Summary of Stop Loss Order Placement: Critical Points and Factors to Bear in Mind

The critical aspect of placing stop orders for XAUUSD involves avoiding placements that are excessively close or too far removed from the current price, and specifically *not* directly upon the established support or resistance boundaries.

A few pips just below the support or above resistance levels is the best place.

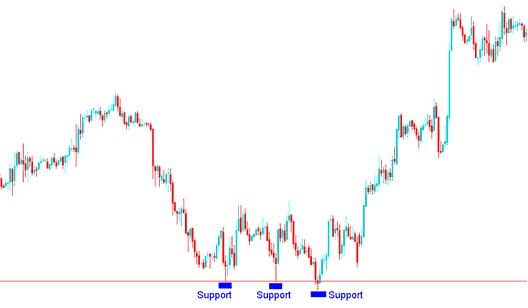

For a long XAUUSD position, find support below your entry. Set the stop loss 10 to 20 pips under that zone. The chart example shows it just below support.

Support Level for Putting Stop Loss Order Level for Buy Trade

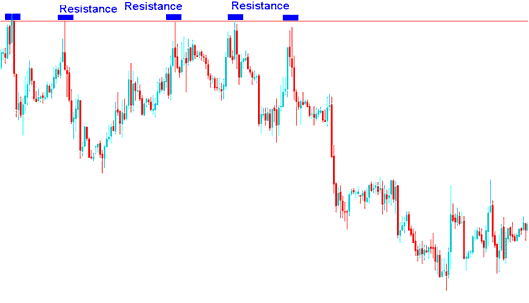

When shorting (selling a xauusd instrument), find a nearby resistance level above your entry point and set your stop loss about 10 to 20 pips above that area. The example provided shows where traders can set their stop orders just above the resistance level.

Resistance Level for Setting StopLoss Order Level for Sell Trade

Stop Orders Lock in Gains, Not Only Stop Losses

The benefit of utilizing a stop order is that it alleviates the need for daily market monitoring regarding performance. This feature is particularly useful in situations where one cannot consistently oversee their transactions for an extended duration, or when one wishes to take a break after a full day of trading.

The bad thing is that the price you set for these orders could be triggered by a quick change in the trading price. The trick is to choose a stop order percentage that lets the trading price change during the day but also limits the risks of losing money.

Traditionally, stop-loss orders are designed to limit losses. However, they can also secure profits when used as trailing stop-loss orders that adjust based on market movements.

A trailing stop order is placed at a certain percentage below the current market price. This level then moves as the trade goes on. Using a trailing stop loss lets profits increase, while also ensuring that you secure some profits if the market changes direction.

These orders can also lower risk if a trade starts making money. If a trade makes a good amount of money, then the stop loss can be moved to where you bought it, making sure that even if the trade goes the wrong way, you won't lose money: you'll just get back what you started with on that trade.

Trailing stop orders help get the most profit and protect it when the price goes up, and they limit losses when it falls.

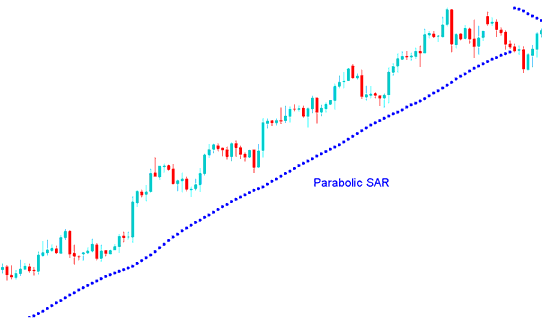

A clear example comes from the Parabolic SAR indicator. You trail your stop loss right to its dot level as price moves.

Parabolic SAR for Placing Trailing Stop-Loss Order in XAUUSD

Another case is when someone moves their stop loss order a certain number of pips after a few hours, each hour, or every 15 minutes, depending on the XAUUSD Trading chart time-frame the online trader uses.

In the preceding example involving the chart, the Parabolic SAR Indicator, set at parameters 2 and 0.02, served as the adjustable trailing stop loss mechanism. The trader would have continuously advanced the trailing stop loss level upward following the plotting of each new SAR point until the moment the Parabolic SAR level was finally breached, signaling a trend reversal.

In summary, a stop order is a simple tool, but many traders do not use it. Whether used to stop big losses or to protect trading profits, almost all investing styles can gain from this trading tool.

Factors To Remember When Putting These Stop Orders

Here are several essential points to keep in mind:

- Be careful with the points where you set these stop losses. If a xauusd instrument normally fluctuates 20 points, you don't want to put your stop loss order too close to that range else you will be taken out by the normal market volatility

- Stop Loss Orders take the emotion out of a trading decisions and by setting one you set preset point of exiting a losing trade, intended to control losses.

- Traders can always use indicators to calculate where to put these zones, or use the concepts of Resistance & Support to work out where to put these stop orders. Another good technical indicator used to set these stoploss order orders is the Bollinger bands where traders use the upper & lower band as the limits of price therefore putting these orders outside the bands.

Discover More Topics and Lessons:

- An Informative Tutorial for Beginner Traders on Learning Trading

- Coppock Curve Expert Advisor Setup

- Strategy for Trading SX 5E in FX

- What's FX Aroon Trading Indicator?

- Drawing and analyzing Fibonacci expansion levels in trading charts.

- Learning to Navigate the MT4 Trading Platform

- Comparing Hidden vs Classic Divergence Forex Strategies

- McClellan Oscillator Automated Forex System

- Index Trading Tactics Specifically for JP225 Instruments

- Inverted Hammer Bullish XAUUSD Candle Patterns