Forex Trend-Line Signals Explained

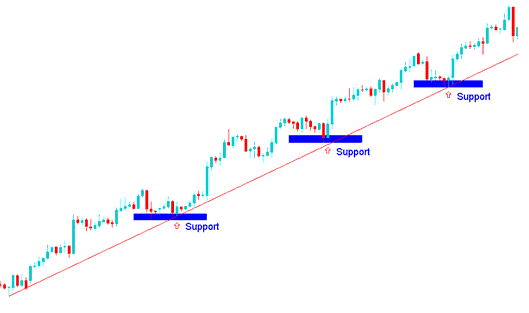

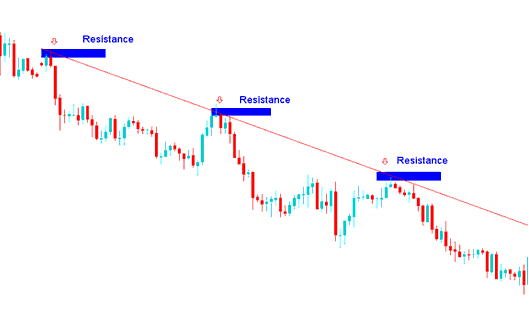

A trendline on a forex chart indicates the overall price direction, whether it is ascending or descending.

Forex trendline signals materialize when the price interacts with or vets the trend-line: such an engagement or vetting is then interpreted as either a signal to buy or a signal to sell.

A price test of the upward trend line signals a buy. Open buys there and hold while prices stay above the line.

What are Trend-Lines Signals? - What are Trend-Lines Forex Signals? - What Do Trend-Lines Signals Mean?

When the price tests or touches the descending trend line, this signals a sell opportunity, and traders will use this juncture on the downtrend line to initiate short positions. These trades remain open as long as asset prices stay below this established downward trajectory.

Defining Trend-Line Signals in Forex - What Exactly Are Trend-Lines FX Signals? - Interpretation of Trend-Lines Signals?

Get More Tutorials & Tutorials:

- Understanding Pips for the Nikkei 225 Index: 1 Pip Explained

- When Are the Optimal Times for Trading?

- How to Figure Out 1 Pip Value for the S&P ASX200 Index

- Definition and Measurement of Draw Down and Maximum Draw Down for XAUUSD Trading

- Method for Calculating the Pip Value Specifically for Trades Made in a Cent Forex Account.

- Using Demarks Projected Range XAU/USD Indicator for Analysis

- Bollinger Band Fibonacci Ratio Indicator

- Nikkei225 Index – What's 1 Pip Worth?

- McGinley Dynamic Lesson Tutorial