only lost 32% of your money.

This is why it's best to use the 2% risk management strategy

The distinction between risking 2% versus 10% per trade is significant. With a 2% risk per trade, after enduring 20 consecutive losing trades, you would still retain $34,055. Alternatively, risking 10% per trade would leave you with only $32,805 after just 5 losing trades - less than the amount you'd have had by risking 2% over 20 consecutive losses.

The key is to establish your equity management rules so that in case of a period with losses, you will still retain sufficient capital for future trading activities.

If you lost 87.5% of the money in your account, you would need to make 640% profit to get back to where you started.

As when compared & analyzed to if you lost 32% of your capital you would have to make 47% profit on your remaining balance just to go back to break-even. To compare and analyze this with the above illustration, 47% maximum draw down is much easier to break-even than 640 % maximum draw-down is.

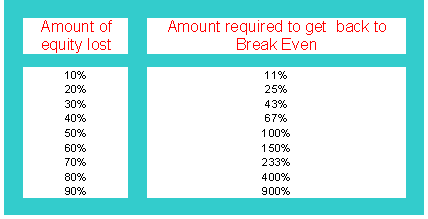

The chart below lists what percent gain you need from your account to break even after a loss of certain amounts.

Concept of BreakEven

Trading Account Equity & Concept of BreakEven

At 50% draw-down, a xauusd trader would have to earn 100% on their remaining capital - a feat accomplished by less than 5 % of all online traders world wide - just to break-even on a account with a 50 % loss.

At 80% draw-down, a gold a trader must quadruple their trading equity just to bring and take it back up to the original equity. This is what is known as "break-even" i.e. Get back to your original account balance that you deposited after incurring a draw down.

The more you lose, the harder it is to make it back to your initial equity.

This explains why, as someone who trades, you should do all you can to PROTECT the money in your account, and not allow yourself to lose more than 2% of your money on any single trade.

Managing money means only risking a small part of your money in each trade so you can get through losing streaks and not lose a lot of money from your account.

In trading, stop losses limit losses. Risk control means adding a stop loss right after you enter a trade.

Effective Money Management

Effective management of risk necessitates oversight of all potential exposures. Every trader must establish a well-defined system for equity management coupled with a comprehensive trading blueprint. Engaging in XAUUSD or any other venture inherently involves making choices that carry some degree of risk. To keep online XAUUSD trading risks minimal, all relevant aspects must be scrutinized, and adherence to the advice in this guide is crucial.

Get More Tutorials & Tutorials:

- Introductory Guide to Trading XAU USD Continuation Chart Pattern Formations

- Determining the Margin Requirement for Trading One Contract of HSI50 Indices

- NETH 25 Trading Strategies and Methods List

- Index Trading: A Strategy for Beginners

- How to Add SPX500 in MetaTrader 4 for PC

- DAX30 Trading Strategies List

- How to Figure Out Pip Movement in Forex Pairs

- Forex Calculator for EUR JPY Pip Value

- GER30 Strategy How to Develop Strategy for GER30 Tutorial Download