Bollinger Band Strategies

- Understanding Bollinger Bands

- Bollinger Bands: Tools for Market Volatility Analysis

- Understanding Bollinger Band Expansion and Contraction

- How do Bollinger Bands show price action in trends?

- Analyzing Bollinger Band Price Action Behavior in Markets Exhibiting Range Bound or Sideways Movement.

- Bollinger Bands and Trend Reversal Indicators

- Summary of Bollinger Bands Strategy

Bollinger Band Indicator Strategy

The Bollinger Band works as a way to measure how much the market changes. The Bollinger Band is a tool to show price on trades.

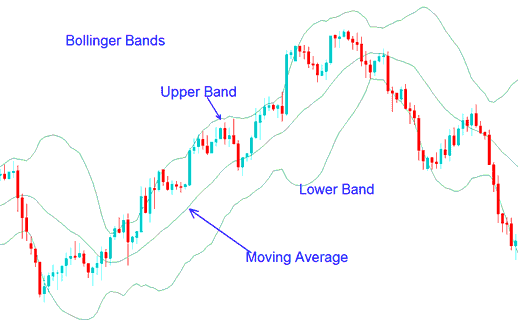

Bollinger Band consists of 3 lines or bands: the middle band (moving average), an upper band a lower band. These 3 bands will enclose price & the price will move within these three3 bollinger bands.

Bollinger Bands create upper and lower lines around a moving average. The standard is a 20-period simple moving average. They rely on standard deviation to set those bands.

The example of Bollinger Bands indicator is displayed below.

Bollinger Bands Guide - Trade XAU USD with Bollinger Method

Bollinger Bands are inherently adaptive due to their reliance on standard deviation to measure price fluctuations. Higher volatility leads to increased standard deviation, causing the bands to widen. Conversely, lower volatility results in a smaller deviation, leading to narrower Bollinger Bands.

Bollinger Bands track price swings for key details. The info covers things like:

- Periods of low volatility - consolidation period of the market.

- Periods of high price volatility - extended trends, trending markets.

- Support and resistance levels of the price.

- Buy & Sell points of price.

More Lessons:

- How Much Money is Needed to Start an FX Trading Account?

- The Six Various Types of Trading Gold Charts

- How to Add Bollinger Bands Gold Indicator to Charts in MT4

- Utilizing the Strategy Tester Feature within MetaTrader 4 for Simulation Testing

- Types of Forex Lots: A Quick Guide

- Forex Swap Example Explained

- How Do I Generate FX Signals in Trading?

- ROC, Rate of Change Technical Analysis in Forex

- How to See a Forex Chart on the MT5 Platform