Draw Down & Maximum Draw-down

To achieve profitability in any venture, risk management proficiency is paramount. A gold trader must grasp the complexities of managing trading risks. For a novice trader asking, "What are the inherent risks in Trading?", the primary conceptual answer is DRAWDOWN. To secure profits in online trading, diligent study of the various risk mitigation techniques detailed on this educational XAUUSD resource portal is essential.

In trading, the risk to be managed is potential losses. Using equity management guidelines will not only protect your trading account but also make you profitable in the long run.

Draw-down

For traders, the biggest risk is drawdown - that's the money you've lost on a single trade.

Say you start with $10,000. A $500 loss on one trade means a 5% drawdown. That's $500 divided by $10,000.

Max Draw-down

This figure represents the cumulative capital loss sustained on your account before you begin achieving positive returns. To offer an example: imagine a trader starts with $10,000 capital, incurs five successive losing trades totaling $1,500 in losses, and subsequently achieves ten profitable trades netting $4,000 in gains. In this scenario, the maximum drawdown is calculated as $1,500 divided by $10,000, equating to a 15% maximum drawdown percentage.

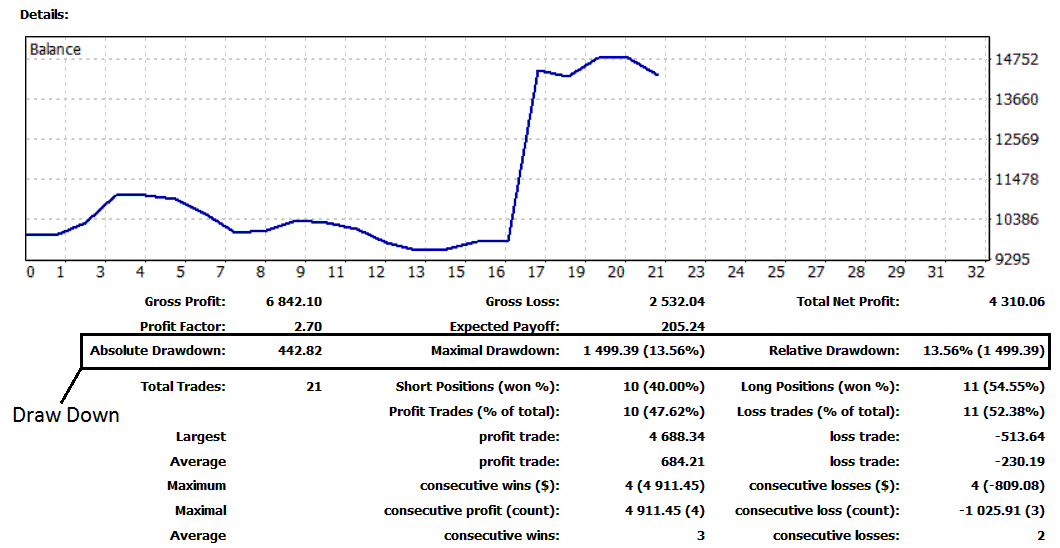

Draw-Down is $442.82 (4.40%)

Maximum Draw Down is $1,499.39 (13.56 percentage)

To learn and know how to get and generate the above trading reports using MetaTrader 4 platform: Generate Reports on MT4 Guide Lesson

XAU/USD Capital Management

The example below shows what happens when you risk a small percentage of your capital versus a higher percentage. Good investing means you never risk more than 2% of your total account equity on one trade.

% Risk Technique

2 percent and 10 percent Risk Rule

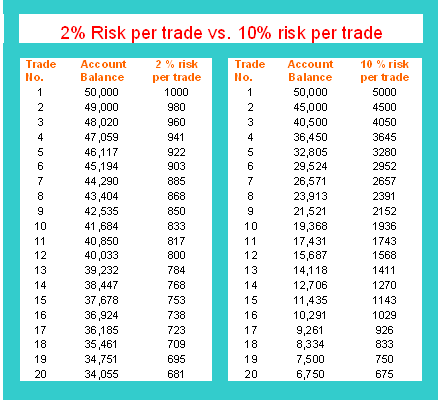

There is a big difference between risking 2 % of what you have versus risking 10 % of what you have on one trade.

If you were subjected to a sequence of losses resulting in 20 consecutive losing trades, your initial trading equity balance of $50,000 would be reduced to merely $6,750 if you, as a xauusd gold trader, risked 10% on every single trade. This scenario would translate to an equity depletion exceeding 87.5%.

If you had risked only 2%, you would still have $34,055, reflecting just a 32% loss of your total account equity. This demonstrates why adopting the 2% risk management strategy is the most prudent approach.

The discernible difference between risking 2% and 10% is that if you chose the 2% risk level, you would retain $34,055 after incurring twenty consecutive losing trades.

In contrast, if you had incurred risk equivalent to 10%, your remaining balance would stand at only $32,805 after just 5 consecutive trade losses. This final amount is substantially less than the capital you would have retained had you limited your risk to just 2% per trade across those same 20 unsuccessful positions.

The key is that if you trade xauusd gold, you need rules so that even when you lose money, you still have enough to trade again.

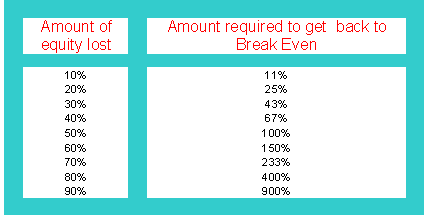

If you lose 87.50% of your capital, you need 640% profit to break even again.

If you lose 32% of your funds, you need a 47% gain to break even. In comparison, hitting 47% feels far simpler than chasing 640%.

This chart lists recovery percents. It tells how much gain you need after a capital loss.

Concept of Break-Even

Account Equity & BreakEven

At 50% drawdown, a gold trader needs 100% gains to break even. Fewer than 5% of traders worldwide do this on a 50% loss account.

If a trader loses 80% of their money, they need to increase what's left by four times just to get back to the amount they started with. This is called "breakeven," which means getting your account back to the original amount you put in.

The extent of your losses directly correlates with the difficulty encountered in recovering your starting account capital.

This underscores the critical necessity for you, as a gold trader, to exhaust every effort in SAFEGUARDING your capital: you must absolutely refuse to incur losses exceeding 2% of your total equity on any single, isolated trade.

Xauusd risk management means risking only a small part of your money on each trade so you can handle losing streaks and avoid losing a lot of money.

In XAUUSD trading, stop-loss orders are strategically positioned to mitigate potential losses: risk management entails placing a stop-loss order immediately subsequent to entering a primary trade order.

Effective Money Management

If you want to manage risk well, you need to take control of every part of it. Create a clear money management system and stick to your trading plan. Whether you're trading XAU/USD or anything else, every decision involves some risk. Measure everything you can to keep that risk low, and use the tips from this guide to help you out.

Get More Topics and Tutorials:

- Buy and Sell Signals using William % R

- Comprehensive Guides for Course Material on Fibo Extension and Fibonacci Retracement Levels

- Navigating US 500 in MetaTrader 4 App

- Trading MT5 XAUUSD Trendlines and Channels on Gold Charts

- What's Margin Forex Account?

- Market Opening Time for the US30 Indices

- Steps to Create a Practice Trading Account on the MT4 Trading Platform

- Setting Up Entry Orders: Placing a Buy Stop XAUUSD Order and a Sell Stop XAUUSD Order?