What is Rate of Change, ROC Indicator? - Definition of Rate of Change, ROC Indicator

Rate of Change, ROC - Rate of Change, ROC technical indicators is a popular indicator which can be found on the - Indicators List on this site. Rate of Change, ROC is used by the traders to forecast price movement depending on the chart price analysis done using this Rate of Change, ROC trading indicator. Traders can use the Rate of Change, ROC buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Rate of Change, ROC indicator. By using Rate of Change, ROC and other fx indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Rate of Change, ROC Trading Indicator? Rate of Change, ROC Indicator

How Do You Combine Indicators with Rate of Change, ROC? - Adding ROC in the MT4 Software

Which Indicator is the Best to Combine with Rate of Change, ROC?

Which is the best Rate of Change, ROC combination for trading?

The most popular indicators combined with Rate of Change, ROC are:

- RSI

- MAs Moving Averages Indicator

- MACD

- Bollinger Band Indicator

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Rate of Change, ROC combination for trading? - Rate of Change, ROC MT4 indicators

What Indicators to Combine with Rate of Change, ROC?

Find additional indicators in addition to Rate of Change, ROC that will determine the trend of the market price and also others that confirm the market trend. By combining indicators which determine trend & others that confirm the trend & combining these indicators with Rate of Change, ROC a trader will come up with a Rate of Change, ROC based system that they can test using a practice demo account on the MetaTrader 4 platform.

This Rate of Change, ROC based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is Rate of Change, ROC Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best Rate of Change, ROC Strategy?

How to Select and Choose the Best Rate of Change, ROC Strategy

For traders researching on What is the best Rate of Change, ROC strategy - the following learn tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the Rate of Change, ROC system.

How to Create Rate of Change, ROC Trading Strategies

- What is Rate of Change, ROC System

- Creating Rate of Change, ROC Trade System Template

- Writing Rate of Change, ROC System Rules

- Generating Rate of Change, ROC Buy and Rate of Change, ROC Sell Signals

- Creating Rate of Change, ROC System Tips

About Rate of Change, ROC Example Explained

Rate of Change Analysis & Rate of Change Signals

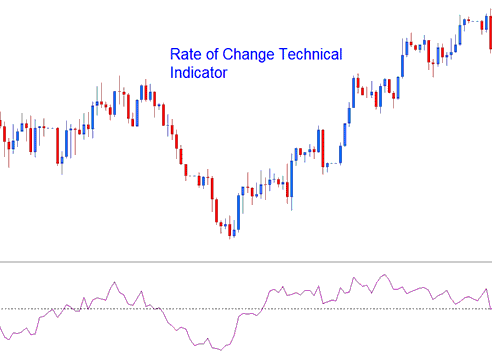

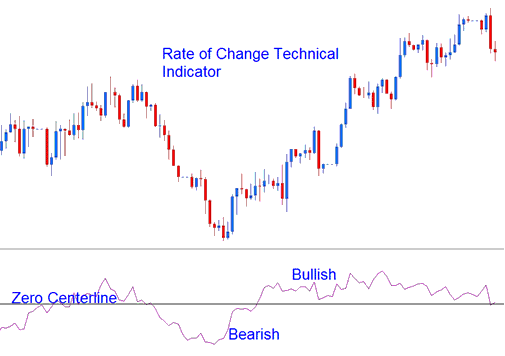

Rate of Change, ROC indicator is used to calculate how much price has changed within a specified number of trading price periods. It calculates the difference between the current candle and the price of a specified number of previous candles.

The difference can be calculated and measured using Points or Percents. ROC moves in an oscillation manner, where it oscillates above and below a zero center line level. Levels above zero are bullish while those below zero center line level are bearish.

The greater the changes are in the prices the greater the changes in the ROC Rate of Change.

Forex Analysis and How to Generate Signals

ROC can be used to generate trade signals using a number of methods, the most regular ones are:

Forex Crossover Signals

Bullish Signal - buy signal is generated/derived when the ROC crosses above zero centerline

Bearish Signal - sell signal is derived & generated when Rate of Change crosses below zero centerline.

Overbought/Over-sold Levels:

Overbought - The higher the reading the more overbought a forex pair is. Values that are above the overbought level imply that a currency is over-bought and there a pending price correction

Oversold - The lower the reading the more over-sold a forex pair is. Values below the over-sold level imply that a currency is over-sold and there a pending price rally.

However, during strong trending markets the price will remain in the Overbought/Over-sold Levels for a long time, and rather than the price reversing the market trend will continue for quite some time. It is hence best to use the crossover signals as the official buy & sell signals.

FX TrendLine Breaks

Trend Lines can be drawn on ROC just the same way trend lines can be drawn on price charts. Because The ROC is a leading indicator, the trend lines on the indicator will be broken before those on the price charts. A trendline break on the Rate of Change is an indication of a bearish or bullish reversal setup.

- Bearish reversal- ROC values/readings breaking above a downwards trend-line warns of a likely bullish reversal.

- Bearish reversal- Rate of Change values/readings breaking below an upwards trendline warns of a likely bearish reversal.

Divergence Trading

ROC can be used to trade divergences, and to identify the potential trend reversal signals. There are 4 types of divergences: classic bullish, classic bearish, hidden bullish & hidden bearish divergence.

More Tutorials:

- How to Use MT4 Triple Exponential Moving Average TEMA Indicator

- MetaTrader NIKKEI Indices NIKKEI225 MT4 Forex Software Platform

- How Can I Analyze/Interpret Forex Pending Orders?

- Forex Margin Calculator Explanation Using MT4 Software

- How Can I Find MetaTrader 4 EUR SEK Chart?

- 1:100 Leverage

- MetaTrader 4 Margin Calculator Gold

- Bollinger Band Bulge and Bollinger Band Squeeze XAU/USD Analysis

- NZDCAD System NZDCAD Trading Strategy

- Online Trading Illustrated and Shown