Pin bar price action method

A pin bar on a chart is a signal that things are changing, showing a clear shift in how people feel at that moment.

This bar has got a long tail with the closing price near the open.

This bar resembles a pin, hence the name Pin-Bar: its appearance follows a sustained upward or downward trend movement.

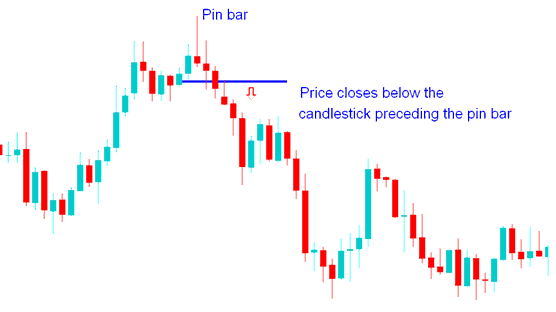

This price reversal is officially confirmed once the market closes underneath the candle that immediately preceded the formation of this pattern. Below, confirmation of the reversal occurs after the market closes beneath the preceding blue candlestick.

Combining Together with line studies:

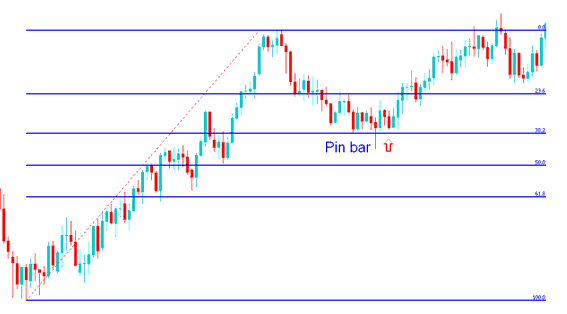

This signal can be used with other chart tools like areas of price Support and Resistance: Fibonacci retracements and trendlines can be combined with this signal to make decisions about when to buy or sell.

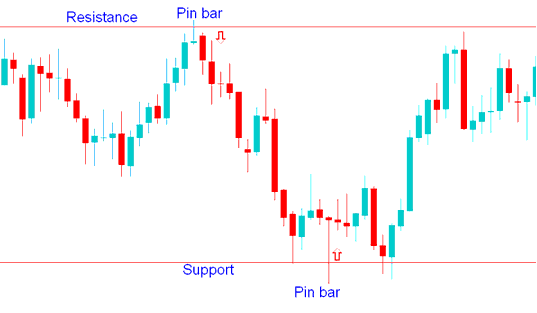

Support and resistance

A pin bar that appears after the trade price touches a key support/resistance area can be used as a trade signal to get into the market. When this pattern appears, the trades you make should go in the opposite direction of the tail's market trend.

If the market climbs and forms a pin bar with a long upper shadow, the signal is to short.

When the market moves downward and forms a pin bar with an extended lower wick, this signals a buying opportunity.

Combining Together with Support & Resistance

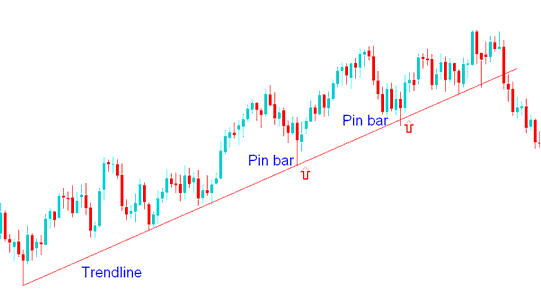

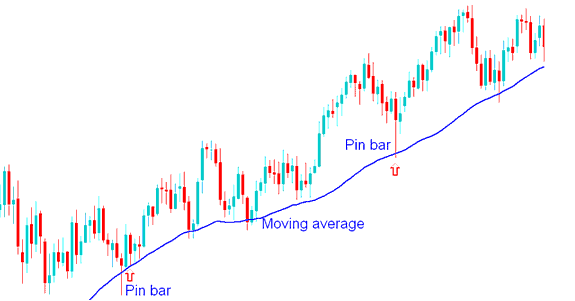

Trendlines and moving averages

Pin bars that form after the price touches a trend line or MA can be utilized as signals to enter the market.

Combining with Trend-lines

Combining with MAs

Gold Fibonacci Retracement Areas

Pin bars that appear after the price hits a Fibonacci level can also be used as signals to get into the market.

Combining Together with XAUUSD Fibonacci Retracement Zones

These patterns tend to show up near the extremes of market swings, often right after fake breakouts. That's why traders use them to take trades that go against the direction of the “tail.”

Learn More Lessons and Courses:

- Steps to Set Up the Forex McGinley Dynamic Automated Trading System

- Spinning Tops and Doji Candles

- SPX500 Trading System Overview

- MT5 Menu Guide and Help Button Features

- FX Leverage & Margin Forex Explanation & Examples

- ADX Indicator Overview

- What's Ehler MESA Adaptive Moving Average Indicator?

- Using Moving Average Strategy for XAUUSD

- FX Ehlers Fisher Transform Analysis Overview