MACD Crossover Signals

MACD center line crossovers generate trading signals using the center-line mark. The sentiment of the market can be confirmed using MACD centerline cross-overs. MACD forex crossover above the center line mark generates bullish market sentiment while cross-over below the center line generates bearish market sentiment.

- When the FastLine crosses below MACD Line (not center line) it shows market momentum is slowing - this isn't a reversal signal or a sell trading signal, wait out for the center line mark crossover.

- When the Fast-line crosses above MACD Line (not center line) it shows the market momentum is slowing - this isn't a reversal setup or a buy trade signal, wait out for center line mark crossover.

- The Center Line cross-over signals will be the best signals for confirming buy & sell signals.

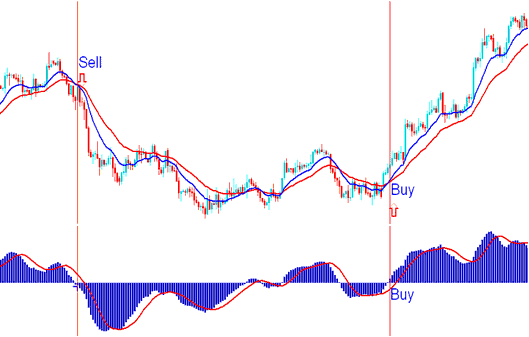

In the chart below, when the MACD fast line dipped below the zero center mark, that confirmed a sell signal - and the market sentiment switched to bearish.

Also on the exemplification shown below when MACD fast line later crosses above zero center line mark, a buy trading signal was generated & the market sentiment changed to bullish - upward trend.

MACD Zero-Line Crossover: Identifying the Precise Moments for Buy and Sell Trade Signal Generation.

Oscillation of the MACD

MACD is an oscillator that swings around a zero line. Above zero means a bullish trend. Below shows bearish moves.

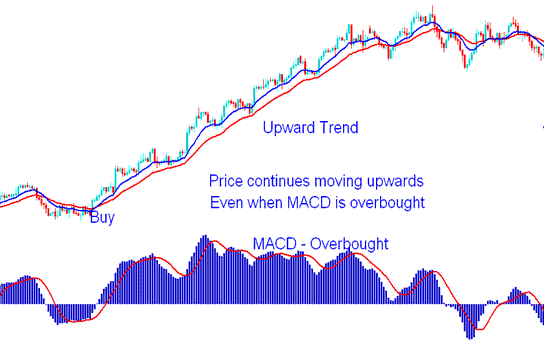

The MACD can also be utilized to indicate zones of over-extension (overbought or oversold). When the MACD reaches extremely high or low values, it signals that a currency is overbought or oversold. However, in a vigorously rising market, prices might remain in an overbought state, making a buying action the preferable decision in such a scenario.

Also, when the market is strongly going down, it's better to sell because prices will stay very low for a while.

Overbought levels occur way above zero line while over-sold conditions/levels form way below zero mark.

MACD Overbought Region - Trend Continuation Signal

Study More Courses & Topics:

- Stop Loss Settings for XAU/USD Orders

- Understanding Stock Indices Trends and Identifying Signals for Index Market Trend Reversal.

- The First Steps with MetaTrader 4

- Technical Insights into the Forex Stochastic Momentum Index Analysis

- How Do You Figure Out Price Action Trades?

- Parabolic SAR Buy and Sell Signals Explained

- Placing Symbols on the MT4 Trading Interface

- Trading Procedures for the SX 50 Index across both MetaTrader 4 and MT5 Systems

- What's the Wall Street 30 index chart on MetaTrader 4?

- Comparing Trade Index with Other Trading Methods