Technical Analysis of the Kaufman Efficiency Ratio and the Corresponding Trading Signals It Generates

Created through Perry Kaufman. explained in his e book entitled "New trading techniques & methods".

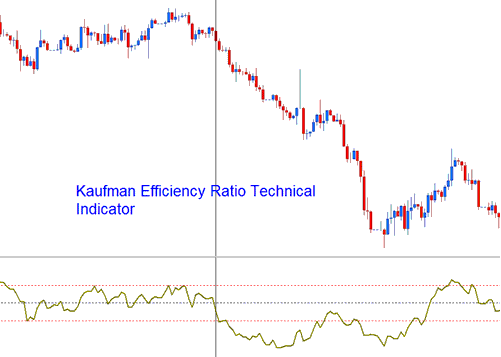

The Kaufman Efficiency calculates how quickly the market moves relative to how unstable it is. Online traders often use the Kaufman efficiency as a way to avoid trading when the market is moving without clear direction or staying within a narrow range. The technical tool also aids in finding and recognizing smoother trends in the XAUUSD Gold market. This tool displays values between +100 and -100, with zero as the middle. +100 means the market is rising, and -100 means it's falling.

Kaufman Efficiency Ratio

To find the Efficiency indicator, you divide the change in gold price over a certain time by the total of all the price changes from one bar to the next, considering these as positive numbers over the same period.

Technical Analysis and How to Generate Trading Signals

Kaufman is used to generate signals as follows:

The more smoothly the market is moving in a certain direction, the higher the Efficiency Ratio shown & displayed by the technical indicator. Efficiency Ratio numbers close to zero show that price movements are not very efficient or are "choppy" (varying markets).

- If the Efficiency Ratio shows a reading of +100 for a instrument, then that xauusd is trending upward with perfect efficiency.

- If the Efficiency Ratio shows a reading of -100 for a instrument, then that gold price is trending downwards with perfect efficiency.

Realistically, it is nearly unattainable for a market trend move to achieve a perfect efficiency quotient, as any corrective movement - a pullback against the current dominant trend during the time frame used for calculating the technical indicator - will invariably deflate that calculated efficiency ratio.

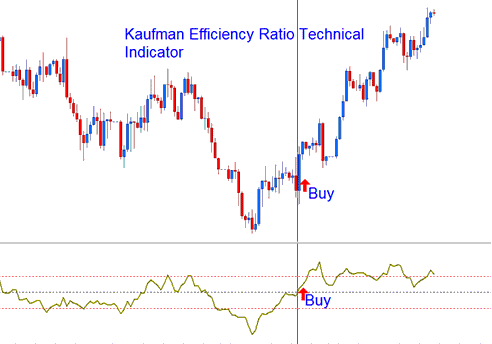

Bullish/Buy Trading Signal

Efficiency Ratio values/readings above +30 show a smoother upwards trend.

Buy signal is generated/derived above center-line mark.

Buy Signal

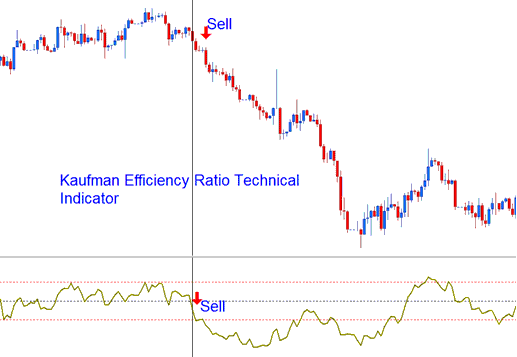

Bearish/Sell Trading Signal

Efficiency Ratio readings below -30 show a smoother downward trend.

Sell Signal is generated/derived below zero centerline mark.

Sell Gold Signal

Still, it's good to try other numbers to find out the best levels for the thing being traded and the number that is the best for your xauusd way of doing things that you're using.

Study More Tutorials and Topics:

- Bollinger Bands Indicator System Overview

- Where to Find Dow Jones 30 Chart on MT4?

- XAU USD Market Hours

- Studying the Ehler Relative Vigor Index, or RVI Indicator

- How to Include the AEX25 Stock Index on MetaTrader 5 Platform

- What's the MA Triple Exponential Average (TRIX) indicator?

- XAUUSD Introduction

- How to Arrange S&P ASX 200 in MT5 on a PC

- Gold Divergence: Spot XAUUSD Divergence on Charts and Trade It