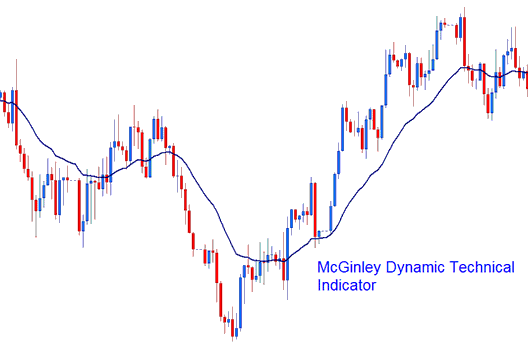

McGinley Dynamic Analysis and McGinley Dynamic Signals

Created and Developed by John McGinley

McGinley Dynamic is engineered to counteract the inherent delay found in conventional simple and exponential MAs: the indicator autonomously adapts its calculations based on the prevailing speed of the market, hence its designation as dynamic.

The indicator follows price movements closely in both a fast and a slow moving market.

Technical Analysis and How to Generate Trading Signals

This specific technical indicator demonstrates superior performance in mitigating the impact of whipsaws compared to the analysis done with the initial MA.

Determined by applying the formula:

Dynamic = D1 + (Price - D1) / (N (Price/D1)4) if is dynamic.

D1 Equals the Prior Dynamic Indicator Value

N = smoothing factor (of price bars periods)

^ = Power of

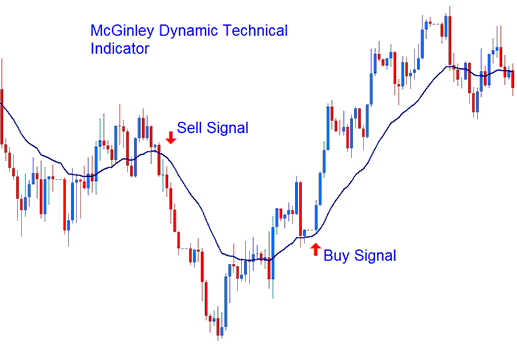

Bullish, Buy Trading Signals and Bearish, Sell Trade Signals

Combining McGinley Dynamic with Moving Averages can enhance trading strategies. McGinley Dynamic acts as a smoothing tool, especially useful when Moving Averages are choppy or static.

- Bullish, Buy Trading Signal - A buy signal is derived and generated when price is crosses above the indicator.

- Bearish, Sell Signal - A sell signal is derived/generated when the price is crosses below indicator.

Skilled Review in Forex

Check Out Extra Subjects and Lessons:

- Economic Data Reports Influencing XAU USD Market Movements

- McGinley Dynamic Gold Indicator Analysis in XAU USD

- Rainbow Charts Automated Trade Forex System

- SP500 Index Trade Signals Strategy

- How to Develop a FX Plan Using a Written Down Trade Plan Example

- CADJPY Opening Time and CADJPY Closing Time

- What Time Do DJ30 Index Close?

- Kauffman Efficiency Ratio Trading Indicator Example Explained

- What's a XAUUSD Stop Loss

- Essential Indicators for Equity Index Trading