CAC40 Index

The CAC40 Index represents the French Market Index, tracking the performance of the top 40 largest stocks listed on Euronext Paris Bourse. This index provides insights into the capitalization of these leading companies.

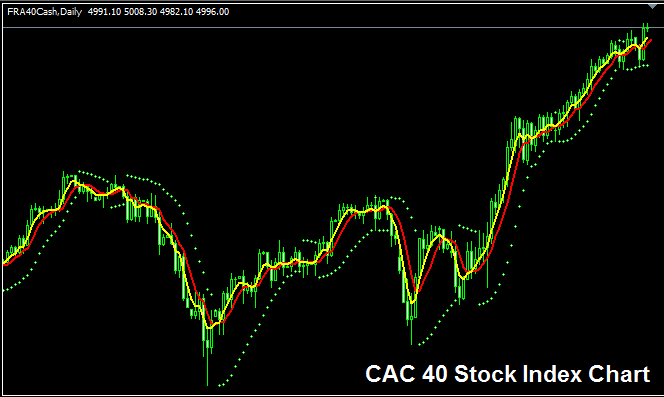

CAC40 Index Trade Chart

The image above shows the CAC40 Index chart. It's labeled FRA 40CASH in this case. Find a broker that offers this index for trading. The example uses MT4 forex software.

Other Data about CAC40 Index

Official Stock Index Symbol - CAC:IND

The 40 constituent stocks that makes up the CAC40 Index are selected from top companies in France. The calculation is reviewed quarterly.

Strategy to Trading CAC40 Index

The CAC40 Index monitors the capitalization of the top 40 businesses in France. Since the French economy is also performing well, this stock index tends to rise overall in the long term.

As a stock index trader you want to be biased & keep buying as the index heads and moves upward. When the French economic environment is doing well most of these top shares will continue moving up and hence this stock index will also move in an upward trend. A good index trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down & Recession

In slowdowns or recessions, companies report weaker earnings and lower growth outlooks. Traders sell shares of firms with falling profits. Indexes tied to those stocks then drop too.

During specific periods, trends are more likely to move downward, and as a trader, it is essential to adapt your strategy to align with the prevailing bearish trends in the index you are trading.

Contracts and Specs

Margin Requirement Per 1 Contract - € 40

Value per Pips - € 0.1

Note: Notwithstanding the general upward bias often observed, traders are required to consider and integrate daily market price volatility. Indices may occasionally move horizontally within a range or undergo a retracement, and these corrective movements can sometimes be quite pronounced. As a result, you, the trader, must execute entries with precision using this 'Stock strategy,' while concurrently implementing appropriate and disciplined money management guidelines in case of unexpected market volatility. For details on capital management techniques within indices courses: explore "What is Stock equity management & Stock Index equity management system."

More Topics & Guides:

- Hang Seng Index: Step-by-Step Tutorial

- How to Open Buy & Sell on MT4 Trade Charts

- Which Broker Should I Choose for AEX 25?

- How to Add the DeMark Projected Range Forex Indicator to Trading Charts

- Calculating Pip Value for FTSEMIB40 Index

- Understanding Pips with Clear Definitions and Practical Examples

- Explanation of the Alligator Indicator