MACD Trading Strategies

- MACD Fast Line and Signal Line Overview

- Buy and Sell Signals from MACD

- Signals for MACD whipsaws and fake-outs

- Creating Signals for Center-line Cross-overs

- Exploring Classic Bullish & Bearish Divergence Via MACD

- MACD Hidden Bullish & Bearish Divergence Trading Setup

- Summary of MACD Indicator

MACD Center Line Crossover - Bullish and Bearish Signals

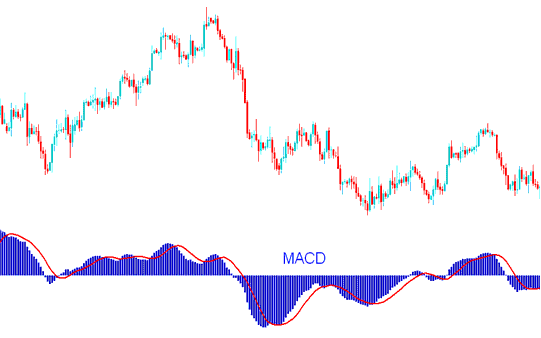

One of the most popular and frequently used technical indicators is the MACD, which is identified as a momentum indicator. The MACD is a momentum oscillator that trades with a few trend-following tendencies.

Lots of people like using MACD in technical analysis. MACD helps create forex signals by using points where lines cross.

MACD spots where moving averages diverge or converge. It builds on moving average methods. As a trend-following tool, MACD links two moving averages.

One MA Covers Short-Term Bars: the Other Handles Longer Periods.

MACD - MACD Analysis

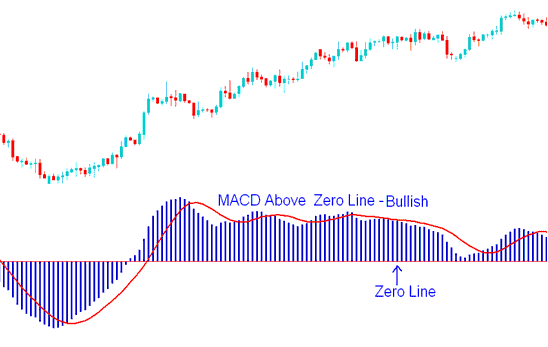

MACD contains a zero center line: readings above the line denote bullishness, while those below indicate bearishness.

In an uptrend, the short MACD line climbs quicker than the long one. This forms a space between them. As long as MACD stays above the zero line, the trend stays up. See the chart below.

Avoid selling while MACD remains above the center line, as this indicates a bullish zone, regardless of its movement, provided it stays above the zero center mark as illustrated below.

MACD Above Zero Mark - Bullish Signal

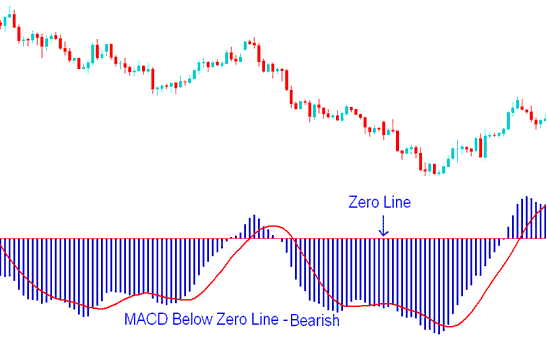

In a down forex trend, the short MACD drops quicker than the long one. This opens a gap between them. The trend stays bearish while it's under the zero line, as the chart shows.

Do not buy as long as the MACD is below the Center Line - this is bearish region and it doesn't matter how it is moving as long as it's below the zero center line mark, as revealed on the illustration below.

MACD Below Zero Center Line Mark - Bearish Signal

When a forex trend is on the verge of shifting or reversing its direction, the lines displayed by the MACD indicator begin to converge, thereby closing the space between them.

Learn More Tutorials and Lessons and Courses:

- Using the MetaTrader Platform for DAX Index (DAX30) Forex Operations

- Manual for Drawing Forex Trend-lines on a Chart Display within the MetaTrader 4 Application

- How Can I Trade Index in MT5 Software?

- Analysis of Stock Index Trading

- How is JP225 Index Traded in the MetaTrader 4 & MetaTrader 5 Software Platform?

- What is the way to understand and analyze the short term moving average indicator?

- How do I study a trade chart using different indicators?

- Tips for SMI20 Index Trading

- Any tips for using the NETH 25 MT4 indicators?