Shooting Star Candlestick Pattern

Inverted Hammer Bullish Candle Setups

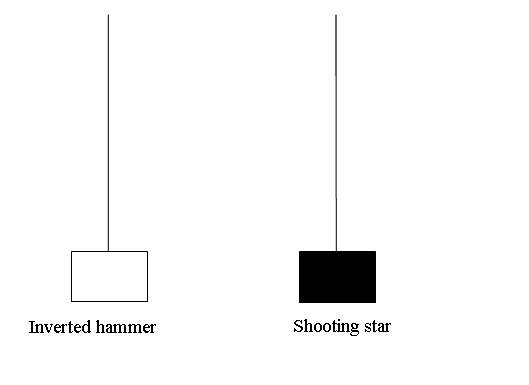

The Inverted Hammer Candlestick Pattern and the Shooting Star Candlestick Pattern exhibit similar visual characteristics: both feature a lengthy upper wick and a compact body situated nearer the lower boundary. The color of these candles is secondary: the critical factor distinguishing the two is their placement - whether they appear at a market peak (Star) or a price nadir (Hammer).

Difference is that inverted hammer is a bullish market reversal setup while shooting star candlestick is a bearish reversal gold pattern.

Upwards Trend Reversal - Shooting Star Candles

Downwards Trend Reversal - Inverted Hammer Candles

Chart Patterns Involving the Inverted Hammer Candlestick Pattern and the Shooting Star Candlestick Pattern.

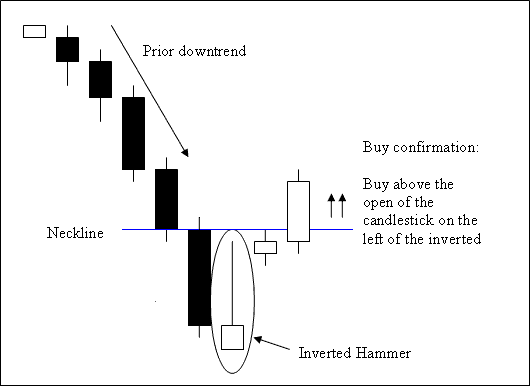

Inverted Hammer Candle

This specific candlestick formation signals a bullish reversal occurring at a market trough.

The inverted hammer forms at the end of a downtrend. It hints at a potential shift away from falling prices.

Inverted Hammer candlestick pattern

Trading Analysis of the Inverted Hammer Candle

A buy action is confirmed when a candlestick closes above the neckline, marking the opening of the candle on the left side of this setup. Here, the neckline establishes the resistance zone.

prevent orders for the buy trades ought to be set few pips underneath lowest fee on the most latest low.

The Inverted Hammer candle derives its name from illustrating that the market forces are actively establishing a price floor.

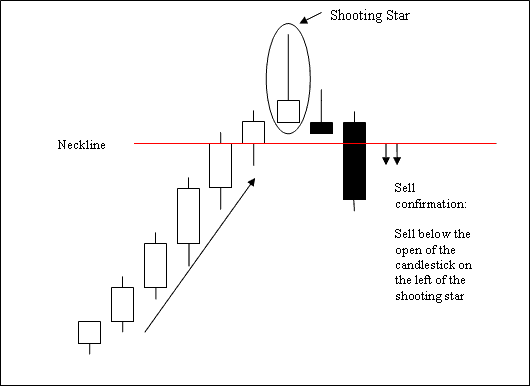

Shooting Star Candle

Bearish Candlestick Pattern Signals Reversal at Trend Peaks.

It happens when a price is going up, and the starting price is the same as the lowest price: then, the price goes up but gets pushed back down to close near the starting price.

Shooting star candlestick

Analysis of the Shooting Star Candle

A sell transaction is considered complete when a candlestick closes beneath the neckline - which is defined by the opening price of the candlestick immediately to the left of the pattern. In this context, the neckline acts as a support level.

Stop orders to sell should be placed a few pips above the highest price in the most recent high price range.

The Shooting Star candlestick derives its name from its resemblance to a shooting star while appearing at the top of a bullish trend.

Find extra courses and training materials