Double Top and Double Bottom Strategies

You should wait for the price to change direction after it touches a Bollinger band before you think a reversal is happening.

Even better a trader should see the price cross-over the moving average MA.

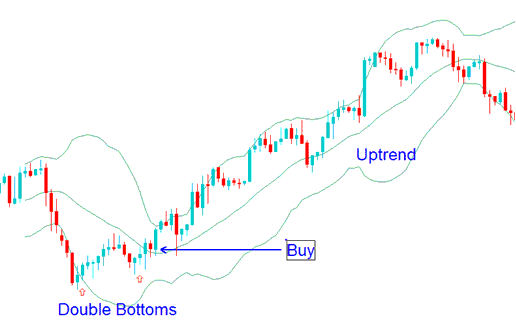

Double Bottoms Trend Reversals

A double bottom pattern serves as a buy signal setup. A double top occurs when the price action breaks through the lower band and then rebounds, creating the first price low. Subsequently, another price low is established, this time above the lower band.

The second low price must not be lower than the first one, and it's important that the second low price doesn't touch or break through the lower line. This positive setup is confirmed when the price goes up and closes above the middle line (simple moving average).

Double Bottom - Strategy for Bollinger Band Trend Reversals Utilizing Double Bottom Setups.

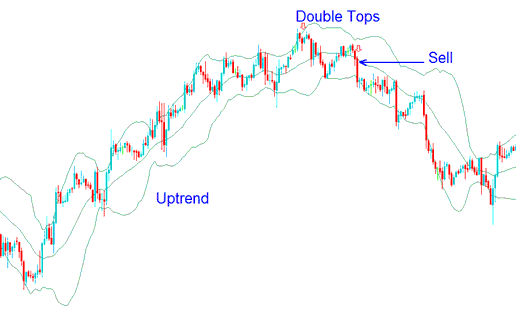

Double Tops Trend Reversals

A double top is a sign that it's time to sell. A double top happens when the price goes above the upper band and then drops, creating the first high price. After some time, another high price is created, but this time, it's below the upper band.

The second price high cannot be higher than the first one, and it's important that the second price high doesn't touch or go past the top band. This bearish gold setup is confirmed when the price moves and closes below the middle band (simple moving average).

Double Top - Bollinger Band Trend Reversals Strategy Using Double Tops Setups

Learn More Guides and Topics: