FTSE MIB 40 Index

The FTSEMIB 40 index keeps track of the 40 stocks with the most trades on the Borsa Italiana, which is the Italian stock market. People also call this index the Italian 40 Index. The 40 stocks in this index are chosen from the stocks with the most trading activity from the most profitable business areas in Italy.

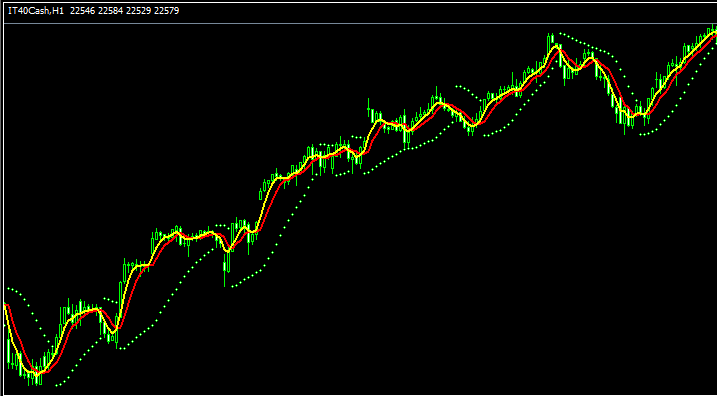

The FTSE MIB 40 Index Chart

The chart above displays the FTSE MIB 40 Index. Here, it's named IT40CASH. As a forex trader, seek a broker with FTSE MIB 40 charts to trade it. The example is the FTSE MIB 40 on the MetaTrader 4 FX and indices platform.

Other Data about FTSEMIB 40 Index

Official Symbol - FTSEMIB:IND

The FTSE MIB 40 Index is comprised of 40 component stocks selected from the premier and most profitable corporations in Italy. These shares are also drawn from sectors exhibiting the highest economic profitability within the Italian economy.

Strategy for Trading FTSEMIB 40 Index

The FTSEMIB 40 index generally moves up over the long-term because the stocks picked represent the best sectors in the Italian economy therefore in general this index will keep moving up over time - because these economic sectors will be doing good business.

If you are a forex participant aiming to trade this specific index, your bias should lean towards the prevailing upward trajectory of the index's price movement.

You aim to maintain a buying bias as the index ascends. This upward trajectory is more probable when the Italian economy is performing well (which is frequently the case). A sound trading tactic involves buying on price dips.

Contracts and Specifications

Margin Required Per 1 Lot/Contract - € 250

Monetary equivalent for a single Pip(Point) - 1 Euro

Note the pip value of the IT40CASH is € 1 compared & analyzed to the value of the other indices such as Germany DAX and EUROSTOXX 50 whose size of 1 pip per lot is € 0.1 - However, the average pip movement for this index is much lower as compared to other indices like DAX 30 and EURO STOXX.

Note: The main trend points up in the long run. But as a forex trader, you must watch daily price swings. Some days, shares might swing back and forth or pull back. Pullbacks can get quite large at times. So as a currency trader, time your trade starts with care. Use the indices strategy for this. Also follow solid money rules if prices shift in ways you don't expect. On money rules topics: What are money management and equity methods.

Learn More Courses & Tutorials:

- MetaTrader Nasdaq Stock Index Nas100 MetaTrader 5 FX Trading Platform Software

- Bullish Divergence Trade Forex & Bearish Trading Divergence Trade

- How Can I Use Bulls Power in Forex Trading?

- Where Can I Find a Learn Online XAU USD Guide Website?

- How Can I Create & Write a FX Strategy Template?

- Instructions for Setting the MA Moving Average Envelope Trading Indicator on Charts

- Forex Account Deposit Bonus Including Lot Rebates and Forex Cash Back