Forex 20 Pips Moving Average Strategy Explained

20 Pips Moving Average Tips: Simple Trading Systems

With the 1 Hour and 15 minute charts, the 20 pips price range moving average approach is applied. We employ the 100 and 200 simple MA Moving Average on these time frames.

The direction of the trend will be determined on both the 1-hour and 15-minute charts by using the 100 and 200 SMA (SMA Technical Indicator).

The 1-hour chart spots the main trend direction, up or down, based on moving averages. Stick all trades to that trend's path.

We check the 15-minute chart to pick the best entry spots for trades. Open positions only if price stays within 20 pips of the 200-period simple moving average. Skip trades if it's outside that range.

Uptrend/Bullish Market

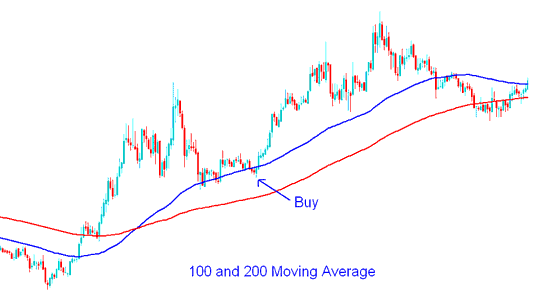

To generate buy signal (bullish signals) using the 20 pips MA strategy, we shall use the 1 hour and 15 minute chart time frame.

On the one-hour (H1) chart, the market price should be situated above both the 100-period and 200-period Simple Moving Averages. Confirmation then proceeds to a shorter timeframe, specifically the 15-minute chart, to pinpoint an entry signal.

On a 15-minute chart, when the price rises to 20 pips above the 200 SMA, a buy trade should be initiated, with a stop loss placed 30 pips below the 200 SMA. While traders may adjust the stop loss based on their risk preferences, a 30-pip stop loss is recommended to avoid being stopped out by typical Forex volatility.

Open a buy position when price hits or tests the 100-period simple moving average. Do this only if it stays close to the 200 SMA. Usually, the 100 SMA falls within 20 pips of the 200 SMA.

100 and 200 Simple Moving Average Trading Buy Signal - A 20 Pips Moving Average Trading Approach.

Sell Trade Signal - Downtrend/Bearish Market

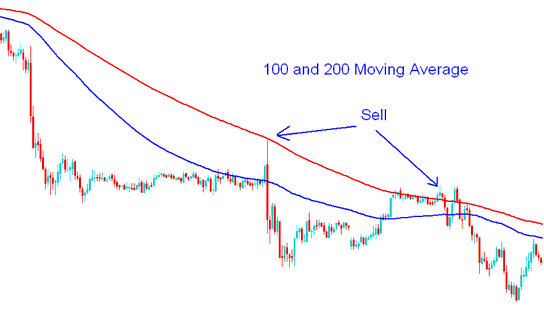

For sell signals with the 20 pips MA strategy, use 1-hour and 15-minute charts.

On the H1 chart's time setting, the price should be under both the 100 & 200 SMA. Then, we switch to the 15 Min chart's time setting to get a Signal.

When utilizing a 15-minute chart, if the price descends to a point 20 pips beneath the 200 SMA, we initiate a sell trade and concurrently institute a stop-loss order 30 pips situated above the 200 simple moving average.

Sell Signal Based on 100 and 200 Simple MAs - Employing the 20 Pip Moving Average (MA) Technique

Using this strategy involves price rebounding from key support and resistance levels. These zones are closely monitored by traders, leading to increased activity at similar entry points.

Support and resistance zones function as short-term resistance/support levels within the charts.

profit booking zone for This Strategy

With this trading strategy, price bounces and moves in the direction of the original trend. You'll usually see a move of about 60 to 70 pips.

The optimal level for realizing profits should be considered to be situated between 60 and 70 pips away from the 200 SMA (Simple Moving Average).

Review Further Instructional Material & Subject Areas:

- Defining the Meaning of Gold Margin Level within the Context of the MetaTrader 4 Platform

- What is Ultimate Oscillator Indicator?

- Chart Formations for XAU/USD: Examination of Consolidation Patterns and Symmetrical Triangles

- How to Master Forex Guide Tutorial Courses Key Concepts

- 5 & 3 Wave Elliot Count Guidelines in XAU USD Trend

- How Can I Interpret Support Resistance Levels using Support Resistance Trading Indicator?

- What is FX Trading FX Pairs Spreads?

- Manage Risk in Gold XAUUSD Trades

- FX Support and Resistance Levels Expert Advisor(EA) Setup