IBEX35 Index

IBEX35 follows the top 35 stocks on the Madrid exchange. It measures their total market value. The list updates two times each year.

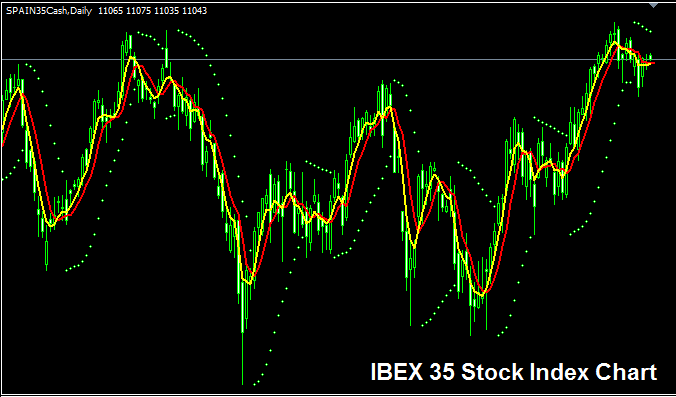

IBEX35 Chart

The chart above shows the IBEX35 Index, labeled SPAIN 35CASH here. Seek a broker that provides the IBEX35 chart to trade it. This example uses the MetaTrader 4 platform for FX and stock indices.

Other Data about IBEX 35 Index

Official Index Symbol - IBEX:IND

The 35 constituent stocks that constitute IBEX35 Index are selected from top performing corporations in Spain. The 35 shares & stocks constitute majority of the daily trade volume in Madrid Bourse.

-

The IBEX35 Index tracks the market value of the top 35 companies in Spain. This Stock Index generally goes up over the long term, but its trend movement changes more often. Compared to other indexes like the EUROSTOXX 50 and DAX 30, which have less change in their trend movements, this stock index has bigger changes in its trend movement.

Over a long period, this index usually goes up, so you should plan to keep buying as the index keeps going and moving upward.

A solid strategy for index trading is to keep buying and buy the dips. But get ready for wider swings and more ups and downs if you trade this stock index.

During Economic Slow-Down & Recession

During economic slowdown and recession periods, companies start and begin to report slower profits and lowers growth projections. It's due to this reason that traders start to sell shares of firms that are posting & reporting lower profits & hence Index tracking these specific stocks will also begin to go & head downward.

Hence, during these times, trends are much more likely to be going downwards & you as a trader should also adjust your strategy accordingly to fit the prevailing downwards trends of the index which you as a trader are trading.

Contracts and Details

Margin Requirement per 1 Contract - € 140

Value per Pips - € 1

Note: Even though overall trend is generally moves upwards, as a trader you've to consider and factor on daily price volatility, on some of the days the Indices may & might move in a range or even retrace and retracement, the market retracement/correction move may also be a significant one at times & hence as a trader you need to time your trade entry accurately using this trading strategy: Stock strategy & at same time use the proper & appropriate money management rules & guidelines just in case there's unexpected volatility in the market trend. About equity management methods and guidelines in indices tutorials: What's Stock index equity management & Indices money management methods.

More Guides and Topics:

- How Can I Add EU50 in MT5 App?

- What is Kase Peak DevStop 2 Indicator?

- Exploring Spinning Top and Doji Candlestick Patterns

- How to Execute FX Pending Orders?

- Using the Relative Strength Index (RSI) for XAU/USD

- The Bollinger Bands Indicator for the MT5 Platform.

- A Detailed Explanation of What Constitutes 1 Standard Forex Lot Size

- EU50 Indices Trading Methodology: How to Formulate a Trading System for the EU50 Index

- How to Use Chande's Dynamic Momentum Index in MetaTrader 5