When to Determine When to Buy a XAUUSD

A trader should know when to open a buy order, just because the market is bullish and prices are moving upward it does not mean you as a gold trader can just buy anywhere. You need to learn the art of where to open a buy order.

Think about it. The market looks strong. You buy at the peak. Prices seem set to climb forever. You fear missing out if you wait. But right after your buy order, it drops 200 pips. This is not the art of how to buy. Even if the market goes upwards and the price returns to where you bought you're still not in profit, you have done zero work and you've just wasted your time. You need to know where to buy at the best price and at the best time so that as the market does not retrace on you just when you've bought.

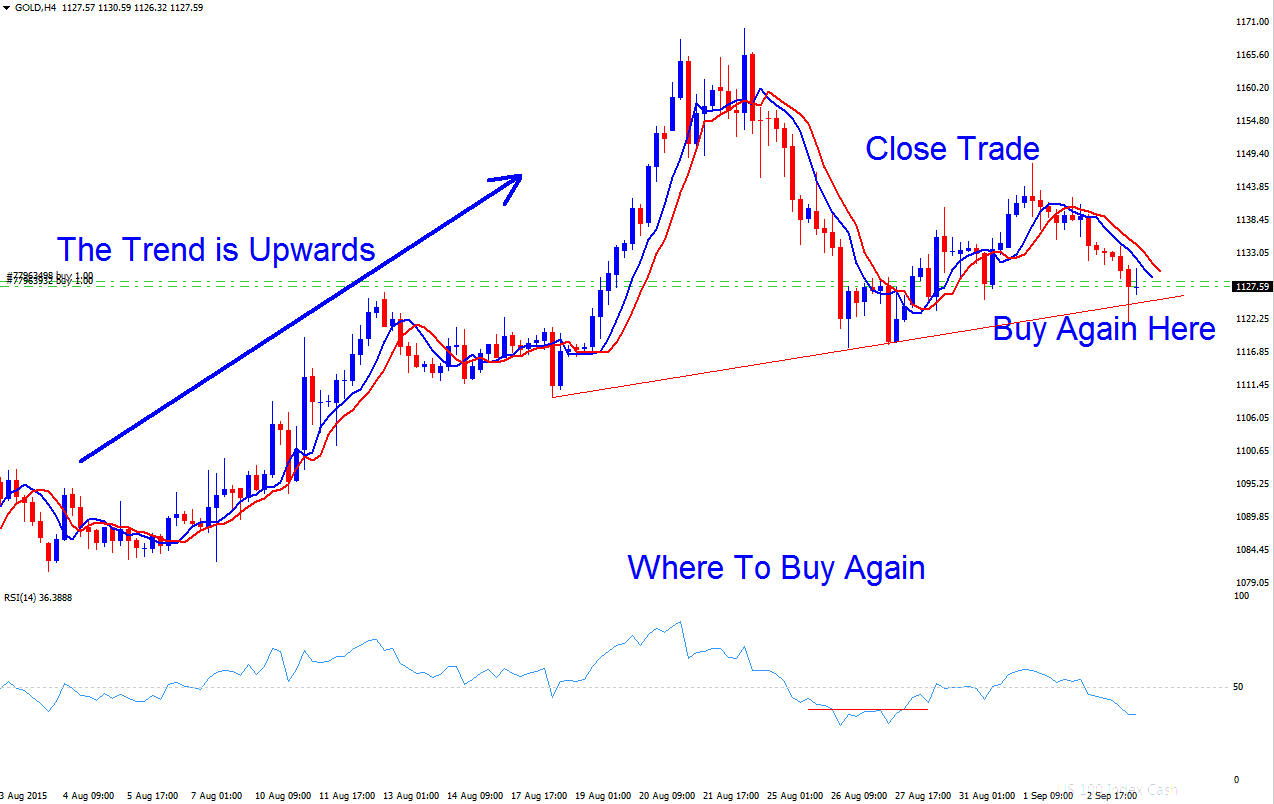

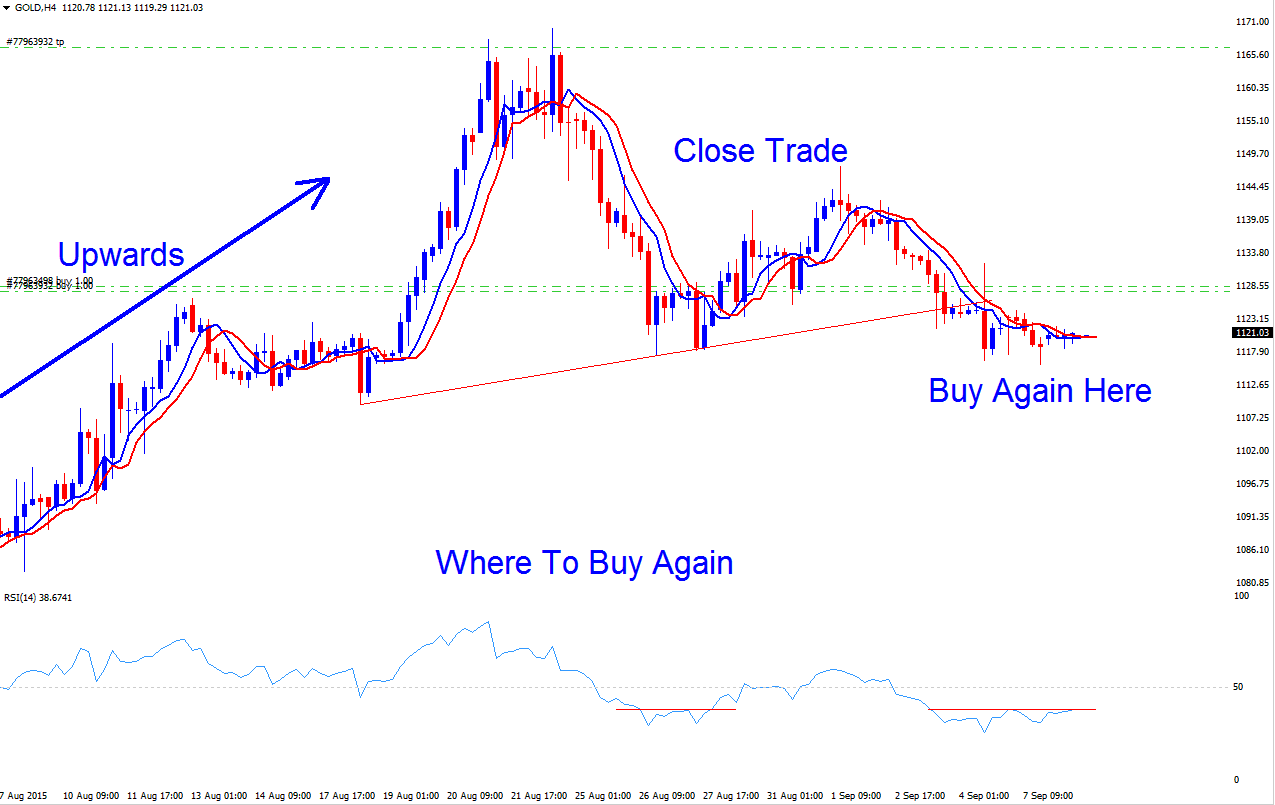

The chart presented here indicates that the market is generally going up. It shows where many people who trade usually buy: most people buy when the market's upward movement seems very clear, but that's not the right time to buy. You should buy when the market's direction isn't so obvious, which happens when the price temporarily goes down. Always try to make your purchases after the price has gone down a bit, as shown here.

The skill involved in this form of purchasing is to buy following a retracement; thus, even if the trading price does not increase immediately, the retracement will have already progressed halfway or three-quarters of the way. Consequently, instead of entering a buy position that retraces 200 pips, as would occur if you bought at the peak, you purchase after a retracement. Therefore, even if the trading price retraces against you, it will only be a minor retracement of a few points. Once the trend resumes, you will realize profits much more swiftly.

For instance, if you make a purchase after the price has fallen by 150 points and the overall drop is 200 points, your buying position will only decrease by 50 pips instead of 200 pips. When the upward trend resumes and prices increase by 200 points, clearing the previous retracement, you'll find yourself with a 150-point profit. This way, you've effectively saved time and by entering at an optimal moment, you can capitalize on the price retracement. Mastering this approach is essential for profiting in a rising market.

The example illustrated below shows where to not to buy and where to buy after a retracement, the buy was quickly confirmed by the moving average which started to move up and RSI went to above 50 center line mark. Buying here after the retracement shows as a gold trader your trade did not have a lot of draw-down and you started to earn money immediately thence making this a low risk trade.

Where to close buy orders

Knowing buy spots also means knowing where to exit and lock profits.

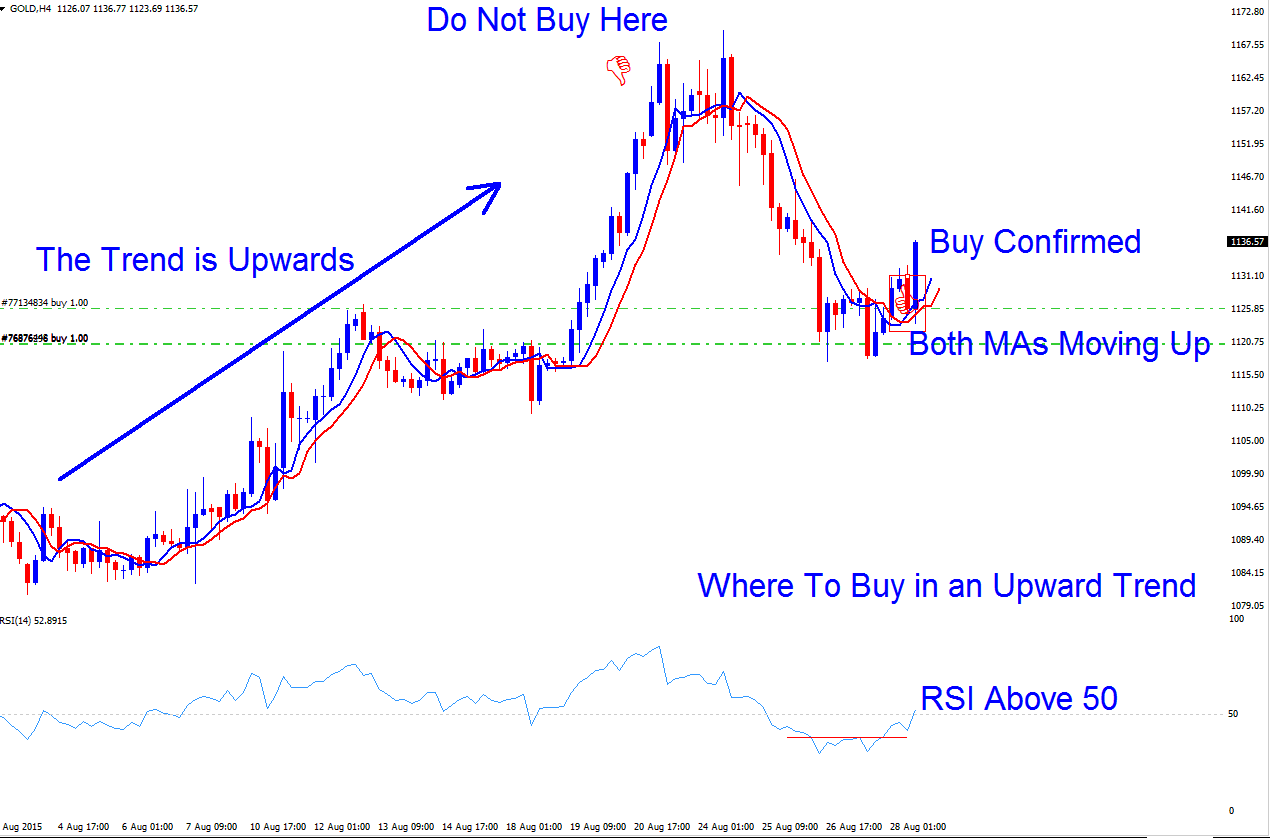

For this setup, watch the RSI overbought signal. When it crosses above 70 and drops below, sell. Close all buy positions then.

Then, wait for another retracement and place another buy order following the retracement, repeating this strategy.

We'll snap a screen of this trade. It shows where to exit as prices climb. This spot is live right now in our guide.

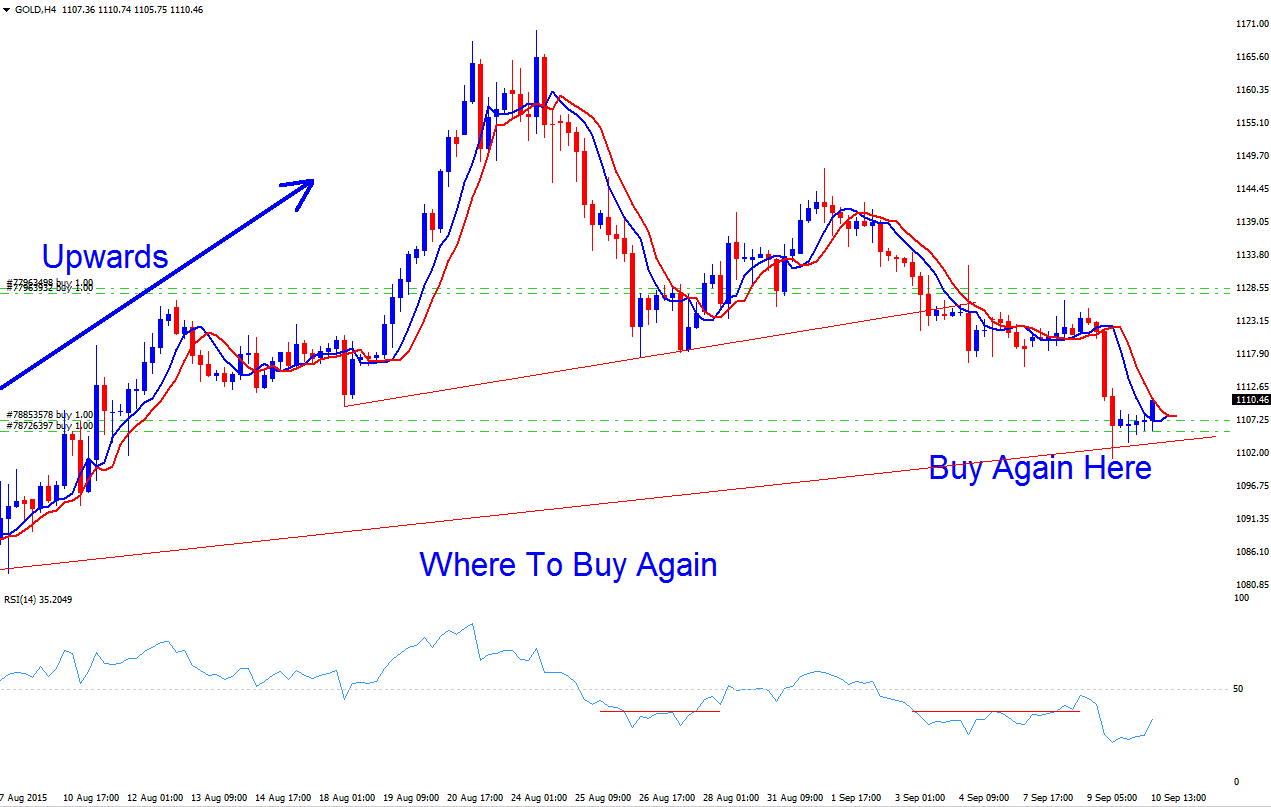

Where to buy again

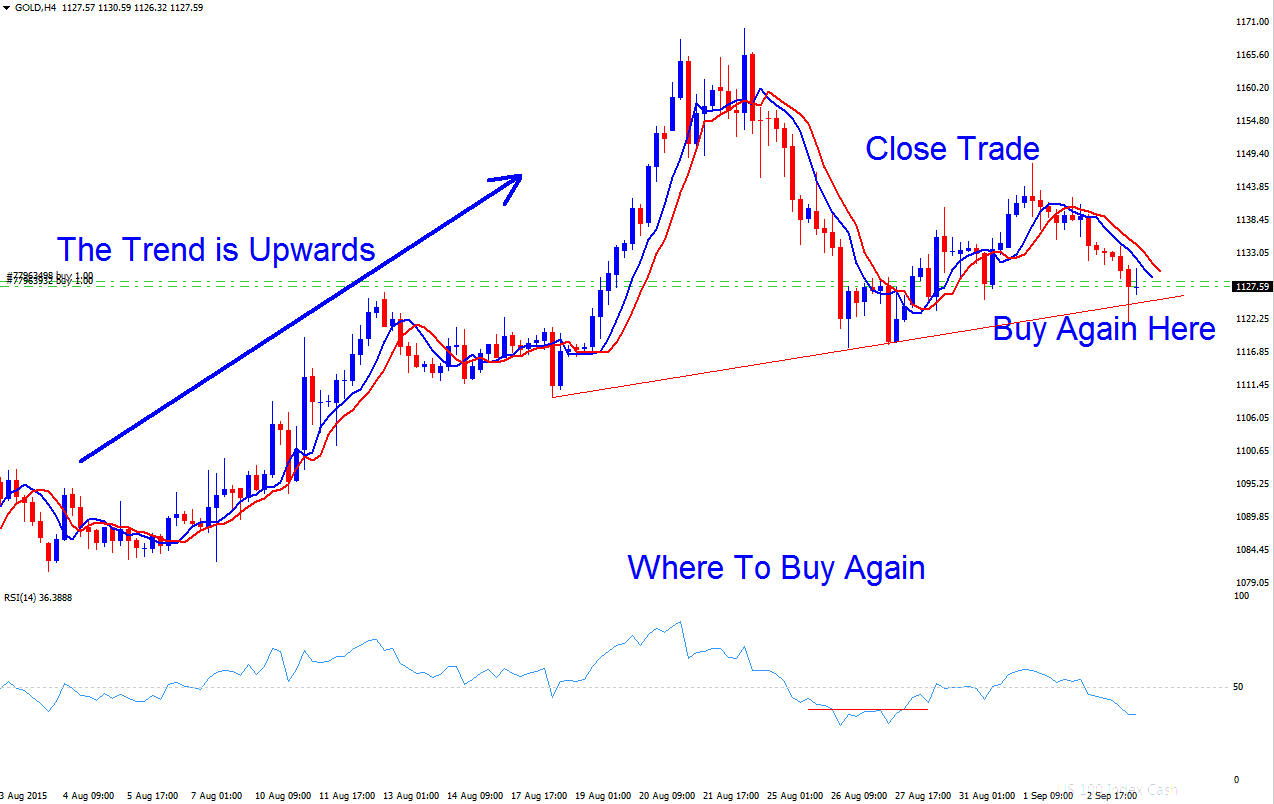

Given that the trend is upward and purchases are made only after a retracement, as a buyer, you would have waited for the opportunity to buy again following a retracement.

This juncture would have presented an ideal opportunity to initiate a purchase, as the prevailing market condition was identified as oversold at this level.

You also can wait for confirmation of the above signal like is shown:

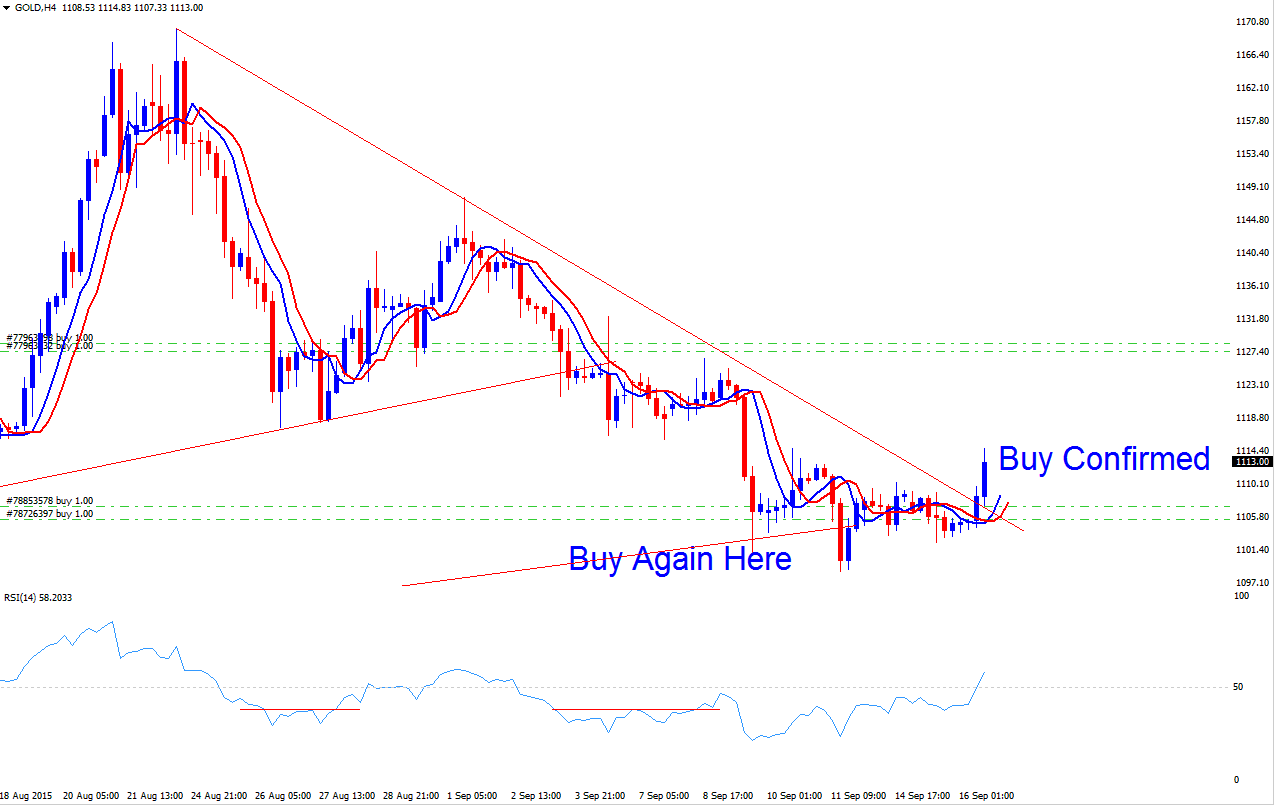

Buy trade setup confirmed

What if a Trader Buys & The Retracement Continues Downward?

This raises a pertinent query: what course of action should be taken if the entry point is missed, and the downward movement persists?

This trade behaved similarly, retracing 200 points down from our buy point, as displayed below.

So the first thing to know is that this is an upward trend and the retracement has moved 671 pips from the top but using our trading strategy we've been caught by only 200 pips(points) retracement instead of the 671 pips. This is the first reason why you should not buy at the top & instead wait out for a retracement then buy. That way you will only be caught by a fraction of the retracement & not the whole retracement, therefore saving you from a lot of drawdown on the trade transaction.

The subsequent benefit is that by avoiding excessive leverage, sufficient capital remains available to absorb any necessary drawdowns. Following this, a new trade position can be opened once the retracement phase concludes and upward momentum resumes, as illustrated previously.

From the above trade setup our newly opened trade went up by 70 points immediately after opening this trade transaction. As a trader you will need to close these new trade positions at the earliest times so that as you as a gold trader can reduce your trading risk and at the same time book some profit amidst all the retracementspullbacks happening.

For this trade, we will set our take profit at 1144, or we will watch the price chart and end this trade if the strength of these trade positions starts to slow down.

We shall take a screen shot of this trade after price trend has developed.

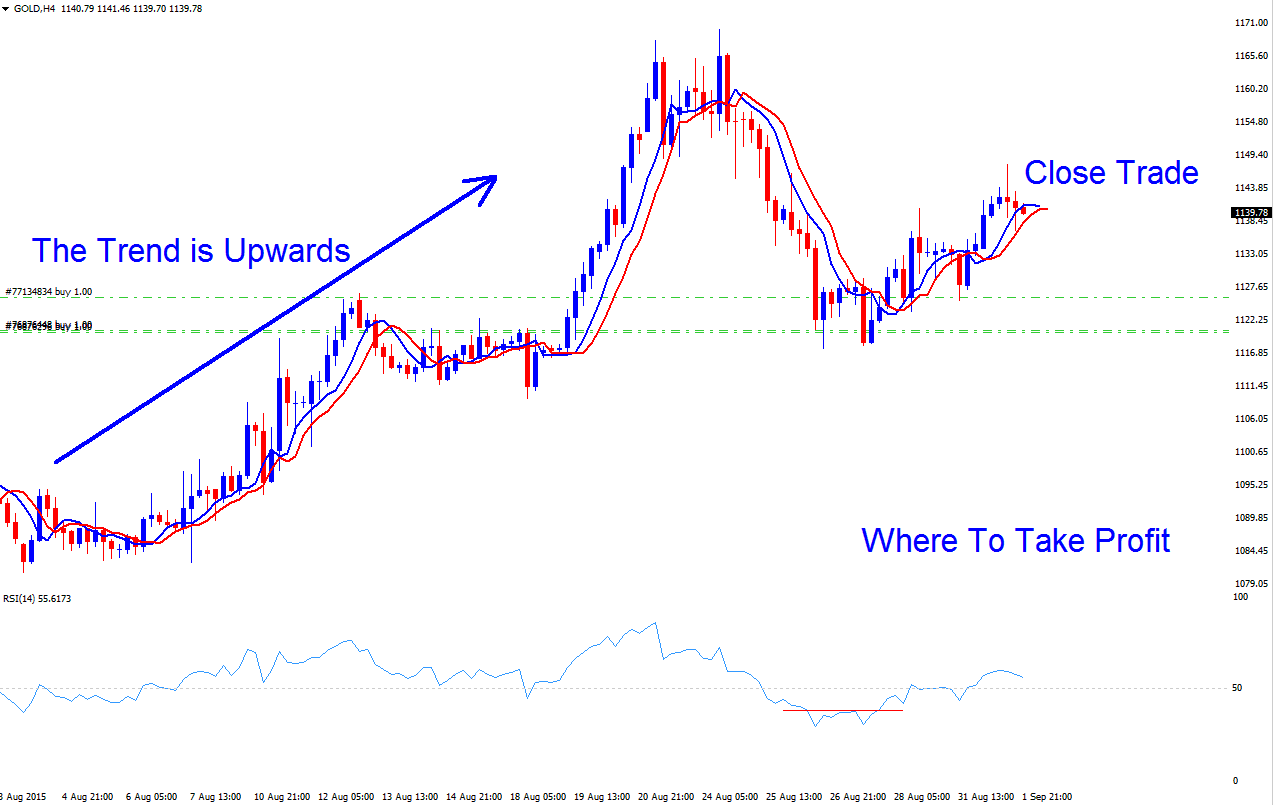

The buy trade was confirmed after there was a consolidation - both moving averages are now heading upwards & the RSI indicator is above 50. There was even a short term downwards trend just as illustrated by the downward trend-line that has now been broken.

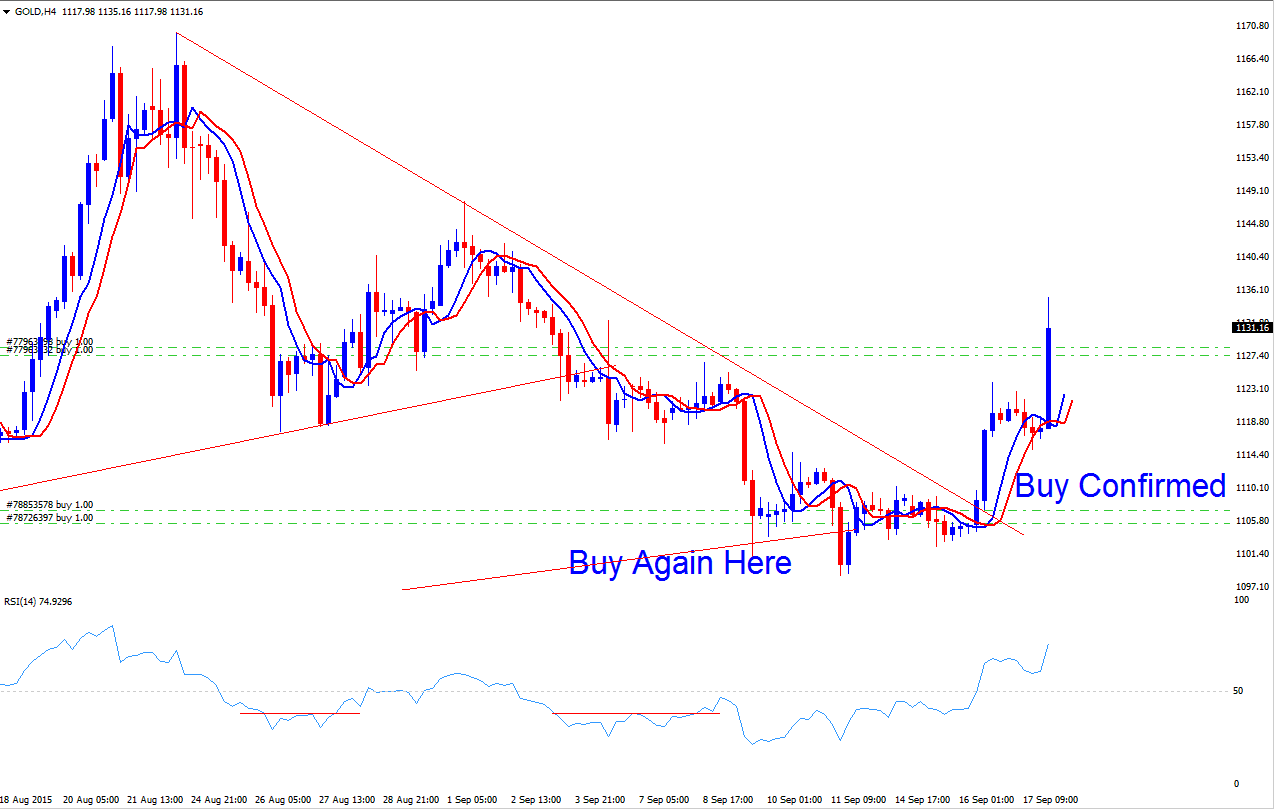

As a trader you as a gold trader can see that using our strategy we have been able to reduce our draw-down despite the short-term down-trend. Should the market go upto where our first trade position was, we shall have added profit to our trading account. The reason why we have added this profit will not be because that we were able to perfectly time the market but because we have entered the market when the possibility of draw-down is very minimal. This means our risk reward ratio is high enough to enable us to extract profit from the market using this trade strategy.

The place below is where you finish your trade: always stop when you're winning and wait for the price to pull back before buying again.

It's better to end trades here because the market has been bought a bit too much right now. End the trade, set a buy limit, and wait.

Based on our established strategy, the most advantageous levels for placing a buy limit order would be at 1123, 1122, or 1121, positioned just above 1120.

If this market keeps going up, we also put in a buy stop order at 1136, just above the latest high, so our buy trade will still happen no matter what.

The thing to remember is retracement before buying - the aim is to first of all minimize any amount of draw-down before beginning to chase profit.

The next thing you've to be sure with this strategy is the present long-term trend is upwards, that way you are trading with the trend - you as a Gold trader can use moving average cross over technique on the weekly chart to do this.

The same concept of retracement before sell can be used to open sell trades when in a downward bearish trending market.

Access Further Subjects and Learning Materials:

- Strategy for Trading SPAIN35 Indices

- How to Place Money Flow Index Indicator on Chart in MetaTrader 4 Software Platform

- Gann HiLo Activator Technical Analysis in FX

- How to Generate Trading Signals in FX with Methods

- Insert Cycle Lines, XAU USD Chart Text Label in Gold Charts on the MetaTrader 4

- Study FX Guide Tutorial for Beginner Traders Guide Lesson

- How to Calculate Pips For UsTec100 Indices

- Index Analysis for Beginner Stock Index Traders

- Buy Limit Order and Sell Limit Order

- Kauffman Efficiency Ratio Gold Indicator Technical Analysis