Trading Analysis of Spinning Tops and Doji Candlesticks - How to Trade These Patterns

Doji Consolidation Candles vs Doji Continuation Candles: Spinning Tops in Consolidation Setups

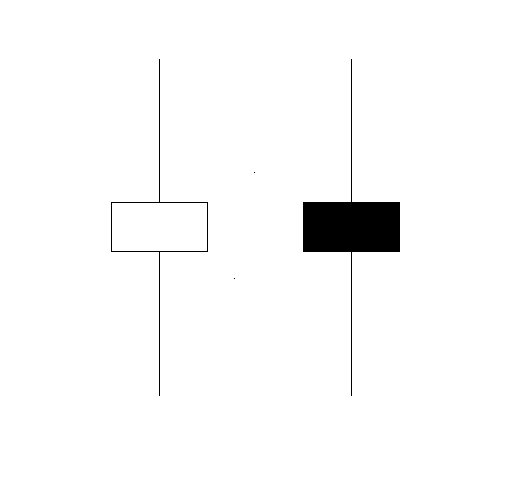

Spinning top candlestick formations have small bodies accompanied by long upper and lower shadows. They are named "spinning tops" because their appearance resembles spinning toys on matchsticks.

The upper & lower shadows of the spinning tops are longer than the body. The illustration below illustrates the spinning top pattern. You can look for pattern on your MT4 charts. The illustration put on display below shows screen shot to help traders when it comes to learning and understanding these patterns.

How to read and study candlestick charts - Spinning Tops

The hue of the spinning tops candlestick holds no significance: this formation demonstrates a lack of consensus between the buyers (bulls) and sellers (bears) in the trading arena. When these patterns emerge at the crest of a market trend or the trough of a trend, it might suggest the price movement is nearing its conclusion and could soon reverse its course. However, it is advisable to await supplementary confirmation trading signals indicating a reversal in the currency's direction before trading based on the signal generated by this chart setup formation.

Candlestick Reversal Patterns Formations in Charts

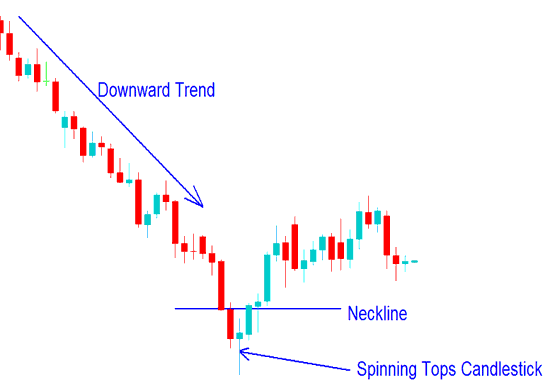

At the top of an upwards trend a black/red spinning top shows that a reversal is more likely than when color of the candlestick is white/blue.

At the end of a downward trend, a white/blue spinning top suggests a change is more likely than if the color is black/red.

The reversal signal is confirmed when the following candle arrangement, which occurs after the spinning tops candle, closes on either side of the neckline, indicating a potential reversal in a downward trend.

The neck-line is:

- For an Upwards Trend - The open of the previous candlestick that was plotted just before the spinning top.

- For a Downwards Trend - The open of the previous candlestick that was plotted just before the spinning top

Here's an example of a Japanese charting technique in action. In the chart below, you'll see a pattern form. When the price climbed above the neckline, the spinning top candle gave a clear reversal signal. That was the cue to close out your short position - a solid exit point.

Spinning Tops Pattern on a Chart

The color of the spinning tops that materialized was blue, which consequently suggests that a price reversal was the more probable outcome, contrary to what would be inferred if the color had been red.

Doji Candles Setup

This pattern is characterized by identical opening and closing prices. Various types of Doji candlesticks often form to indicate market uncertainty or reversals.

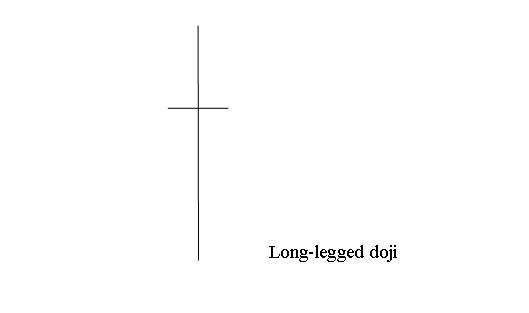

The following illustrations explain different patterns of the doji candlestick:

A long-legged doji candlestick pattern is characterized by extended upper and lower shadows, with the opening and closing prices located very near the center point. The appearance of a Long-legged doji on a chart signals a state of uncertainty or indecision between participants - both the buyers and the sellers (bears).

Displayed Below is exemplification screen-shot screen shot of the Long Legged

- Doji pattern

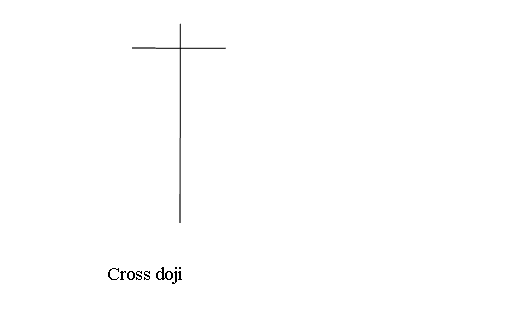

Cross Doji

A cross doji consists of a long lower shadow, a short upper shadow, with the day's open and close being the same.

This setup shows up at market turning points and warns of a possible trend reversal in Forex. Shown Below is an example of this chart setup formation

- Cross Doji Candle Pattern

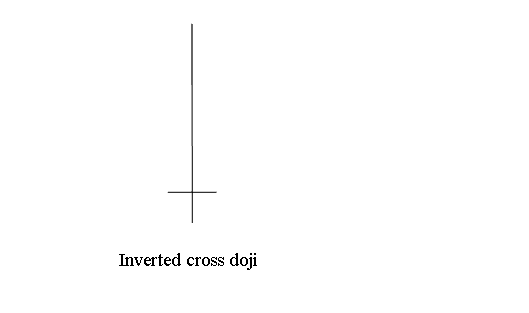

Inverted Cross Doji

Inverted cross doji candlesticks are characterized by an elongated upper wick and a short lower wick, with identical opening and closing prices.

This reversal pattern often appears at key turning points in the Forex market, signaling a potential trend reversal. Below is an example.

- Inverted Cross doji

Analysis in FX Trading - All doji candlesticks setup show the indecision in the market this is because at the top buyers were in total control, at the bottom the sellers were in control but none of them could gain control and at the close of the market the currency price closed unchanged at the same price as opening price. This doji shows that the overall price movement for that particular day(trading period) was zero pips or a minimum range in the price movement of between 1 and 3 pips. Reading these charts patterns require very small pip(point) movement between the opening price & closing price.

Study More Lessons and Tutorials & Topics:

- Criteria for Selecting the Optimal Linear Regression Acceleration Trading Strategy

- A Guide on How to Calculate and Interpret Pips for the EUR/SEK Currency Pair

- Which FX Platform is Best for Trading?

- Description and Use of the William % R Indicator

- Using the UsTec 100 indicator with MT4 to help your trading.

- Description of FX Chandes DMI Indicator

- Forex XAUUSD Guide

- EURRUB Opening and Closing Hours Explained