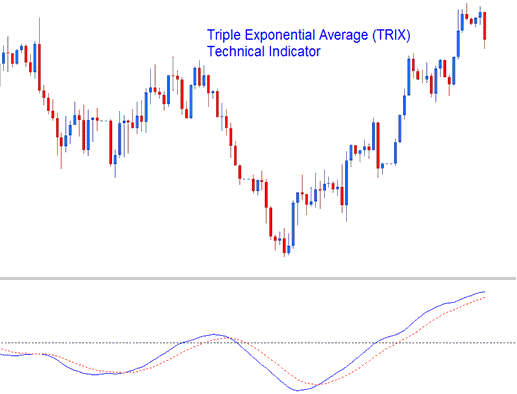

Triple Exponential Average (TRIX) Analysis & TRIX Signals

Created and developed by Jack Hutson

TRIX is a triple smoothed oscillator that is designed to eliminate spikes that cause fake outs in the calculations, these spikes or market cycles which are shorter than the selected indicator period used to calculate & plot are ignored.

The TRIX indicator is a type of oscillator that fluctuates above and below a central line. This centerline helps identify bullish and bearish trends. It quantifies the strength of both upward and downward trends, with values above the centerline indicating a bullish trend and those below indicating a bearish trend.

Forex Analysis and How to Generate Trading Signals

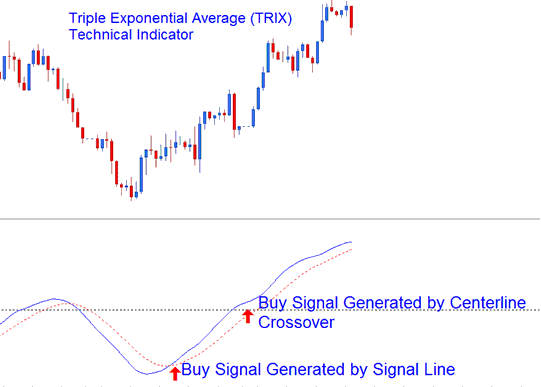

Bullish Buy Signal

A buy signal can be derived and generated using 2 techniques:

- The first one is the center-line crossover signal where readings above the line are bullish.

- The second one is used to generate a signal when the signal-line crosses above TRIX line.

Bullish Buy Signal

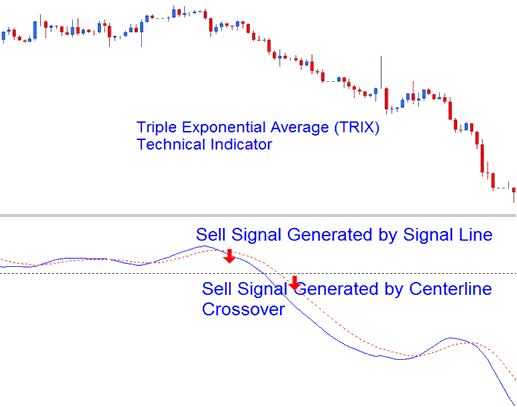

Bearish Sell Trade Signal

A sell signal can be derived and generated using 2 techniques:

- The first one is the center-line crossover signal where readings below the line are bearish.

- The second one is used to generate a signal when the signal-line crosses below TRIX line.

Bearish Sell Trade Signal

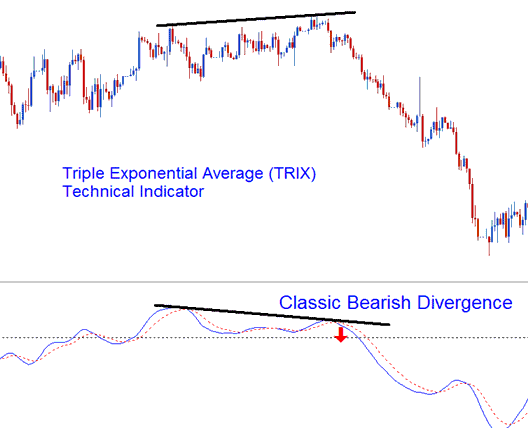

Divergence FX Trading

Divergence offers a means for generating trading indications. Market participants can identify discrepancies between the price action and the technical indicator to inform their trading direction decision.

Divergence Forex Trading

Explore Further Training & Programs:

- Example of Used XAU/USD Margin & Free XAU USD Margin in MetaTrader 4 Platform Software

- What's a XAUUSD Stop Loss

- Two Commonly Used FX Trading Methods

- How to Integrate the Forex Channel Indicator into MetaTrader 4 Charts

- Double Tops Setup Guide Tutorial

- Where to Trade GER 30 Indices

- How Can I Work with the Kase DevStop 2 in MetaTrader 4?

- Learn How to Trade XAUUSD Course Lesson

- How to Analyze/Interpret Pips on SGDHKD How to Count Pips in SGDHKD

- Use kurtosis analysis for sharper FX chart insights.