The Elliot Wave Theory

This analysis forecasts price trends through mood swings, price highs and lows, and group moves. It views human behavior as patterned over time. Buy and sell acts shape market prices.

This analytical framework was devised by Ralph Nelson Elliott, predicated on the natural observation that many phenomena occur and resolve themselves within a repeating five-wave structure. These identifiable patterns have been adapted for trading analysis to examine the behavioral patterns of XAUUSD market dynamics.

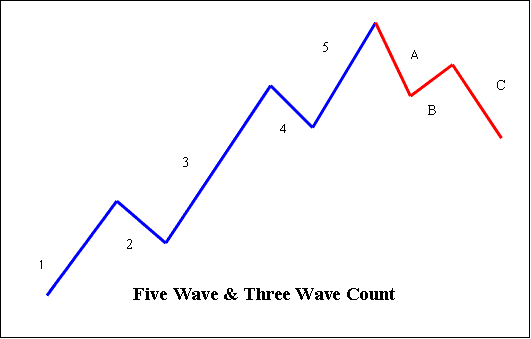

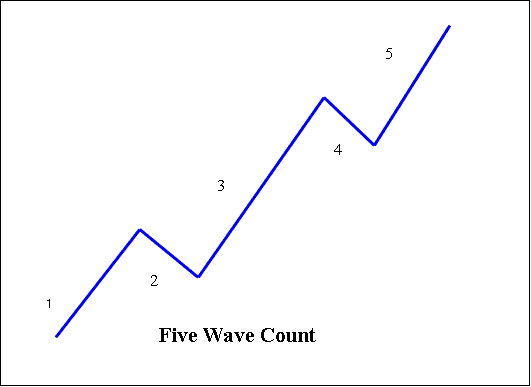

When you apply this theory to XAUUSD, it assumes the market moves in five waves - three up (waves 1, 3, and 5), separated by two down moves (waves 2 and 4). Put the three upward moves and the two downward ones together, and you've got the classic 5 Wave trading pattern.

Furthermore, the theory posits that every upward movement consisting of five patterns is succeeded by a downward pattern move comprising three constituent downward patterns, designated with letters A, B, and C - to distinguish them from the numbered segments of the upward wave.

5 and 3 Wave Pattern

The main trend consists of five moves, while the price retracement consists of three moves.

Five pattern (dominant trend) - uses 1, 2, 3, 4, 5

3 pattern (corrective trend) - uses A, B, C

This report concerns how to trade online marketplaces utilizing the Elliot Theory as the driving basis for xauusd. This methodology heavily depends on observing price charts. Technical analysts employ this principle to examine evolving trajectories to pinpoint the waves & determine what trading valuations might do subsequently.

Traders study chart patterns with Elliott Theory to decide entry and exit points. They spot where the market might reverse.

Markets show changing investor mindsets through price action. Spotting repeating patterns helps. Link them to Elliott wave counts, and predict price direction.

Rules for Elliot Count

This theory shapes market patterns. It includes rules for valid counts.

- Wave 2 shouldn't go below the beginning of Part 1.

- Wave 3 should be the biggest among Part 1, 3 and 5.

- Wave 4 shouldn't over-lap with Part 1.

Five pattern (dominant trend)

1: New bull markets start without much notice. At the first wave, news stays mostly bad. The old downtrend seems to hold strong. Analysts keep cutting their forecasts. The shift doesn't look solid yet. Sentiment stays negative. Market volatility runs high. Volume rises a little with prices, but not enough to warn many experts.

2: This corrective wave retraces the move seen in wave one but is prohibited from extending below the starting point of wave one. Typically, market news remains unfavorable during this period. As prices retest the prior low point, negative sentiment rapidly resurfaces, reinforcing the "crowd" mentality that the bear market remains dominant. Nevertheless, observant traders can detect subtle positive shifts: trading volume during wave two should be lesser than that recorded during wave one, and the price generally does not decline by more than 61.80% of the preceding up-move (wave one). The price will establish a bottom that sits higher than the prior low, thus forming a 'higher low.'

3: This is normally the biggest and strongest upward movement, bigger than movements 1 and 5. The news is now good, and those who study basic information begin to increase their guesses. Prices go up fast, and drops do not last long or go very deep. People wanting to join in when the price goes down will probably miss out. When three starts, the news is likely still a bit bad, and most traders are still down: but around the middle of part three, many people will often join in and agree that the new feeling in the market is good. Wave 3 will go past the highest point reached by 1.

4: It usually fixes something and is very clear about it. Prices could stay roughly the same for quite a while, and number 4 usually doesn't go back more than 38.20 % of number 3. The amount of trading is much less than during wave number 3. It's a good idea to buy when the price goes back down a bit if you know what might happen in Part 5. However, this number 4 is often annoying because it doesn't make much progress in the overall upward direction.

5: This stage represents the culminating phase in the direction of the current major market trend. Positive news becomes overwhelmingly prevalent, and market optimism is widespread. Unfortunately, this is frequently when the majority of retail traders enter the market, precisely when the price is nearing its peak or highest test point. Volume in wave five often trails that seen in wave three, and numerous momentum oscillators begin to exhibit divergences (i.e., gold prices reach a new high, but the indicators fail to do so). Near the terminus of a significant upward market trend, those attempting to sell into strength or call the top might well be met with derision.

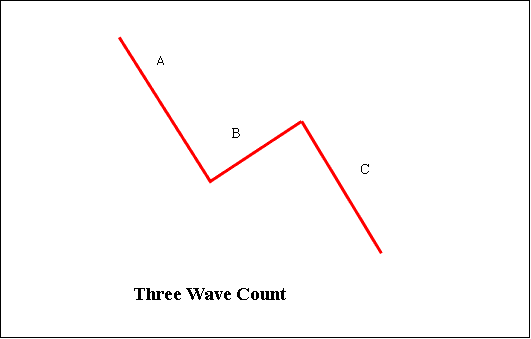

3 Pattern (Corrective Trend)

A: Spotting corrections beats finding main moves. In A's down phase, news stays good. Experts call the dip a pause in a bull run. Signs include more volume, rising real and expected ups and downs, plus more short bets.

B: Prices turn up a bit, which some view as the old uptrend returning. Those who know classic chart patterns might spot this peak as the right shoulder in a head-and-shoulders flip for gold. Volume at B stays below A's level. By now, basics likely stopped getting better but haven't gone bad yet.

C: Prices drop in sharp moves. Trading volume increases. By the third part of C, most people see the bear trend is strong. Wave C often matches wave A in size or reaches 1.618 times beyond A's low point using Fibonacci.

More Topics & Courses:

- 100 Best FX Brokers

- Trade Rate of Change (ROC) Indicator Course Tutorial for Beginner Traders

- Average Directional Movement Stock Indices MetaTrader 4

- Methods for Analyzing and Interpreting Chart Data Using Established Trading Systems

- MetaTrader 4 Meta-Editor: How to Add EAs How to Make Expert Advisor(EA) for MT4

- How Do You Set USDTRY Chart to MT4?

- Classic Bullish Divergence vs Classic Bearish Divergence

- How Do You Set NKY225 Index on MetaTrader 5 Platform?

- How Do You Use Bulls Power in FX?

- MetaTrader 4 XAUUSD Charts Options Settings on Tools Menu