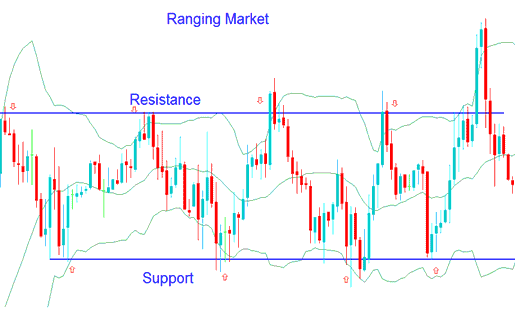

Bollinger Bands Price Action on Range-Bound Markets

You can use Bollinger Bands to spot when a market trend has stretched too far. The next few guidelines help you use this indicator if the market's moving sideways.

Bollinger Bands Indicator is really important because it can show signals that a price might suddenly go up or down.

In a trending market, these techniques may not apply: they are only valid as long as the Bollinger Bands are oriented sideways.

- If the price touches/tests upper band it can be considered overextended on the upside - over-bought.

- If the price touches/tests lower band the price can be considered overextended on the bottom side - over-sold.

One application of the XAUUSD Bollinger Bands indicator involves leveraging the established overbought and oversold thresholds to set prospective buy and sell targets during periods of market oscillation (range-bound activity).

- If gold price has bounced off the lower band crossed the center-line moving average then the upper band can be used a sell level.

- If gold price bounces downwards off the upper band crosses below center moving average the lower band can be used as a buy level.

Bollinger Band in Ranging Markets - Bollinger Band Strategy

In the context of a range-bound market previously discussed, instances where the price touches the upper or lower boundaries can serve as precise price targets for liquidating long or short trade positions.

Trades can be opened when the market hits the upper resistance zone or lower support zone. A stop loss should be placed a couple of pips above or below depending on the trade transaction opened, just in case price action breaks-out of the range within these Bollinger bands.

Get More Tutorials: