Examining the Application of Fibonacci Extension Levels on Trading Charts

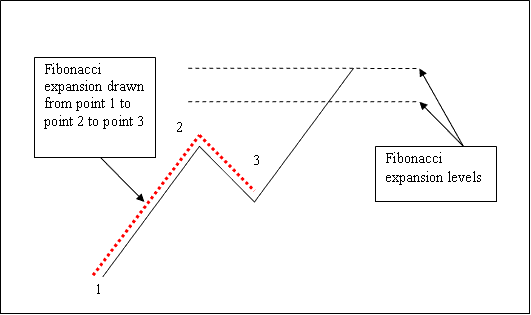

We've looked at Fib retracements in the previous lesson, Fib Retracement is drawn between 2 points. But to draw Fib Expansion we use 3 chart points to draw Fib Expansion.

To draw these Fibo Expansion areas, we wait for the price of the forex to come back down completely, and then for the forex currency pair to start moving in the original direction of the trend again. The point where the price comes back to is used as point 3 to draw the Fib Expansion.

The forex example below highlights three key points for drawing the Fibonacci Extension. These points are labeled and marked as 1, 2, and 3. Point 1 marks the start of the forex trend. Point 2 shows the pullback and retrace in the trend. Point 3 is where the price ended its retrace, as seen in the illustration below.

Take note of where the Fibonacci Extension levels are plotted - these are drawn above the Fibonacci Expansion indicator. Traders utilize these points and levels to set their take-profit orders.

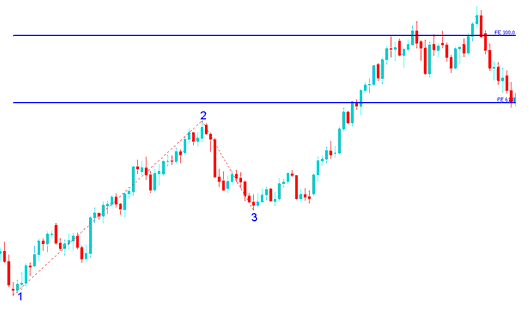

Drawing Fibonacci Extension Levels on an Upward Trend

We use Fibonacci Extension Levels to predict where the price will move and end up. Two Fibonacci Expansion areas are key: 61.8% and 100%. We use these areas to lock in profits and to set our orders for taking profits.

In this forex case, draw Fibonacci extensions along the trend line. For an uptrend, pull it upward from the lows.

Fibonacci Expansion levels are displayed as horizontal lines above the indicator, highlighting profit-taking zones. For instance, utilizing the 100% Fibonacci Expansion Level below would have resulted in significant trade profits.

**Note:** This trade mirrors the prior illustration where we utilized Fib retracement to enter a buy position around the 38.2% Fibonacci Retracement Level. Concurrently, we employed the 100% level of Fibonacci Expansion to establish the take-profit target. Locate a chart now and practice these trading techniques.

From the above forex examples, the upwards trend continued & both 61.8 % & 100.0 % Fibonacci Extension Levels were all hit after which price retraced again after getting to the 100.0 % Fibo Expansion Level.

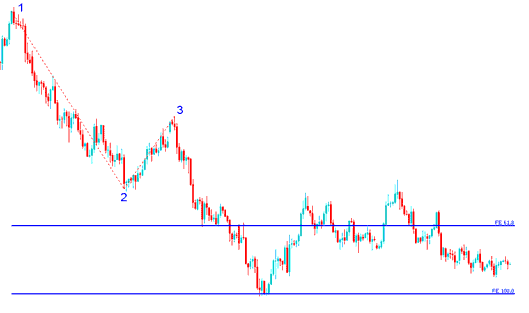

Drawing Fibo Expansion Areas on a Downward Trend

Since we use this Fibo Expansion tool to estimate takeprofit levels, how do we draw it in a downwards trend?

Draw the Fib expansion from point 1 to 2 to 3, as illustrated below. Always align it with the trend direction. In this example, it's drawn downward. Can you spot that?

Observe the difference between how Fibonacci Expansion has been drawn previously and how it is illustrated below. In this instance, the Fibonacci Expansion Level of 100% is also applied. Take note of where the price peaked - it would have been an ideal area to set a take-profit level.

From the exemplification revealed above, after drawing this Fibonacci Expansion tool there are 2 levels that are used to show the taking and booking profit zones, these 2 levels are drawn as horizontal lines across the forex price chart.

More Tutorials & Courses:

- ECN vs STP vs Non-Dealing-Desk vs Dealing-Desk Brokers

- Analysis using Multiple Chart Time Frames

- Essential Information Regarding Forex Trading: Examining the Pros and Cons.

- FX Trade Swap Example Shown and Made Clear

- What is IBEX 35 Indices in Stock Indices Trade?

- How to Use MetaTrader 4 Alligator on the MT4 System

- True Strength Index (TSI) Analysis for Forex