Bilateral/Consolidation Patterns XAUUSD

With chart patterns that show the market going sideways, it could go either way. There are 2 kinds of these patterns that show up on trading charts:

- Symmetrical Triangles - Consolidation Chart Patterns

- Rectangles - Range market

Consolidation Setups

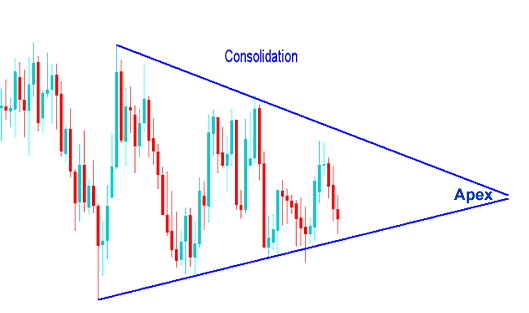

Symmetric triangles are chart patterns where lines come together and form a pause in the market. The technical buy signal from a symmetric triangle is when the price goes up, and a downward break is a signal to sell. Ideally, the market breaks out from the triangle before it reaches the end.

Trendlines can be established by linking the lows and highs of the market consolidation pattern, resulting in symmetrical lines that converge at a point. A breakout is typically expected to happen between 60-80% through the triangular pattern. Breakouts that occur too early or too late are at a higher risk of failing, making them less dependable. Following a breakout, the apex serves as support and resistance levels for pricing. Once the price has broken beyond the consolidation setup, it should not fall back below the apex point. The apex serves as a reference point for setting stop loss orders for active trades.

When these setups for consolidation charts appear, it means the market is pausing before choosing where to go next.

Consolidation patterns build during battles between buyers and sellers, with no clear winner.

Consolidation Chart Setup

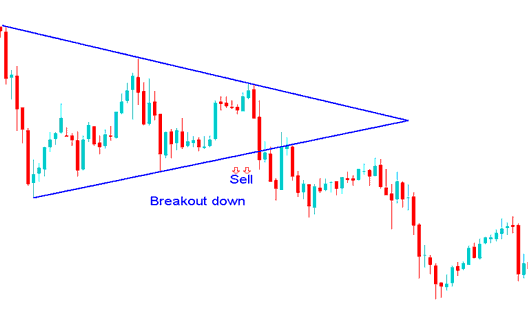

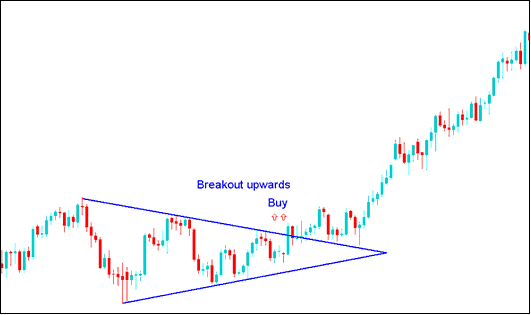

Consolidation setups in charts don't last indefinitely, much like a tug of war where one side eventually prevails. Examining the chart example below, you can see how this setup leads to a breakout. The focus now is on positioning yourself on the winning side during such movements.

Breakout Downward Sell Signal after a Consolidation Setup Pattern

Upward Breakout Buy After a Consolidation Pattern Forms.

Now back to our question, how can we ensure we are at the facet this is the prevailing side?

We wait for the price to go past one of the lines and then place buy or sell orders in that direction. If the price breaks above the upper line after staying in one place, we buy, and if it breaks below the lower line, we sell.

If you don't want to wait for the market to consolidate, you can use pending orders instead. Want to learn more? Go to the lesson on Stop Entry Order Types.

The two stop order types for consolidation patterns are:

- Buy Entry Stop An order to buy at a level above price.

- Sell Entry Stop An order to open sell trade at a level below price.

These orders are designed to initiate buy trades above the market price or sell trades below it.

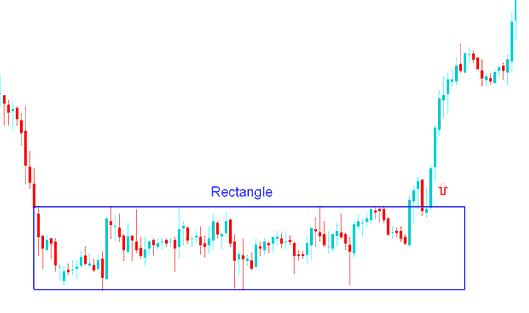

Rectangle Chart Pattern

A rectangle consolidation chart setup is a range with small price changes that creates a break in market activity. The price range is shown by 2 trendlines that run side-by-side, are flat, and show support and resistance. This pattern is drawn on a chart using a rectangle, which is why it is called a rectangle pattern.

With this pattern, the price makes several highs and lows that can be linked by straight, horizontal lines that are parallel to each other. This pattern takes place over a long time, which gives it the shape of a rectangle.

A price action breakout from this consolidation structure is realized when either of the horizontal boundaries is penetrated, thereby breaking the rectangular pattern's trading range. An upward breach signals a buy: a downward breach signals a sell.

Rectangle Pattern XAUUSD - Consolidation Pattern

After a period of consolidation, the price breaks out of the range and continues its upward trajectory following an upward market breach.

Get More Guides and Topics:

- How to Interpret Trend Reversal Analysis

- USDX Chart and How to Trade Forex Using US Dollar Indices

- No-Nonsense Pivot Points: Buy and Sell Signal Indicator

- List of Trading Strategies for FTSE and List of FTSE Methods

- Identifying the Most Favorable Periods for Trading Foreign Exchange (FX) Currencies

- How to Figure Out Forex Profit and Loss in a Mini Account Simply Explained

- How do I trade IBEX35 stock indices as a beginner?

- How Do I Set Bears Power XAU/USD Indicator in Trading Chart in MetaTrader 4 Platform?

- William % R Indicator Settings in MT4 Platform