DIVERGENCE FOREX TRADING SETUPS SUMMARY

Normal Bearish - HH price, LH indicator - This shows that the price trend is basically weak - This is a warning that the market trend could change from going up to going down.

Classic Bullish - LL price, HL indicator - Indicates the underlying weakness of a market trend - Warning of a possible reversal in the trend from downwards to upward.

Hidden bearish shows lower high in price but higher high in indicator. It signals hidden strength in a trend. You find it in pullbacks during downtrends.

In the MetaTrader 4 quotes below, only 5 FX pairs show. Stock symbols like US500 do not appear.

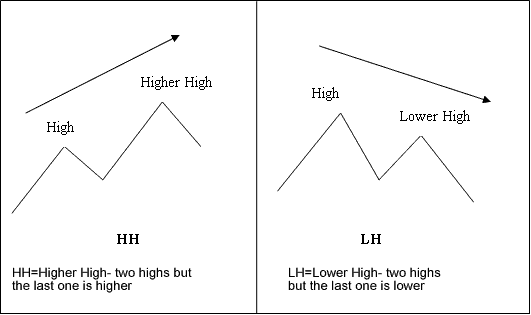

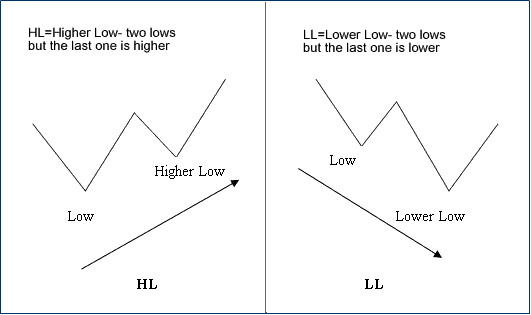

Example illustrations of the divergence trading terms:

M shapes dealing with Forex Price highs

M-shapes

W shapes dealing with price lows

W-shapes

These are the shapes to look for when looking for when using these setups.

A highly effective indicator for this specific trading configuration is the MACD: specifically, a MACD divergence functions as a signal indicating a high-probability opportunity to enter a trade. Nevertheless, similar to any trading signal, certain prerequisites and guidelines must be adhered to for this signal to qualify as a high-probability setup. Launching directly into a trade position immediately upon spotting this configuration is seldom the most prudent course of action. This setup should be corroborated by a secondary indicator to confirm the overall directional momentum of the currency trend. A beneficial trading methodology to incorporate alongside it is the MA cross over trading strategy.

Be aware this setup on a smaller timeframe is not so significant. When divergence is seen on a 15 min chart it may or might not be very essential as compared and analyzed to the 4 H chart time frame on MT4 trading platform.

If seen on a 60 minutes chart, 4 hour chart, or daily time frame, then begin looking for other factors and aspects to reflect when price may & might react to the divergence.

This brings us to a key point and factor when using this trading signal to open a trade transaction: on a higher time-frame MACD divergence can be a fairly reliable indicator of a shift in the price direction. However, the large/big question is: WHEN? That is why getting straight in to a trade position as soon as you observe this setup isn't always the best strategy.

Many investors and traders are tripped up by entering trades too prematurely upon spotting an MACD divergence setup. In numerous instances, the market retains enough momentum to continue moving in its established direction. The trader who enters a position too early can only watch helplessly as the price moves through their stop-loss order, resulting in their removal from the trade.

If you simply look for this setup without any other considerations you will not be aligning yourself with the best chances, so to increase odds and chances of making and executing a successful trade you as a fx trader should also consider other factors and aspects, specifically other trading indicators.

What else should traders think about in this Forex setup?

1. Support, Resistance, and Fibonacci Levels on Higher Timeframes

Another way to greatly/significantly increase the chances of a winning trade is to look at higher chart time frame before opening a order based on lower time-frames.

If you look at and observe the hourly, 4 Hour or daily chart has got to a major resistance, support or Fibonacci level then the probability of a successful trade based on divergence on a lower chart time frame at this point increases.

2. Reward to Risk Ratio in FX Trading Money Rules

And finally, when scanning for divergence, it is very key that you as a trader enter the trade transaction correctly, so that as you as a trader have a good risk/reward ratio and only open transactions that have more profit potential than what you're risking. If you understand how to enter a trade transaction properly, you can gauge your risk/reward before you open a trade transaction. That way, you can only select & choose to open orders that offer a favorable ratio.

Finally, when used correctly & combined with other indicators to confirm this trading signal, divergence can offer huge profit potential.

Get More Courses:

- Choppiness Index Indicator

- How Can I Trade Currency Pairs Described?

- Dow Jones Index Trading Strategies – Examples

- What is CHF SGD Spreads?

- Movements in Forex Currencies

- Learn XAUUSD Course Website

- Analyzing Gold Indicators - Choppiness Index in XAUUSD Charts

- A List of S&P500 Plans and Top S&P Plans for S&P Trading

- Instructions for Calculating Pip Values on MT4 Accounts Trading Nano Lots