Kase Peak Oscillator & Kase DevStop II Analysis & Signals

Conceived and Constructed by Cynthia Kase

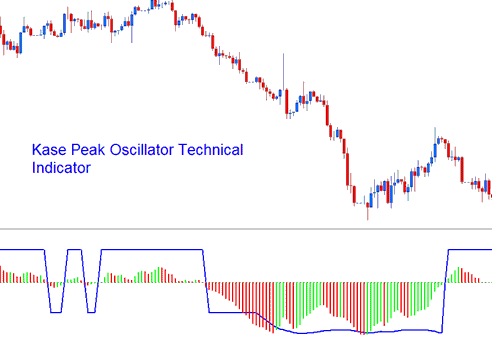

Kase Peak Oscillator Technical is used in same way as other traditional oscillators indicators, but oscillator is derived from a statistical evaluation of the Forex trend: this statistical evaluation evaluates over 50 different trend lengths. The oscillator is capable of automatically adjusting itself to the cycle length and volatility changes of the trend.

Kase Peak Oscillator Metric

Histogram readings below the centerline indicate bearish market trends, while readings above signal bullish trends. Crossover points serve as both entry and exit signals.

Kase DevStop 2 Indicator

Developed & Created by Cynthia Kase

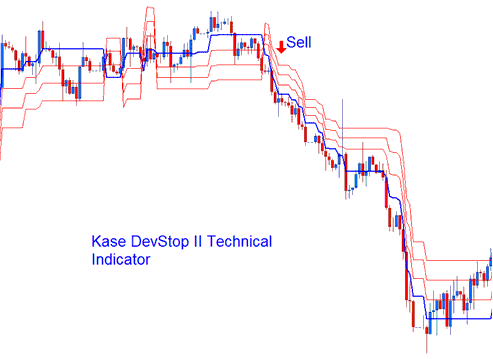

Kase DevStop II Finds Average Range and Its Three Standard Deviations.

Forex Analysis of the Kase DevStop II Indicator

This Indicator is designed to precisely determine optimal exit points for trade positions based upon volatility metrics, specifically volatility variance and volatility skew. The indicator projects four distinct lines: one Warning Line and three Standard Deviation Lines marked as 1, 2, and 3. These lines enable traders to enact take-profit actions or cut losses at levels where the probability of a trade remaining profitable diminishes significantly, all while avoiding premature profit-taking or incurring unnecessary losses.

Kase DevStop 2

The three red lines are utilized by traders to determine exit points or stop-loss levels. The DevStop II serves as a technical indicator that follows price trends.

Learn more lessons and subjects: