Tips for Setting Stop Loss on Gold XAUUSD Trades

Setting stop-loss orders for gold trading requires precision. Avoid placing them too close or too far from support or resistance zones. Instead, position them a few pips below support or above resistance levels for optimal results.

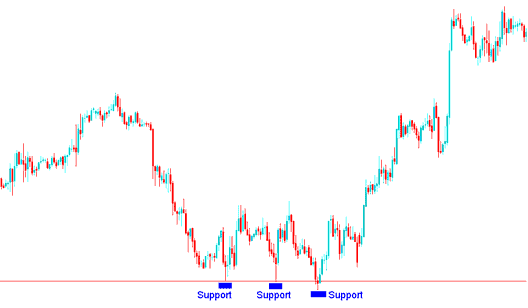

If you're going long (buying Gold pair), just look for a nearby support level that is below your entry point and set this stop loss about 20 to 30 pips below that support zone. The example illustration below shows the level where a gold trader can set-up their stop loss orders on the XAUUSD price chart just below the support zone.

Where to Put the Stop Loss When Buying Gold, Using the Support Level on Gold Charts

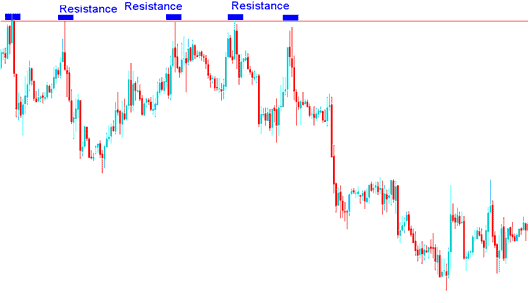

For shorting XAUUSD, find resistance above your entry. Set stop 20 to 30 pips over that zone. The chart example places it just past resistance on Gold.

Resistance Level for establishing the Stop Loss Level for Sell Trades on the XAUUSD Trading Chart.

You can also utilize stop loss orders to secure profits, not just to avert losses

The good thing about a stop loss is that you don't need to check the Gold price chart every day to see how it's doing. This is really helpful if you can't keep an eye on your trades for a long time, or if you want to sleep after trading Gold all day but still have one XAUUSD trade running.

The primary drawback of utilizing a stop-loss order is that the precise price set for activation might be triggered by a fleeting, short-term fluctuation in the XAUUSD price. The crucial element lies in selecting a stop-loss order percentage that accommodates the daily intraday variability of the Gold price yet effectively mitigates potential downside risks.

People usually think of these stoploss orders as a way to prevent big losses, which explains the name. These stop loss orders can also be used to secure profits: when used this way, they are called a trailing stoploss order.

For a stop loss order that adjusts as the price moves, it's set at a percentage below the current Gold price. This stop loss level that adjusts is then changed as the Gold trade progresses over time. Using this kind of stop loss lets you keep making profits while also ensuring you lock in some profits if the market changes direction.

These stop loss orders can also be used to eliminate risk if a XAUUSD trade becomes profitable. If a position makes some feasible gains then the stoploss order can be moved to break even point, the point at which you bought the Gold pair, thence ensuring that even if the Gold trade position moves against you, you'll not make any loss, you'll breakeven on that XAUUSD trade.

Trailing stop loss orders help get the most profit as the Gold price goes up and reduce losses when the price drops.

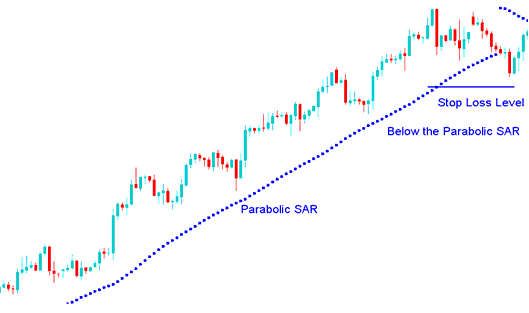

A great example of an indicator for setting a trailing stop is when you use the parabolic SAR chart indicator & continuously adjust your stop loss to the parabolic SAR level.

Deploying the Parabolic SAR Indicator to Set a Protective Trailing Stop-Loss When Trading XAU USD.

Another instance is when a trader adjusts their stop loss by a specific number of pips after several hours, every hour, or even every 15 minutes, depending on the time frame of the Gold chart being utilized by the Gold trader.

In the above illustration the parabolic SAR which had a setting of 2 and 0.02 was used as the trailing stoploss order level for the above chart. The trader would have kept moving the trailing stop level upward after every SAR was plotted until the moment when the Parabolic SAR was hit & the trend reversed.

Conclusion

A stop loss order is a straightforward instrument, yet many traders neglect to utilize it. This tool can either reduce significant losses or secure trading gains, making it useful in nearly all investment strategies.

Things to Keep in Mind When Setting and Using These Stop Loss Orders

Remember these important things:

Place stop-loss orders with care. Gold (XAUUSD) often swings 50 points. Set them outside that range. Otherwise, normal price moves will trigger them early.

Stop-loss orders remove feelings from trade choices. They set a fixed exit for bad trades to limit losses and protect your account balance.

Traders in XAUUSD may use indicators to determine the location of stop-loss order levels, or they can use the principles of Resistance and Support levels to decide where to set them. The Bollinger bands indicator is another effective MT4 indicator that may be used to place these orders. Here, traders use the upper and lower band as the limits of price and then place these stop loss order orders outside of these bands.

Examine more guides and topics

- Trading the EURO STOXX 50 Index Using the MetaTrader 5 Indices Software

- GER30 Index Trading Strategy Training Guide Download

- What Time Does The Market Open for Us30 Index?

- Kauffman Efficiency Ratio MT4 Indicator

- What Trading Company Lets You Trade the CAC 40 Index?

- Top Trading Account Bonuses with Lot Rebates and XAUUSD Cashback