Trailing Stop Loss Levels: Signals and Analysis

Created by Tushar Chandes.

This volatility tool sets stop loss spots. It bases trail distance on price swings.

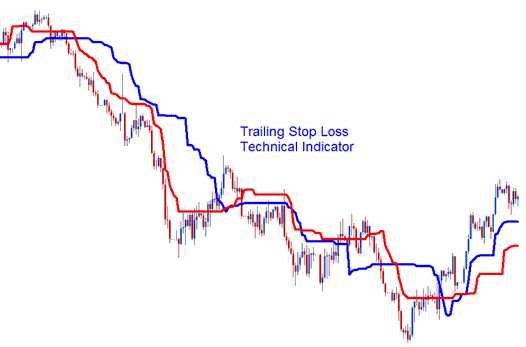

The Levels of the two lines, these 2 lines represent:

- Long Stop Level - Blue Line

- Short Stop Level - Red Line

When compared and analyzed to short stop level, which uses tight stoploss order, this stop level line has a far wider price range in terms of where it trails stoploss order.

This tool follows price based on volatility. In downtrends, it trails above price. In uptrends, it trails below.

XAU USD Analysis and How to Generate Trading Signals

These values are computed by applying volatility measures to decide the placement of the indicator - this is instrumental in determining appropriate stop-loss order levels.

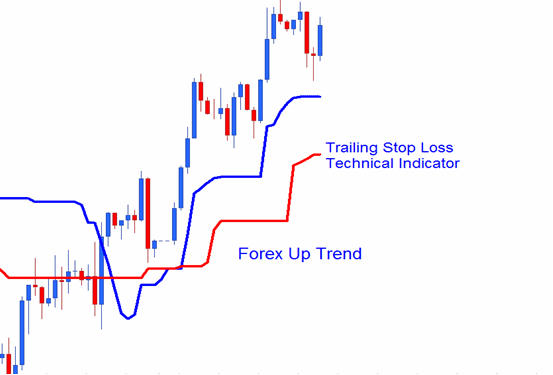

Upwards Trend

In an uptrend, these levels trail below the price. Pick the short stop for a tight stop loss or the long stop for a wider one. As price rises, the trailing stop moves up too. An exit signal appears when price drops below these levels.

XAUUSD Uptrend

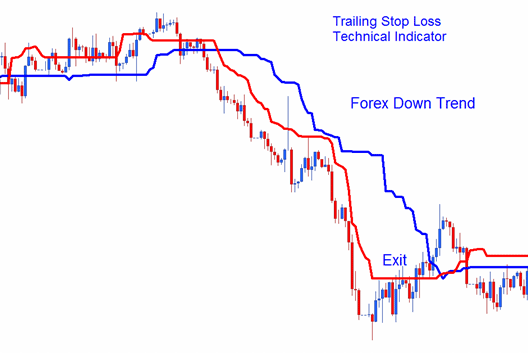

Downward Trend

In a downwards trend the stoploss order levels will trail above the price these 2 levels can be used to set these stoploss levels. As price drops further these levels will continue to drop lower and follow price lower. An exit signal gets derived & generated when the price crosses above these levels.

XAUUSD Downtrend

When price starts to retrace, but certain levels hold steady, it means eventually the trailing stop loss will take you out of the trade.

More Subjects and Online Classes:

- What's Average NASDAQ100 Spreads?

- Instructions for Locating the FTSE MIB 40 Index on a MetaTrader 4 PC Installation

- Trading System for DJI 30 Stock Indices

- RSI Hidden Bullish XAUUSD Divergence & RSI Hidden Bearish XAUUSD Divergence

- Momentum MT4 Indicator Example Explained

- EUR NOK Spread Explained

- The Strategy Training Lesson Tutorial for Top Strategy for Beginner Traders

- MACD Buy & Sell Signals Tutorial

- How is S & P 500 Index Traded on the MT4 & MT5 Software?

- Indicators That Serve to Determine Take Profit Levels