NASDAQ 100 Index

NASDAQ 100 is an index that include 100 of the biggest firms shown in the NASDAQ Index exchange market which aren't in the financial sector. The calculation of this index is based in a weighted component of market capitalization of listed 100 securities. The 100 companies shown on this stock index are re-evaluated quarterly.

The 100 corporations comprising this index are not exclusively US-based: international firms are also incorporated into the calculation provided they are listed on the NASDAQ Stock Market exchange.

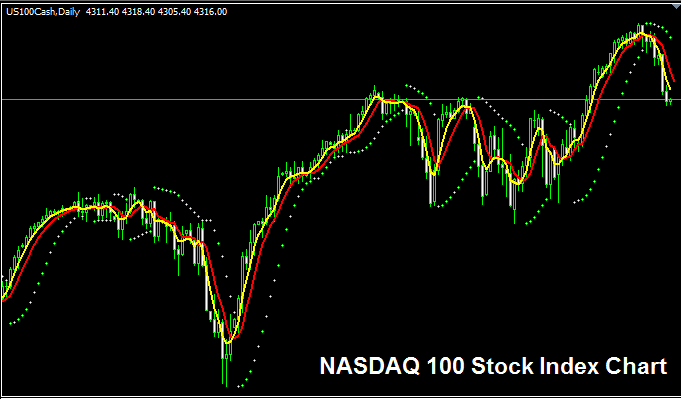

NASDAQ 100 Index Trade Chart

Displayed above is the chart for the NASDAQ100 Index. In the provided sample, this Index is identified as USA 100CASH. Your aim is to seek out and secure a broker offering the NASDAQ100 Index chart so that trading can commence. The image shown is an example of the NASDAQ100 Stock Index as presented on the MetaTrader 4 FX and Trading Platform.

Other Info about NASDAQ 100 Index

Official Index Symbol - QQQ:IND

The 100 component stocks that make up NASDAQ100 Index are calculated using a weighted component for each stock. The constituent stocks & weighting for each Stock Index is re-evaluated quarterly.

Strategy to NASDAQ100 Stock Index

The way the NASDAQ100 Index is figured out makes it change more, so there are bigger ups and downs in how the price of this index moves. The index includes a part that shows how much each Index included in this index affects it. This index usually goes up over time because the USA economy is also growing well.

As a trader of indices, your goal should be to maintain a buying bias, continuing to purchase as the index demonstrates upward movement. When the United States economy experiences favorable conditions, the valuations of equities comprising the NASDAQ100 index tend to appreciate, leading this index to likely sustain an upward market trajectory. A sound trading approach for this Stock Index involves buying during temporary pullbacks.

During Economic SlowDown and Recession

During economic slow-down & recession times, firms begin to report slower profits & slower growth projections. It's due to and because of this reason that traders start to sell shares of corporations that are reporting & recording lower profits and hence the Indices tracking these given stocks also will start to go downward.

In these periods, markets tend to drop. Adjust your strategy to match the downward index trends you trade.

Contracts and Details

Margin Required for 1 Lot - $ 30

Value per Pips - $0.1

NB: Even though the price usually goes up over time, traders need to think about how much the market changes each day, because some days the Index might stay in one place or even go back down, and sometimes these drops can be big, so traders need to time their trades carefully using this plan: Stock strategy & also use good money management rules in case the market changes unexpectedly. About the rules for managing money in indices: What is index equity management and money management system.

Find More Subjects and Educations:

- Setting FX Sell Stop Orders on the MetaTrader 4 Platform

- Strategy for SWI 20 in FX

- FRA 40 on MT4 - here's the exact name in the software.

- Strategies for EURO STOXX 50 Index

- Entry Stop Forex Orders: Buy Stop Forex Order and Sell Stop Order

- SMA, EMA, LWMA & SMMA Moving Averages Index Examples

- EURRUB System EURRUB Trade Strategy

- Setting Up a Practice Account for XAU USD & MT4 Gold