Bollinger Bands Indicator and Price Volatility

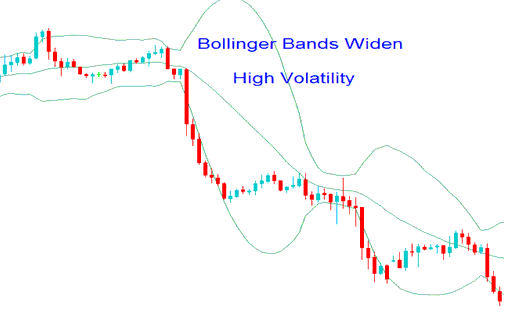

When price volatility peaks, the gold prices tend to be significantly distanced from the moving average, causing an expansion of the Bollinger Band width to accommodate a larger range of potential price movements, which can fall within 95 percent of the mean.

The Bollinger Bands indicator for XAUUSD will expand in width as the price exhibits increased volatility. This expansion manifests as the bands bulge outward around the current price levels. When the Bollinger Bands widen in this manner, it signals a continuation pattern within the XAUUSD context, suggesting the market is likely to sustain its current directional movement. This generally serves as a continuation signal.

The illustration of the Bollinger band xauusd indicator provided below demonstrates the Bollinger bulge.

High Price Volatility - Gold Bollinger Band Indicator - Bollinger Band Bulge

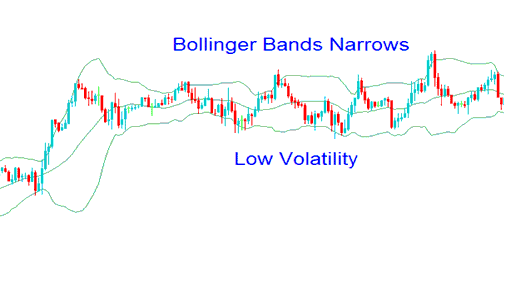

Low volatility narrows gold prices around the moving average. The band shrinks to cover 95% of price swings near the mean.

When price changes are small, the price will begin to get stable as it waits for a price breakout. When the bollinger bands tool is moving to the side, it's best to wait and not make any trades.

The subsequent examples of the Bollinger Bands indicator are demonstrated when the bands exhibit a contraction.

Low Price Volatility - Gold Bollinger Band Indicator - Bollinger Band Squeeze

More Topics and Tutorials:

- MACD Centerline Crossovers for Bullish and Bearish Forex Signals

- What's the Best Site to Use in Learning Gold for Beginner Traders?

- How Do You Find MT4 HangSeng50 Indices Chart?

- How to Use MetaTrader 4 Brokers Demo Account

- A list of plans for SWI 20 and ways to trade SWI20 effectively.

- MT4 Technical Indicators Insert Menu on MT4 Insert Menu Options

- How to Calculate Pips For EUROSTOXX 50 Indices

- CAC 40 Index Trading System

- What's the Best Forex Platform for?

- Forex FTSE100 Index FTSE100 Symbol/Quote in Forex