Overview of the Dow Jones Industry Average (Dow 30) Stock Index on Wall Street

The Dow Jones Industrial Average, or Dow 30, is a market index that tracks 30 of the largest stocks in the United States. These components are calculated using shares from some of the most prominent companies in the country.

The Dow Jones is the most liked and most followed Stock Indexes worldwide. The Dow Jones Industry Average stock index traditionally kept track of the performance of Industrial stocks but that has changed to include also stocks from other economic sectors of the overall economy. Main criteria being the shares/stocks chosen are from the largest US companies.

The Dow Jones exhibits greater price fluctuation compared to most other major indices. While the long-term direction for the Dow Jones is typically upward, it is prone to more frequent price retractions and periods of stagnation than its counterparts. Traders who favor trading in indices displaying stronger and more consistent upward trends might prefer alternatives to the Dow Jones Industrial Average.

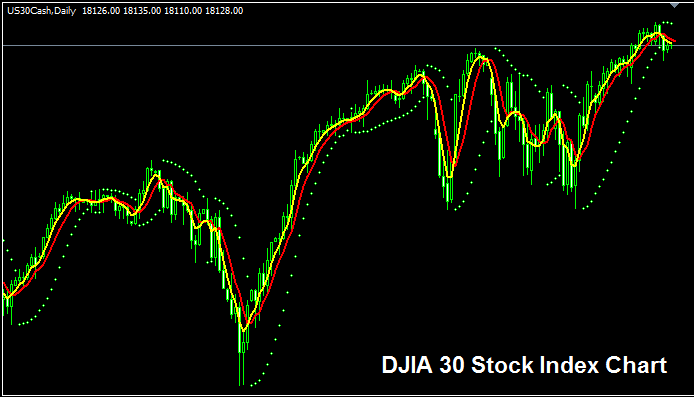

The DowJones30 Stock Index Chart

The DowJones30 Index chart shows above. In the illustration, this tool is named USA30CASH. Find a broker that provides the DowJones30 Index chart. Then you can start trading it. The example is from DowJones30 Index on the MT4 Forex Platform Software.

Other Data about DowJones30 Index

Official Symbol - DJI

The Dow Jones 30 Index gets its 30 stocks from top U.S. companies, but its calculation is a bit different from other indexes. Instead of weighting, it just adds up the prices and divides by a common divisor. This approach actually makes the index more volatile than others.

Strategy of Trading DowJones30 Index

The way the DowJones30 Stock Index is figured out makes the Dow 30 index change more quickly, so its price moves up and down more widely. Although this index usually goes up over time because the US economy also shows strong growth and is the largest economy in the world.

If you're a trader looking to trade this index, be ready for somewhat higher volatility and wider price swings.

As an index trader, stay biased toward buying as the index climbs. The US economy often performs well. So an upward trend usually dominates. A solid strategy is to buy on dips.

During Economic SlowDown & Recession

During economic slow-down and recession times, firms begin to report slower revenues and earnings, slower profits & lowers growth projection. It's because of this reason that traders start & begin to sell shares of corporations which are posting & recording lower profits & hence the Index tracking these specified stocks will also begin to move downward.

During these periods, index trends often head down. Adjust your strategy to match the downward moves in the index you trade.

Contracts and Specifications

Money Needed for 1 Lot - $150

Value per Pips - $ 0.5

NB: Even though general and overall trend is generally moves upward, as a trader you've got to consider and factor in the daily market volatility, on some of the days the Index may oscillate or even retrace & retracement, market retracement/correction move might also be a large one at times & therefore you as a trader you need to time your entry precisely using this strategy: Index strategy & at the same time use the suitable and appropriate & appropriate and proper money management principles and guidelines just in case there's more unexpected volatility in the market. About equity management rules and guidelines in stock indices topics: What is index equity management & money management strategies.

More Guides & Tutorials:

- How to Find Value/Size of 1 Pips of S&PASX200 Index

- Online XAU/USD Brokers through MetaTrader 4 Platforms

- How to Start Gold for Beginner Traders Guide Tutorial

- XAUUSD Lessons and Tutorials: Gold Trading Training Course

- How to Use MT5 T3 MA Indicator in MetaTrader 5 Software

- How to Place Zigzag Indicator in FX Chart on MT4 Software

- Balance of Power BOP MetaTrader 4 Technical Indicator Trading Analysis

- Ichimoku Signals for Forex Buy/Sell Trades

- GBPHKD Opening Time and GBPHKD Closing Time