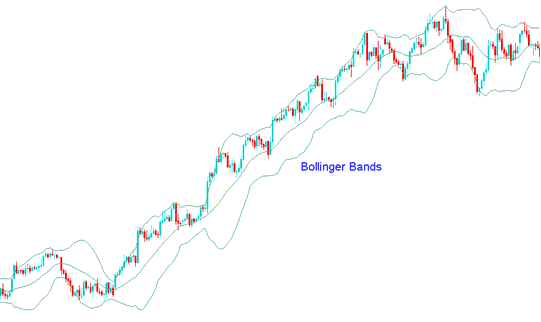

Bollinger Band Analysis and Bollinger Bands MetaTrader 5 Indicator

Developed by John Bollinger.

This trading indicator serves three primary functions:

- Provide a relative definition of high & low

- Show periods of high & low volatility

- Identify periods when prices are at extreme levels

Bollinger Band do this by using standard deviations as a measure of volatility. Since standard deviations trading indicator is a measure of volatility, the bands are self-adjusting: they widen during periods of higher volatility & contract during periods of lower volatility.

This MT5 indicator consist of 3 bands designed to encompass the majority of a instrument's price action. The middle band is a basis for the intermediate term trend, typically a 20-periods simple MA, which also serves as the base for the upper and lower bands.

The upper band's & lower band's distance from the middle band is decided by volatility. Typically, the upper band is plotted +2 standard deviations above middle bollinger band while lower +boollinger band is plotted -2 standard deviations below middle +boollinger band.

Interpretation

Bollingers are usually calculated using the instrument's prices & they have the following characteristics.

- Sharp price changes tend to occur after the bands tighten as volatility lessens, this is referred to as Bollinger band squeeze.

- When prices move outside the bands a continuation of the current market trend is implied.

- Bottoms & tops made outside the bands followed by bottoms & tops made inside the Bollinger Band respectively, call for reversals in the market trend.

- A move which originates at one band tends to go all the way to the other band.

FX Trend Identification

This indicator is used as a price trend following technical indicator since it shows the overall direction of the market trend.

If the market trend is upward middle and the lower bollinger provide excellent points for opening a buy trade, these levels act as support levels.

In a down trend the middle and the upper bollinger provide excellent points for opening a sell trade position. These levels are used as resistance zones.

The outer levels are also commonly used to set stop loss levels above or below these outer levels bands.

More Tutorials and Topics:

- How to Use MetaTrader 4 Gold Platform Data Window Tutorial Guide

- FX Market Softwares

- What are Chaikins Money Flow Buy and Sell Trading Signals?

- Best Time for Trading USDZAR GMT

- How to Add Chaikin Money Flow Technical Indicator in Chart

- Trading Strategies for Trading AEX25 Indices

- Learn How to Trade with Forex Tutorial Guides

- What is USDMXN Spreads?

- 3 Gold Bollinger Bands: Upper, Lower & Middle Bands Described

- What are the Different Types of FX Risk?