Stock Index Trading Strategy

The most effective approach to trading indices involves utilizing a system in conjunction with a pullback entry strategy. This combination significantly increases the risk-reward ratio, thus enhancing the chance of achieving greater profits in index trading.

The Pull Back - Retracement

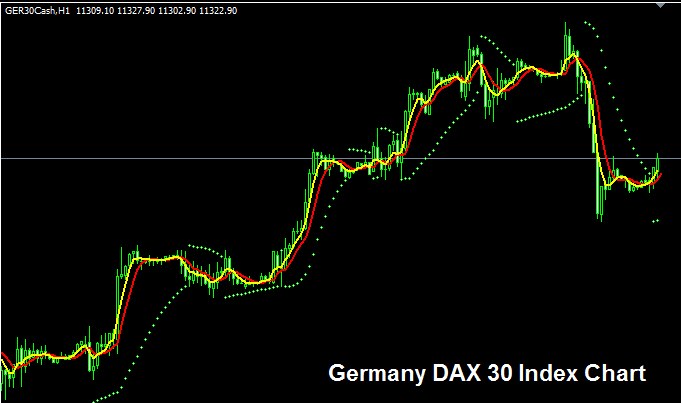

As a trader, wait for a pullback before your system kicks in. See how price pulls back in the chart below.

In the above exemplification the chart is of Germany DAX30 Index - The H1 chart time frame is used to look for a price pullback. In this index chart the long term trend is upward - the upward trend is determined by the daily chart that shows the trend is upward - in addition the main fundamental strategy that is being used for Germany DAX30 and all European Indices at the time of writing is Q.E. - means Quantitative Easing - we shall describe this on our market sentiment for indices course. For now let's continue with the illustration of our strategy.

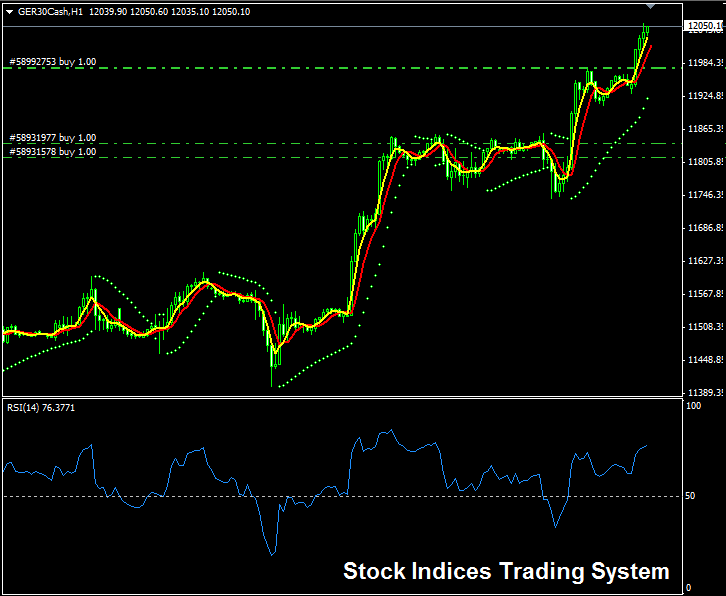

In the mentioned setup, after observing a pullback in the index, the moving averages have shifted upward, presenting a buy signal for traders. To further validate this signal, additional indicators like RSI can be used to confirm the entry decision.

In the example above, we waited for a price dip. The pullback soon flipped, and the uptrend rolled on. The moving average pointed up, and RSI climbed over 50 to back the buy signal. We entered a buy at 11,810, and prices rose to 12,050. Our setup showed building strength all along. The MA crossover stayed upward, and RSI held above 50. That signals bullish prices, with closes higher than opens.

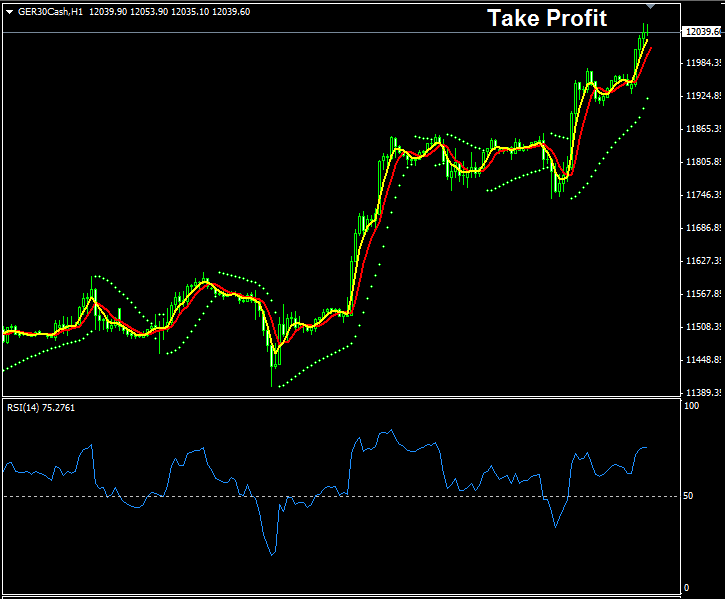

Take Profit

Also, because our trades are making money, we want to take our profit while we're doing well. Even though our trading strategy still suggests buying, we're going to close this trade to make sure we keep the profit we've earned. This trade has gone up 2,400 points, making a profit of $236 per lot. We initially opened two lots, which made a total profit of about $560, and we also added two more lots at 11,980, earning an extra 700 points of profit.

Keep in mind that for Indices, 1 pip for each lot equals 0.1, not 10 for each pip as in FX. However, the usual market changes each day for indices are about 500 to 2000 points, while the average daily pip change is 50 to 100 points, so for indices, even if the market changes by about 2000 points, the profit for each point is just 0.1, meaning when trading indexes, if you gain 2000 points, the total profit in dollars is only $200, like the example shown.

The average contract or lot size for indexes is smaller than the standard lot size. For a standard lot, you need a margin of $1,000, while the standard lot for the trade mentioned above only requires about €85 (which is roughly $90). This tells us that the standard lot for indices is 10 times smaller than that for foreign exchange - so the lot used in the previous trade is like a mini lot.

The screenshot provided below displays our index chart subsequent to closing a trade and realizing profits.

The System Specifications

Indicators

- 5 and 7 LWMA - Method for MA Crossover Strategy

- RSI - The 50 Center-Line Crossover Trading Technique

Rules

- Wait for Pullback

- After Pullback, look for entry signal - Both Moving Averages Moving Averages should be moving upwards and RSI should be above 50 center mark.

Keep in mind that the long-term directional bias for this index is upward: therefore, we should exclusively open/execute buy transactions (The Trend is Your Friend).

More Topics & Courses:

- Practical Exercises Focused on Fibonacci Expansion Levels and Fibonacci Retracement Concepts.

- Trading XAU USD by Leveraging Both the MACD Fast Line and the MACD Signal Line

- Need a guide lesson for NKY225 strategies? Download it here.

- How to Get MT4 SPAIN35 Index Trading Chart

- RSI MT4 Technical Indicator Example Explained