McGinley Dynamic: Tech Analysis Signals

Developed by John McGinley

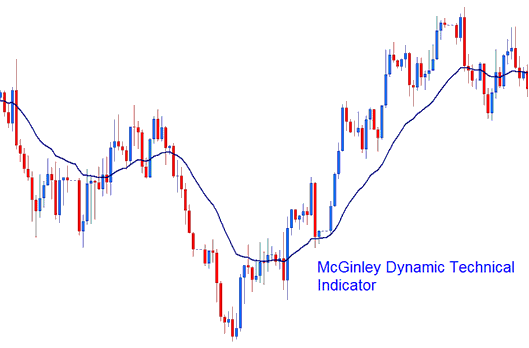

The McGinley Dynamic is designed to mitigate the inherent delay found in conventional Simple and Exponential Moving Averages. This indicator dynamically adjusts its calculation based on the current velocity of the market, hence its "dynamic" designation.

This indicator tracks the transactional price action closely, regardless of whether the market is moving rapidly or slowly.

Technical Analysis and How to Generate Trading Signals

This particular indicator demonstrates superiority in mitigating whip saws when contrasted with the initial, standard moving average.

Using the following formula to determine:

Dynamic = D1 + (Price - D1) / (N (Price/D1)4) if is dynamic.

D1 Equals the Prior Dynamic Indicator Value

N = smoothing out factor (of trading price periods)

^ = Power of

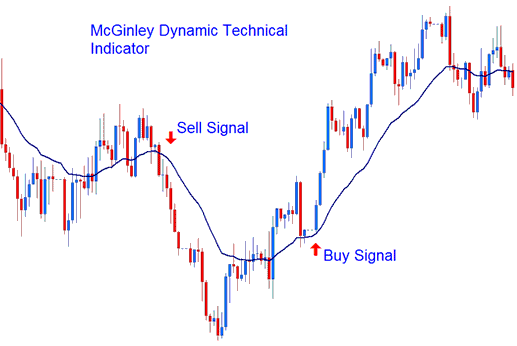

Bullish, Buy Signals and Bearish, Sell Signals

McGinley Dynamic should be used with Moving Averages to create a trading system. McGinley Dynamic should help smooth things out when the MA is jumpy or stays in one area.

- Bullish, Buy Signal - A buy signal gets derived and generated when price crosses above indicator.

- Bearish, Sell Signal - A sell signal is derived and generated when price crosses below indicator.

Technical Analysis in XAU USD Trading

Extra Lessons, Tutorials, and Courses Available:

- MA Indicator Analysis & Moving Average Cross-over Trading System

- Register Account

- Best Time for Trading AUDSGD GMT

- What's FX and the FX Market Trade Sessions Explained?

- Trade Strategies for Trading AEX25 Indices

- How to Display the Bollinger Band Width Indicator on a Trading Chart

- Divergence Setups of M-Shapes Price Highs and W-Shapes Price Lows

- One of the Best FX Broker for Beginner Traders

- A List of Top Indicators for Gold

- SPAIN35 Trading System