Types of Index Moving Averages: SMA, EMA, LWMA, and SMMA

There are 4 types of Indices moving averages:

- Simple Index moving average

- Exponential Indices moving average

- Smoothed moving average

- Linear weighted moving average

The distinction among these four indices' moving averages lies in the weighting given to the most current price data.

Simple MA - SMA Indicator

The Index SMA is a technical tool that gives equal importance to the data from the indices when figuring out the simple moving average. It works by adding up the prices from a chart for a set period and then dividing that total by the number of price periods. For instance, if you're looking at the Index simple moving average for 10, you would add up the price data from the last 10 price bars and divide that sum by 10.

Exponential MA - EMA Indicator

The EMA for indices weights recent prices more. It uses a percentage to boost the latest data in calculations.

Linear Weighted MA - LWMA Indicator

The LWMA moving average gives more importance to the newest price data because the recent data matters more than the older data. The linear weighted moving average MA is found by multiplying each closing price within the set of indices by a certain weighting factor.

Smoothed MA - SMMA Indicator

The Indices SMMA Indicator is figured out by using a smoothing number of N: this number is made up of N smoothing for N price bar times.

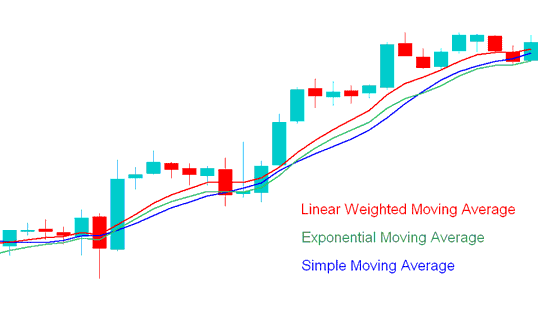

The trade chart example below shows SMA, EMA & LWMA. The SMMA Indices moving average is not commonly used so it is not shown below.

LWMA trading indicator reacts fastest to price information, followed by the EMA and then the SMA.

*SMA, LWMA, EMA -* Different Classifications of Index Moving Averages - Simple, Exponential, and Linear Weighted MAs

Day Trading Index with Exponential & Simple MAs

The SMA and EMA types of Moving Averages are the most frequently employed for trading Indices. While the EMA Indices moving average employs a more complex calculation method, it enjoys greater popularity among traders compared to the standard SMA Indices moving average.

The simple moving average takes the average of closing prices for an index over a chosen time period. You add the prices from each period and divide by the number of periods. For a 10-period average, add the last 10 closing prices and divide by 10.

The SMA indicator is just a simple average. It's straightforward, and a lot of index traders use it to track the trend since it follows price action closely.

The EMA uses an acceleration factor making it more sensitive to the index trends compared to other metrics.

The SMA Indices moving average is used on Stock Indices charts to look at and understand how the Index price is moving. If the Index price action is more than 3 or 4 time Index price periods the SMA, then you should close long Index trade positions right away, because the buy Indices trade is losing strength.

The shorter the Simple Moving Average (SMA) period, the quicker it reacts to changes in price. The SMA indicator can display direct insights regarding the trend of the indices based on its slope: a steeper slope indicates a stronger trend in the index.

Many index traders use the Exponential Moving Average. It responds quicker to price changes than the simple version.

The SMA and EMA can also help find good times to buy and sell when trading Indices. These MAs can also be used with Fib and ADX to make sure the Index signals from these averages are correct.

Learn More Lessons & Topics:

- NKY225 Market Index - Insights Into Efficient Trade Execution

- The Plan Training Instructions Lesson for Top Plan for Beginner Traders

- Need to add the ADX indicator on a MetaTrader 4 chart? Here's how.

- Best ECN Trade Brokers Ranking List

- How Can I Day Trade Pivot Points Levels & Reversal Signals?

- How to Set Up and Open XAUUSD Trades on MetaTrader 4

- XAG/USD Chart Analysis

- How is S & P 500 Index Traded on the MT4 & MT5 Platform/Software?

- HK50 Trading: The Best Strategies for the Hang Seng Index

- What's US 500 Index in Trade?