Drawing Fibonacci retracement areas - both in uptrends and downtrends.

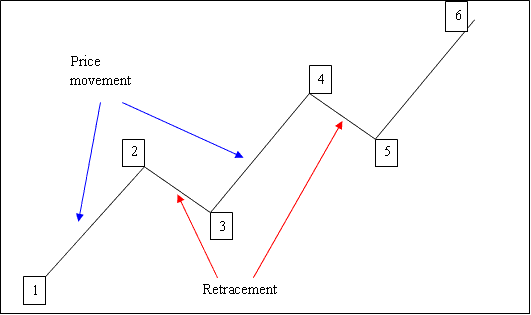

The price of a currency pair doesn't go straight up or down. Instead, it goes up and down in a zigzag pattern. Fibonacci Retracement is a tool traders use to guess where the zigzag will stop. The levels where the price might pull back are 38.2%, 50%, and 61.8%. These are the spots where the market price is likely to go back a bit.

What's a retracement? It's when prices go back a bit before going back to the way they were initially moving, which is the original trend.

Zigzag Price Movement Explained - Examples of Upward Zigzag Price Action

The diagram below shows movement in an upward market.

1-2: Price moves up

2-3: Pull back

3-4: Moves up

4-5: Pull-back

5-6: Moves up

Since we can pinpoint the initiation point of a pullback on a Forex chart, the remaining question is determining its ultimate retracement level.

The answer is we use Fib retracement indicator.

This is a type of line study used in forex to predict & calculate these levels. This technical indicator is placed directly on the currency chart within the platform provided by your broker, This trading indicator will then mechanically/automatically calculate these levels on the chart.

What are The Retracement Levels

- 23.6%

- 38.2 %

- 50.0%

- 61.8 %

The 38.2% and 50.0% levels are the most common, and often the price pullback will reach these levels, with 38.2% being the most popular and used.

The 61.80% Fibonacci level is commonly used to set stop-loss orders in trades using this strategy.

This tool will be drawn in direction of the trend as expounded in the exemplification below.

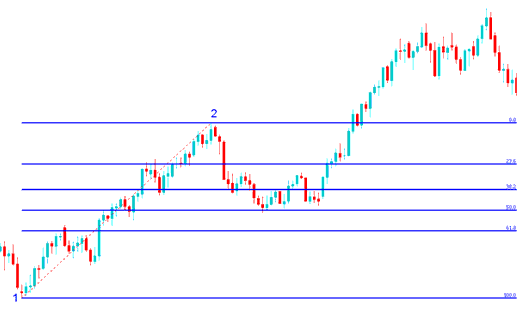

How to Draw on an Upward Bullish Market

In the diagram below price is heading upward between point 1 & 2 then after 2 it retraces downward to 50.00 % retracement area then it continues moving up in the original and initial upwards trend. Notice that this indicator is drawn and plotted from point 1 to 2 in the direction of the Forex trend (Upward).

Since our use of this indicator tells us that this is only a pullback, we placed a buy order between the 38. 2% and 50. 0% levels, with our stop loss just below the 61. 80% retracement point. You would have made a lot of pips if you had placed a buy trade at this point in the transaction example below.

Explanation for the Above Trading Example

When trade transactions hit the 50% level zone, it provided strong market support. Subsequently, prices resumed their upward trajectory in alignment with the earlier trend direction.

23.60% provides minimum support & isn't an ideal place to place an order.

38.2 % provides some support but price in this example continued to retrace upto the 50% zone.

The 50% level offers strong support, making it a good spot for a buy order here.

For this example, the pullback went all the way to the 50. 00% retracement zone, but the market will usually retrace up to 38. 2% and then traders will typically establish their buy limit orders at the 38. 2% level, simultaneously placing and setting a stop loss just below 61. 8%.

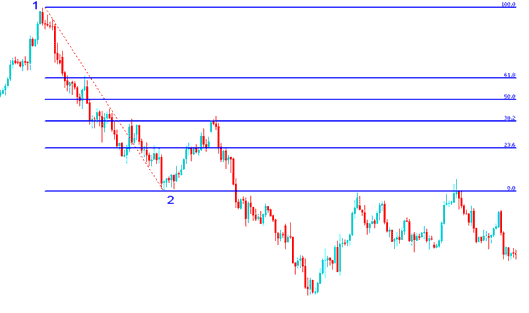

How to Draw on a Downwards Bearish Market

In the diagram below the market is moving downward between point 1 & 2, then after 2 it retraces upto 38.20 % retracement then it continues heading down in the original and initial downward trend. Notice that this technical indicator is drawn and plotted from point 1 to 2 in direction of the Forex trend (Downwards).

Since it's a pullback, place a sell at 38.2% and stop loss just over 61.8%.

If you had placed a sell order at the 38.20% level, as shown in the trade below, you would have earned a lot of pips later. In this trade, the price went back to the 38.2% level but not to the 50.00% level. From experience, using 38.20% is often good because the pullback usually does not reach 50.00%.

Explanation for the Above Forex Trading Example

The demonstration above perfectly illustrates a scenario where the price reverses course instantly after interacting with the 38.20% Fibonacci level.

This technical level provided strong resistance during the pullback, making it an ideal spot for placing a sell limit order. After touching this level, the market quickly reversed downward.

More Courses & Lessons:

- Using Kurtosis Indicators in MetaTrader 4 Charts

- A Collection of Strategies and Trading Methods for the UKX100 Index

- USD/CAD Spread Overview

- RSI Indicator in MT4

- Analysis of Doji Candlesticks and Marubozu Candlesticks Patterns

- How to Create Signals to Buy and Sell Using Various Kinds of Strategies

- How to Set the Hull Moving Average Indicator in MT4

- What is the Method to Plot a Downward Channel on MT5 Online?

- What is NZD/CAD Spread?